Amidst the housing crisis in Canada, which has placed significant pressure on aspiring young homebuyers, Prime Minister Justin Trudeau has proposed a new Capital Gains Tax. This tax would range from 50% to 67%, depending on the taxpayer’s income bracket.

The Capital Gains Tax is levied on individuals when they sell an asset or capital property, with capital gains representing the profits from such sales.

According to the Canada Revenue Agency’s website, common capital properties include cottages, securities (such as stocks, bonds, cryptocurrencies, and units of a mutual fund trust), land, and buildings.

Who will be affected by the new Capital Gains Tax?

Starting June 25, the proposed alteration will impact individuals with over $250,000 CAD in capital gains annually. Corporations and trusts will also face increased tax obligations on a larger portion of their gains.

The government clarified that this change will primarily affect the wealthiest 0.13% of individuals, encompassing approximately 12% of Canada’s corporations and Canadians with an average income of $1.42 million CAD.

The Liberals emphasized that 99.87% of Canadians will remain unaffected by this adjustment, which excludes the sale of primary residences. Projections indicate that this measure will generate $19.3 billion in revenue over the next five years.

How is crypto taxed in Canada?

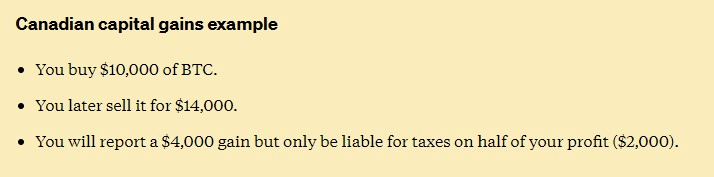

In Canada, cryptocurrency is taxed as either business income or capital gain and classified as a commodity. Canadian taxpayers are not required to pay taxes to purchase or hold crypto. However, taxes apply to capital gains or business income from cryptocurrency sales, mining activities, or other crypto-related transactions.

Individual crypto holders are subject to tax on 50% of their total capital gains, while professional (day) traders are taxed on 100% of their profits.

How are stocks taxed in Canada?

In Canada, any taxable capital gains must be reported as income on the tax return for the year the stock was sold. The income is typically considered to be 50% of the capital gain.

For instance, if an asset is sold for $2,000 CAD with an adjusted cost base of $1,000 CAD, the taxable income would be $500 CAD ($1,000 gain x 50%). This $500 CAD must be added to taxable income and will be taxed at a marginal tax rate according to the tax bracket.

Under the new Capital Gains Tax law, if the amount exceeds $250,000 CAD, the yearly tax percentage may vary from 50% to 67%.