Sometimes, all it takes for a stock that’s undergone a substantial decline to bounce back is a single catalyst. Investors have every reason to cheer for NextEra Energy Partners (NYSE: NEE) to make a swift rebound for several compelling reasons.

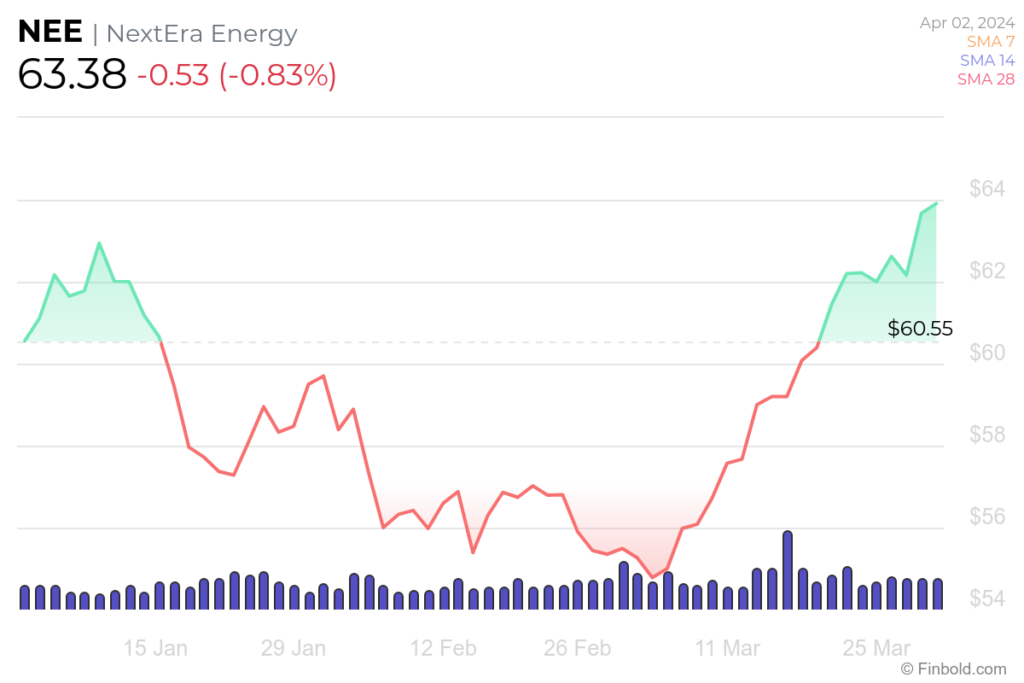

In 2023, NEE stock faced a tough time amid rising interest rates, extensive borrowing, and refinancing of existing debts, resulting in nearly a 20% loss in value.

However, NextEra’s leadership appears to be steering the company in the right direction, as NEE shares are showing signs of a slow but steady recovery in 2024.

Why should investors root for NEE stock?

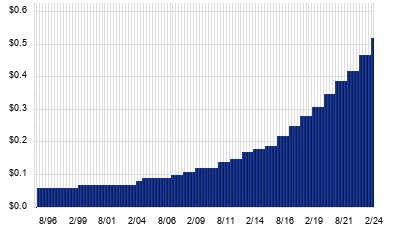

NextEra Energy Partners offers one of the most lucrative dividend yields in the market. With the current rate, a $1,000 investment could potentially yield over $100 in annual dividend income.

The critical question revolves around whether the company can sustain its impressive yield. NextEra Energy Partners has no immediate plans to cut its dividend; rather, it aims to bolster its payout until at least 2026.

The company targets an annual dividend growth rate of 5% to 8%, with a specific goal of 6% growth. Although this rate is slower than its initial projection of 12%-15% annual growth, it still represents a robust increase, particularly for a stock with such a high yield.

Ambitious plan for recovery

NextEra Energy Partners is executing a strategic plan to bolster its financial position while maintaining dividend growth. It aims to sell its gas pipeline assets, using proceeds to retire existing convertible equity portfolio financings (CEPFs) and finance acquisitions until 2027.

Additionally, the company is shifting towards organic growth by repowering wind energy assets, expecting a 6% dividend increase this year without requiring further equity capital until 2027.

NextEra Energy Partners holds significant potential for total returns if it successfully executes its plan. With the possibility of a substantial and increasing dividend alongside strengthened financials from redeeming its CEPFs, there’s potential for a significant boost in stock price, especially with the potential for falling rates.

This could facilitate further acquisitions, potentially accelerating growth. While there are risks to consider, such as the possibility of dividend cuts if plans don’t materialize, the upside potential remains compelling.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.