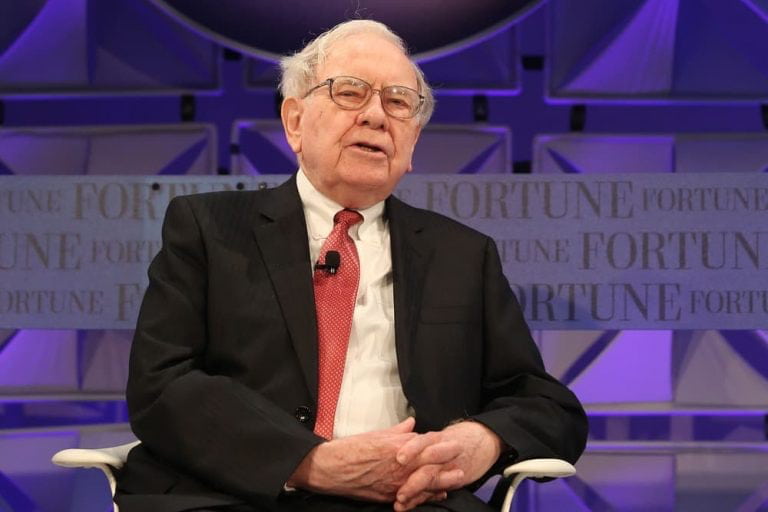

Warren Buffett, the Oracle of Omaha, is one of the most respected investors in the world. His hedge fund, Berkshire Hathaway (NYSE: BRK.A), is known for its long-term approach to investing in high-quality companies.

As of March 13, 2023, the top three stocks held by Berkshire Hathaway were Apple, Bank of America, and Chevron, according to data retrieved by Finbold from HedgeFollow.

In this line, Finbold has performed comprehensive research on each of the top three firms in the hedge fund. The purpose of this was to gather additional information related to the companies to better understand the range of possible prices for the stocks during the following year.

Apple (NASDAQ: AAPL)

Apple is the largest position in Berkshire Hathaway’s portfolio, accounting for 38.9% of the fund’s equity holdings. The fund owns 895.14 million shares at the average buy price of $36.98.

Apple is the world’s largest technology company by market capitalization, and its products, including the iPhone, iPad, Airpods, and Macbook, are known worldwide. What’s more, its Apple Services business has now grown to become one of its most lucrative segments, with revenue surpassing that of major corporations such as Nike (NYSE: NKE) and McDonald’s (NYSE: MCD) combined.

Despite concerns about supply chain disruptions and competition from other tech giants, many analysts remain bullish on Apple’s long-term prospects.

The average price forecast for the next year is $169.16; the target indicates a 13.91% upside from its current price, while the highest price target over the next year is $199 +34% from its current price.

Bank of America (NYSE: BAC)

Bank of America is the second-largest position in Berkshire Hathaway’s portfolio, accounting for 11.19% of the fund’s equity holdings, with over 1 billion shares owned at an average buy price of $25.66.

Bank of America is one of the largest banks in the United States, with operations in all 50 states. Despite concerns about rising interest rates and regulatory pressures, many analysts remain bullish on Bank of America’s long-term prospects.

Wall Street analysts have given BAC a consensus ‘buy’ rating from 28 analysts based on its performance over the past three months. In total, eleven experts advocate for ‘strong buy,’ and another three opt to ‘buy.’ Elsewhere, twelve chose to ‘hold,’ and two decided to give a ‘sell.’

Notably, the average price forecast for the next year is $40.40; the target indicates a 33% upside from its current price, while even the lowest price target over the next year is $33, +9% from its current price of $30.27.

Chevron (NYSE: CVX)

Finally, Chevron is the third-largest position in the portfolio, accounting for nearly 10% of the fund’s stock holdings. Chevron is one of the world’s largest oil and gas companies, operating in over 180 countries.

The business continues to invest in new technologies, such as plans to expand into the metaverse and offers branded non-fungible tokens (NFTs), as well as gas, renewable energy products, and convenience store products in the form of digital commodities.

Many experts are still optimistic about the energy giant’s long-term prospects as it aims to diversify its operations despite fears about the transition towards renewable energy and the effect of climate change on the oil and gas sector.

The average price target for the next year is $191; the target indicates a 19% upside from its current price, while the highest price target over the next year is $215, +34% from its price at the time of publication.

Berkshire Hathaway’s top three holdings, Apple, Bank of America, and Chevron, are all high-quality companies with strong financial results and promising long-term prospects. Since no investment is risk-free, many investors continue to follow Warren Buffett’s guidance because of his track record of success with long-term investments in these firms and others.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.