U.S. banking industry is grappling with increasing insolvency issues, as highlighted in the latest quarterly report from the Federal Deposit Insurance Corporation (FDIC).

In the first quarter of 2024, 63 banks were preparing for bankruptcy, up from 52 in the same period the previous year. This troubling trend signals a worsening situation for the sector.

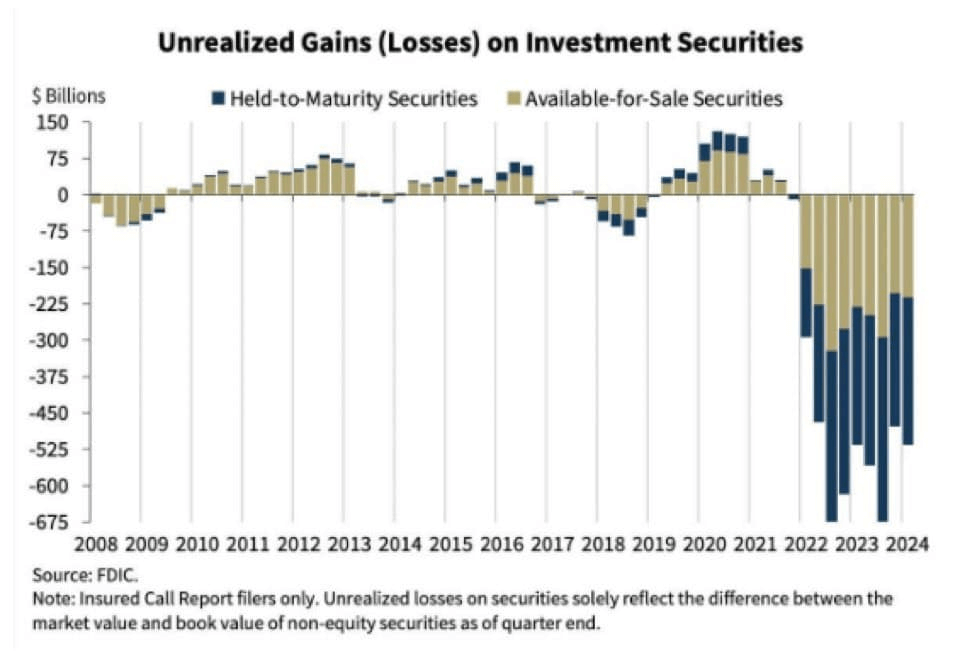

Mounting unrealized losses in the banking sector

The FDIC report reveals that banks collectively recorded unrealized losses of $517 billion, a $39 billion increase from the previous quarter. These losses have escalated for nine consecutive quarters, primarily due to the Federal Reserve’s interest rate hikes since 2022.

A persistent rise in unrealized losses underscores banks’ financial strain and vulnerability to market fluctuations.

Discontinuation of the BTFP and potential liquidity crisis

The U.S. banking sector is facing a perfect storm of challenges. The recent discontinuation of the Bank Term Financing Program (BTFP), which was established in March 2023 to provide additional funding to eligible depository institutions, has not only halted new mortgage loan applications but also exacerbated an already precarious situation.

Previous year has witnessed significant bank failures, including Regional Signature, Silvergate, and Silicon Valley, as customers hurried to withdraw deposits. The closure of the BTFP, combined with high interest rates, has sparked fears of a potential liquidity crisis, reminiscent of the 2008 global financial meltdown.

Analysts are predicting that over 50 U.S. banks may default due to declining earnings, rising loan costs, and possible capital outflows. Despite regulatory reforms since 2008, the sector remains fragile and seemingly lacks solutions that address the potential vulnerabilities in case of a potential banking crisis, whose effects could be much worse than during the previous recession.