Luxury companies might be an unconventional investment due to their slightly different operations, especially with Hermès International (EPA: RMS), a 200-year-old family-owned business.

In the previous year, RMS stock showed some solid results as it grew and increased in revenue and sales to over €13 billion.

So, what exactly makes this luxury stock a standout choice for luxury brands? The answer lies below.

Strong, growing financials of Hermès

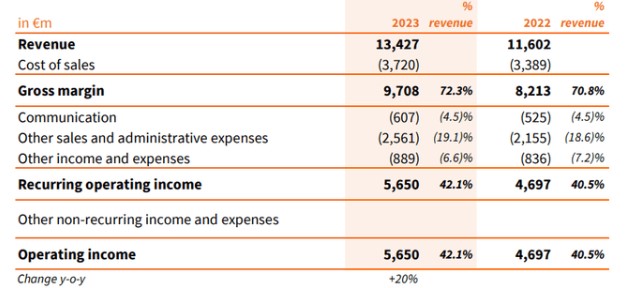

In the fiscal year 2023, Hermès achieved revenues totaling €13.4 billion, marking a notable 16% year-over-year growth trajectory. As previously outlined, this growth was attributed to enhancements across all operational segments.

The enhancement observed in gross margin was particularly noteworthy, which increased to 72.3%. Furthermore, the operating margin exhibited a significant improvement, rising by 160 basis points to attain 42.1%.

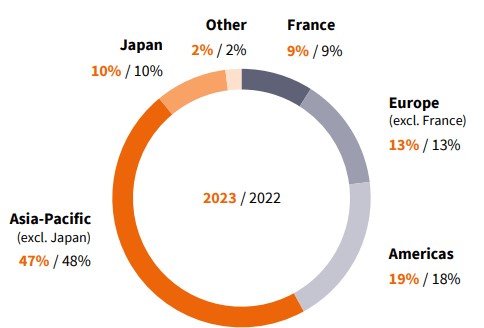

A significant aspect to consider regarding Hermès is its substantial presence in the Asia Pacific region, which accounts for nearly 50% of its total sales revenue. By comparison, LVMH (EPA: MC), another prominent luxury goods company, derives approximately 30% of its sales from this region.

Analyst targets for Hermès stock

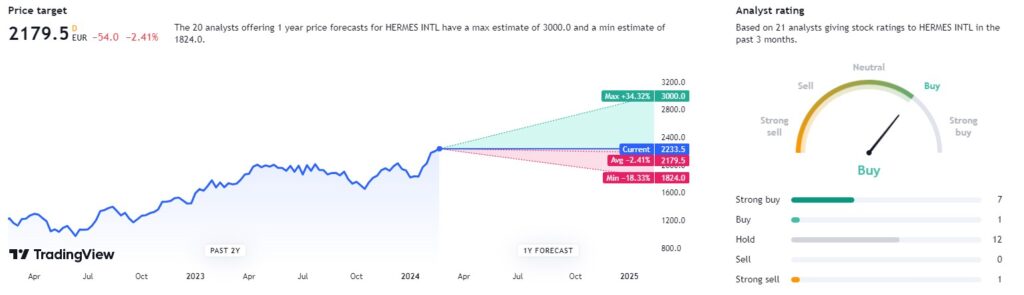

Analysts at TradingView noted Hermès’ previous year of success, assigning a ‘buy’ rating to its stock. Among 21 opinions gathered, 7 recommended a ‘strong buy,’ 1 suggested ‘buy,’ 12 advised ‘hold,’ and only one proposed a ‘strong sell’ for Hermès shares.

The designated price target is €2,179, indicating a slight downside of -2.39% from the current Hermès stock price.

Louise Singlehurst of Goldman Sachs reaffirmed a ‘Hold’ rating for Hermès International, with a price target of €2,245.

Alongside Goldman Sachs, J.P. Morgan’s Chiara Battistini also assigned a ‘Hold’ rating to Hermès International in a report released on February 9.

Carole Madjo at Barclays upheld a ‘Buy’ rating for Hermès, setting a price target of €2,073.

Given the conflicting expert reviews, investors may find it prudent to await the release of Hermès’ semi-annual report. Once available, they can make a more informed decision regarding pursuing this investment opportunity.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.