2024 has been marked by an impressive market rally that has seen most of the major indexes reach new all-time highs multiple times, meaning that U.S. stocks have been on a months-long bull run that has only recently shown signs of diminishing.

Insiders from the largest publicly traded U.S. companies have used this period to offload their stock holdings and take profits to a level not seen in over a decade, according to research by Nejat Jon Seyhun from InsiderSentiment.com.

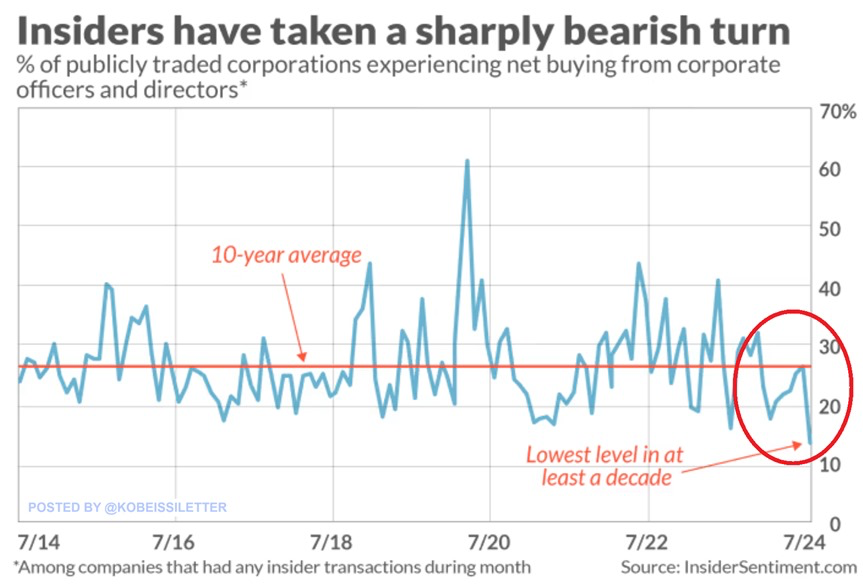

Only about 15% of publicly traded firms see net purchases from their officers and directors, a significant drop from the 10-year average of approximately 26%.

Until July, this ratio had been slightly to moderately below the average. However, in the first three weeks of July, the insider buy ratio turned “deeply negative,” dropping to 13.6%, its lowest level in at least a decade.

The overall bearish sentiment is not tied to a single sector but has spread over the stock market.

The researchers noted, “insiders are pessimistic on both growth and value, small and large firms, and winners and losers.”

‘Magnificent Seven’ CEOs led the insider stock-selling activity throughout 2024

Founders, CEOs, and other higher-ranking executives of the “Magnificent Seven” stocks have been particularly active in 2024, with most of them setting records for the number of shares sold in a single year.

Jeff Bezos, founder of Amazon (NASDAQ: AMZN), leads the pack with over $10 billion worth of AMZN shares sold in 2024, with plans to offload several more before 2025.

Second place goes to Mark Zuckerberg, CEO of Meta Platforms (NASDAQ: META), who was particularly active in April and May, selling more than $1 billion worth of META stock.

Some top executives sold shares for the first time during the rally. In March, Alphabet President Ruth Porat made her first-ever sales of Alphabet (NASDAQ: GOOGL) stock since joining the company in 2015, netting about $6.6 million from selling shares in the search engine giant.

What do insider stock sales mean for the overall market?

Although it is hard to connect insider trading activity to significant stock market events, CEOs and founders know that now is probably the best time to divest from their holdings, as eventually, all rallies end.

Insiders are likely concerned about a potential U.S. economic recession.

Professor Seyhun stated:

“In a deep recession, we would expect insider selling across the board. This recent insider selling from January to April, and again in July, appears to be the start of a larger pattern of indiscriminate insider selling.”

Despite metrics indicating a ‘soft landing’ for the U.S. economy, insiders seem less certain and worry more about the potential of the economy contracting.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.