The United States economy is grappling with mounting concerns regarding the browning government spending, which some view as unsustainable.

In this line, data shared by the global capital markets commentary platform The Kobeissi Letter in an X (formerly Twitter) post on June 10 highlighted these concerns, noting parallels with the 2008 Financial Crisis.

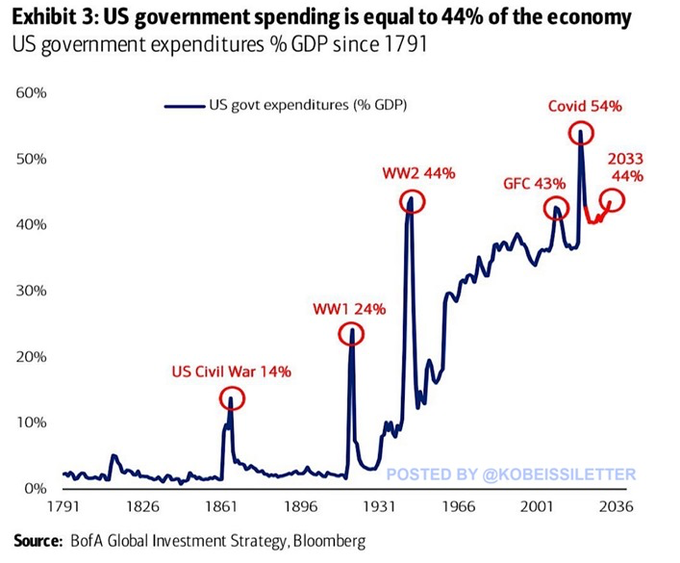

Based on insights from Bank of America’s (NYSE: BAC) Global Investment Strategy and Bloomberg, the data reveals that government expenditures as a percentage of Gross Domestic Product (GDP) have surged to 43%, matching levels observed during the Great Recession.

Picks for you

Alarmingly, current spending levels are merely 1% shy of those witnessed during World War II, a period marked by global conflict and extraordinary circumstances, which are notably absent today. For context, government spending during World War I was 20 percentage points lower than the present figure.

“The U.S. government is spending as if we are in a crisis. U.S. government expenditures as % of GDP just hit 43%, matching levels seen during the 2008 Financial Crisis.<…> This is a crisis,” remarked the platform.

Further historical peaks in spending are delineated, including the U.S. Civil War at 14% of GDP, World War I at 24%, World War II at 44%, the Great Financial Crisis (GFC) at 43%, and the COVID-19 Pandemic at 54%.

Possible impact of a soft landing

Despite these heightened spending levels, the Federal Reserve advocates for a “soft landing” in the economy, asserting that economic data remains robust. However, The Kobeissi Letter’s analysis suggests a more precarious situation, hinting at an underlying crisis masked by current financial indicators.

Moreover, the data projects that in 2033, U.S. government spending could again surge to 44% of GDP, echoing levels observed during World War II. This projection raises concerns regarding the sustainability of current fiscal policies and their long-term economic ramifications.

Additionally, the platform pointed out troubling economic trends in the U.S., characterized by soaring inflation rates—the highest in 40 years—driven by persistent deficit spending and prolonged low interest rates.

This situation has culminated in concerns about the economy slipping into recession, with some forecasting a downturn in the latter half of 2024.

Notably, experts warn of further economic challenges, as elevated inflation and dwindling consumer sentiment could curtail spending, exacerbating fears of recession.

Indeed, as reported by Finbold, macroeconomist Henrik Zeberg cautioned that the U.S. economy might experience one of the worst recessions since 1929. Before the recession, the economist suggested that the stock market and crypto sector would first reach a peak.