Even though Apple (NASDAQ: AAPL) stock price has failed to make a significant advance this year despite its first-quarter earnings beating Wall Street’s expectations, experts remain cautiously optimistic in terms of its further movements in the following 12 months.

As it happens, Apple seems to be finalizing the terms of a deal with ChatGPT creator OpenAI to incorporate its generative artificial intelligence (AI) technology into iOS 18, as well as holding talks with Alphabet (NASDAQ: GOOGL) to license its Gemini AI bot, according to a recent report.

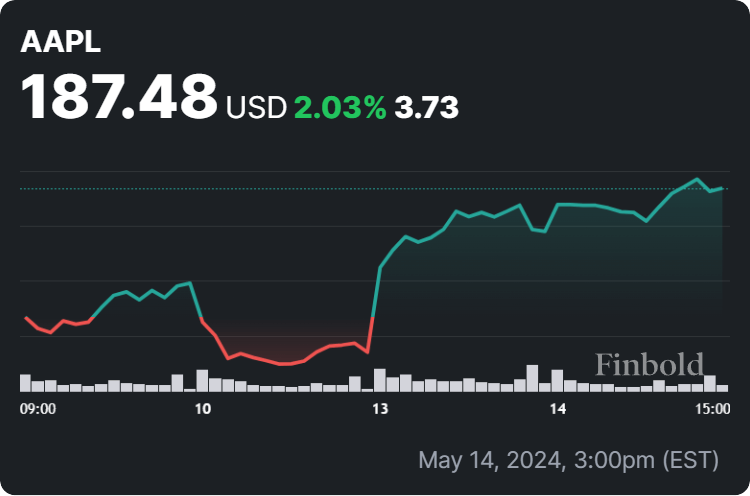

Not long after this bullish piece of news came out on May 10, Apple stock jumped by 1.66%, increasing its price from $182.50 to $185.52 in a matter of hours and steadily continuing its advance in the following several days towards a one-month high of $187.43, against concerns about falling sales in China.

Apple stock price prediction

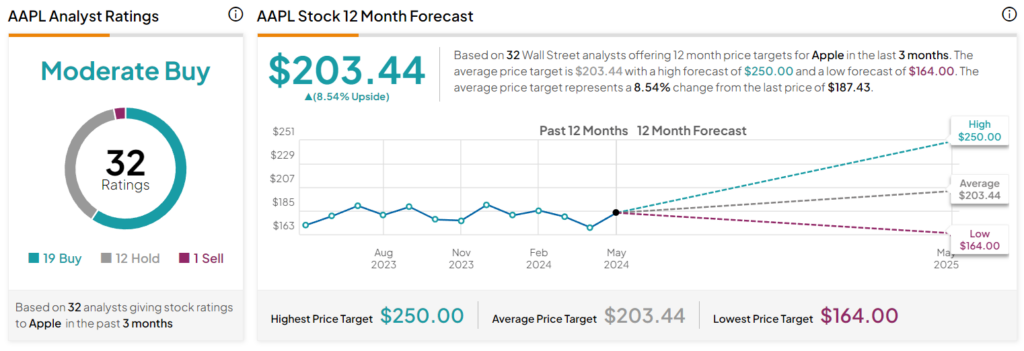

In this context, 32 Wall Street experts who have shared their projections for the future performance of AAPL stocks over the course of the previous three months have rated them as a ‘moderate buy,’ with 19 votes for ‘buy,’ 12 for ‘hold,’ and only one for ‘sell,’ according to the latest TipRanks information on May 15.

At the same time, the analysts have offered their specific Apple stock price targets for the following 12 months, suggesting an average price of $203.44, which would represent an 8.54% gain from its current situation, with the lowest target standing at $164 (-12.52%) and the highest at $250 (+33.35%).

Notably, among the bullish experts is Wedbush’s Daniel Ives, who sees AAPL shares hitting $250 within the next 12 months. Furthermore, Bernstein’s Toni Sacconaghi has upgraded his assessment to $195, with Citigroup’s Atif Malik downgrading the target to $210, albeit keeping the ‘buy’ rating.

Indeed, as Sacconaghi recently told CNBC’s Squawk Box:

“We are positive on the stock. We upgraded the rating a couple of weeks ago and we think risk/reward on the name is attractive at current levels.”

AAPL stock price history

For now, AAPL shares are changing hands at the price of $187.48, which indicates a decline of 0.05% on the day, but still represents an Apple price increase of 2.03% across the past week and an accumulated advance of 8.45% over the month, as per the most recent charts retrieved on May 15.

In conclusion, Apple shares could continue to slowly advance toward the average price target set by Wall Street analysts, and the fact that Nancy Pelosi, a prominent politician-trader and former United States House Speaker, trusts in the technology behemoth’s future performance is certainly a good sign.

However, things in the stock market can sometimes change unexpectedly, which is why doing one’s own research, keeping up with relevant Apple news, and carefully weighing the risks and one’s own risk tolerance is critical before investing a significant amount of money in AAPL shares (or any other asset).

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.