The stock trading activity of United States Congress members has generally generated interest among the public, primarily because of the potential misuse of insider information to make market bets.

Although the laws allow lawmakers to trade, they are required to adhere to the STOCK Act (Stop Trading on Congressional Knowledge Act). The act stipulates that Congress members must disclose their stock transactions within 45 days and prohibits leveraging insider information.

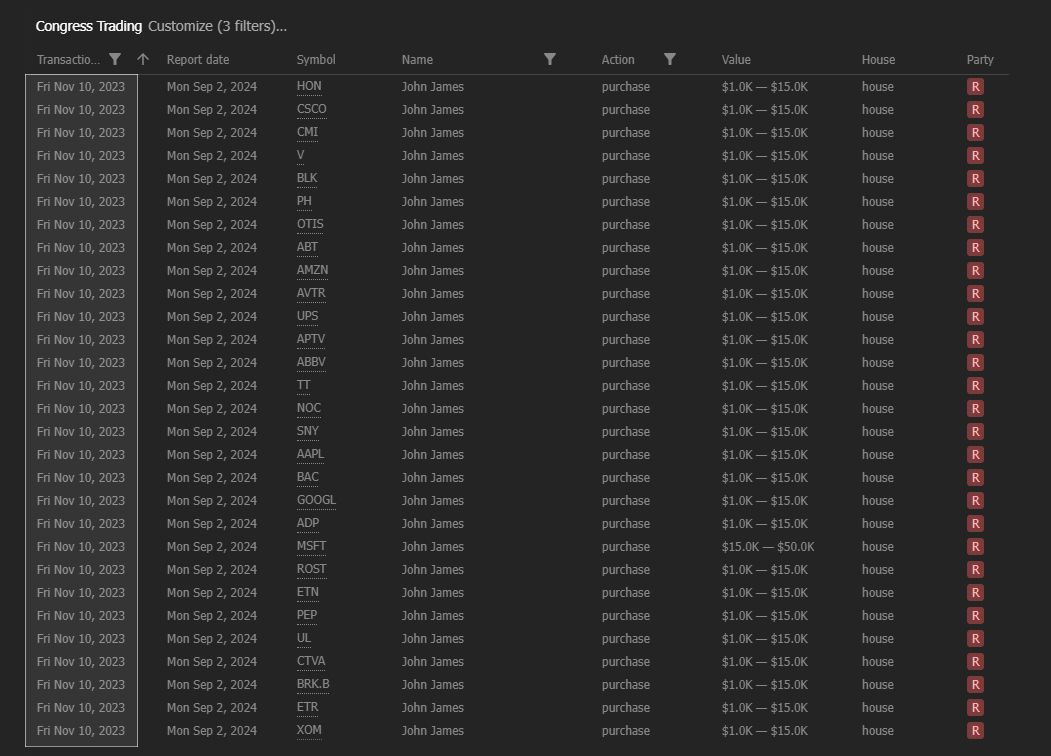

However, in what can be considered a violation of the law, Representative John James from Michigan disclosed his trade almost a year after the transaction. Notably, data shared by charting platform TrendSpider in an X post on September 6 indicated that the politician disclosed his purchases in multiple companies on September 2 in transactions initiated on November 10, 2023.

James purchased notable equities, including technology giants Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL), alongside a stake in Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A).

According to the data, all the transactions accounted for values ranging from $1,000 to $15,000, except for Microsoft, which was allocated between $15,000 and $50,000.

Rep. James’ other trades

Overall, another data set retrieved from Congress trading tracker Quiver Quantitative suggested that the politician elected in 2023 registered 146 trades, accounting for a volume of $1.19 million.

In the meantime, the lawmaker’s primary preference is healthcare stocks, which account for 26 trades, followed by financials. Interestingly, this approach partly deviates from trading patterns by his colleagues, who prefer defense and technology stocks.

Congress’s trading has seen some politicians stand out, reaping significant profits, with former House Speaker Nancy Pelosi ranking among the most successful traders.

Despite Pelosi’s track record, the latest data shows her prowess might be waning based on several missteps around key stocks such as semiconductor giant Nvidia (NASDAQ: NVDA).

In the context of what can be categorized as unusual trading behavior, Finbold also reported that Representative Debbie Wasserman Schultz reemerged in the trading scene after months of hibernating.

Notably, the politician purchased shares in Hecla Mining Company (NYSE: HL), which deals in gold and silver mining. Indeed, the transaction raises eyebrows, considering it’s not a common choice among politicians.

Multiple violations of STOCK Act

Regarding observing the STOCK Act, this is not the first time the legislation has been ignored, with politicians going unpunished.

Back in June in 2024, it emerged that Representative Mike Kelly and his wife, in 2020, bought Cleveland-Cliffs (NYSE: CLF) stock. This was after Kelly provided insider information that saw the stock surge by 300% in months.

In conclusion, with the outright violation of the STOCK Act, it remains to be seen if the relevant authorities will step in and reprimand the politicians. Failure to punish the lawmakers will generally escalate suspicion regarding Congress’s trades.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.