Dividend investing is often hailed as an excellent way to grow wealth, and who better to prove its worth than Warren Buffett, the esteemed investor and chairman of Berkshire Hathaway (NYSE: BRK.A). He recently pocketed nearly $200 million solely from dividends from a single stock.

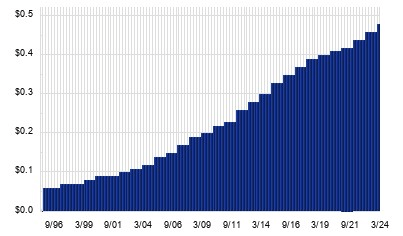

To elaborate, on April 1, Coca-Cola (NYSE: KO) distributed its quarterly dividend of $0.485 per share. With Berkshire Hathaway holding 400 million shares, its total dividend payout amounted to a staggering $194 million in just one quarter.

To put it into perspective, Buffett earns a staggering $61,300,000 per month, which breaks down to approximately $2,000,000 per day, $85,000 per hour, $1,400 per minute, and a jaw-dropping $25 per second just from Coca-Cola dividends.

Buffett’s long-lasting love for KO stock, and for a reason

Buffett’s portfolio typically comprises stocks with a common trait—they pay dividends. The Oracle of Omaha views this as a fantastic strategy to amplify the gains from his preferred long-term investments.

Among his favorites is KO stock, which has garnered significant affection. Recently, Coca-Cola announced a 5.4% increase in its quarterly dividend, raising it to 48.5 cents per share from 46 cents.

This year also marks a milestone as Coca-Cola celebrates 60 consecutive years of paying dividends, solidifying its reputation as a dependable and steady choice for traders.

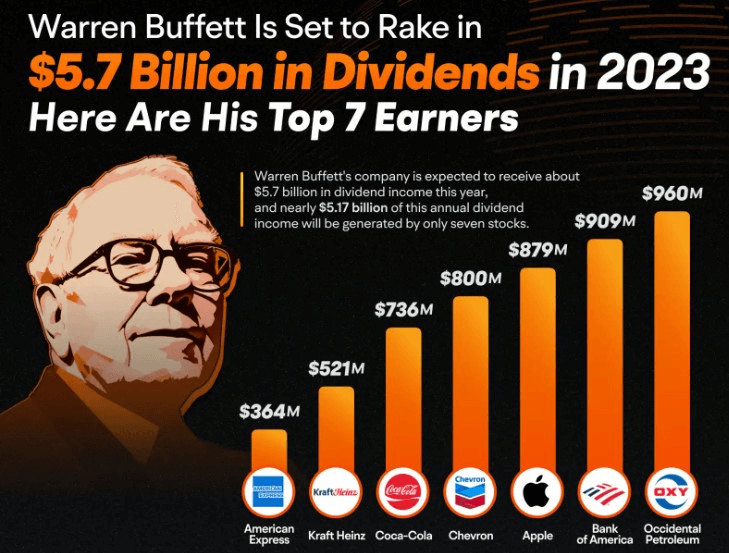

Top dividend performers in Buffett’s portfolio

In Berkshire Hathaway’s portfolio, five standout high-yield dividend stocks include Citigroup (NYSE: C), Coca-Cola, Marubeni (OTC: MARUF), Sumitomo (OTC: SSUM.F), and Chevron (NYSE: CVX). Citigroup’s affordability and Coca-Cola’s enduring dividend history make them attractive choices.

Marubeni and Sumitomo, prized for their diversification and shareholder-friendly policies, also offer solid yields.

However, Chevron claims the top spot with a dividend yield of 4.13%, backed by a consistent dividend increase streak spanning 37 years.

But notably, Buffett received his biggest dividend check from Occidental Petroleum (NYSE: OXY), a stock that has proved to be a real performer for his portfolio.

These dividend yields underscore the advantages of dividend-paying stocks over others, serving as an effective means for investors to grow their wealth through compounding.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.