Although it managed to return above the $100 price level recently, Nvidia (NASDAQ: NVDA) stock has failed to sustain the upward movement and is back below this psychologically important level, but many Wall Street analysts remain optimistic that it will recover in the next 12 months.

As it happens, Nvidia shares suffered losses amid a challenging period for artificial intelligence (AI) stocks across the board, as well as the expected delay in the launch of the technology giant’s Blackwell chip, although some experts see this as a “tremendous opportunity” to ‘buy the dip.’

Nvidia stock price prediction

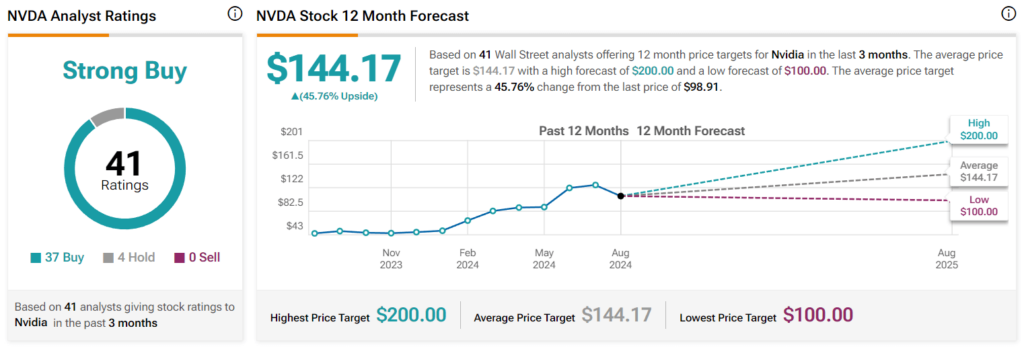

For the moment, the majority of the 41 analysts offering their ratings and price predictions for Nvidia stock agree that NVDA shares are still a ‘strong buy,’ with 37 of them recommending a ‘buy,’ four sticking to the ‘hold’ score, and with no ‘sell’ calls, as per TipRanks data on August 8.

At the same time, the consensus of these experts offers an average Nvidia stock price target of $144.17, which would represent an increase of 45.77% from its current situation, with the lowest offered target at $100 (+1.1%), and the highest standing at $200 (+102.20%).

What analysts say about Nvidia stock

Among these analysts is Piper Sandler’s Harsh Kumar, who recently said that Nvidia stocks looked “attractive after their sizable pullback,” representing a “tremendous opportunity” for investors to stock up on Nvidia shares while they are still trading relatively cheap.

According to the stock market analyst, who still stands by his ‘buy’ rating and Nvidia stock price target at $142.67, the company does not seem to anticipate “any meaningful impact of delays to the timing of its Blackwell chip,” despite pushing the ramp back a bit. As he further explained:

“Fundamentally, [Nvidia] remains the strongest player in the AI accelerator space with an estimated share of 80% of the merchant market by 2028. (…) We also believe that strong tailwinds from the Blackwell architecture coming in October will continue to drive revenues well into 2025 as demand exceeds supply.”

Earlier, Bernstein research and analyst Stacy Rasgon suggested that “it remains clear that demand levels continue to rise, with all major hyperscalers continuing to grow their capex outlooks,” adding that sales of Nvidia’s older Grace Hopper chips should help fill the gap, rating the NVDA stock as ‘buy,’ with a $130 price target.

As a reminder, the Bernstein equity research team noted several weeks ago that NVDA shares were among its “top picks” alongside Nvidia’s competitor in the semiconductor sector, Broadcom (NASDAQ: AVGO), and Rasgon has recently also commented that:

“Nvidia’s competitive window is so large right now that we don’t think a three-month delay will cause significant share shifts.”

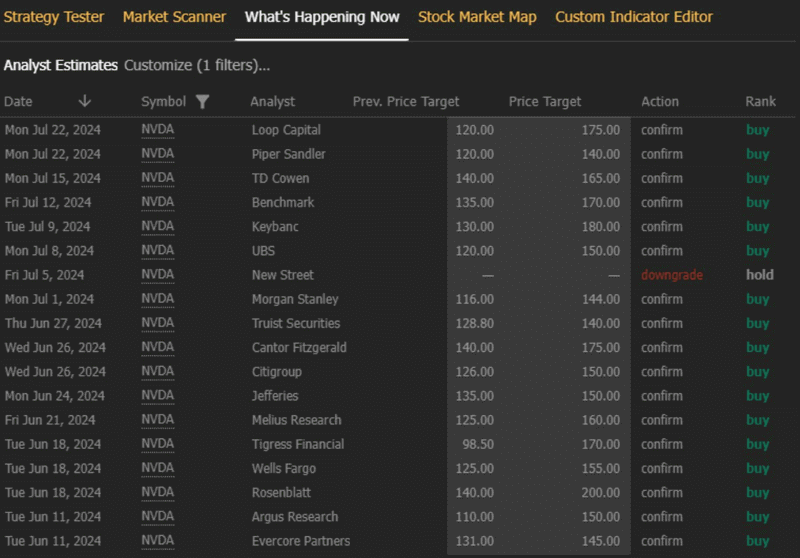

In general, analysts have been upgrading Nvidia stock price targets over the last two months, with projections ranging between $140 and $200, including New Street Research’s Pierre Ferragu, who raised his rating to a ‘buy’ after downgrading it to a ‘hold’ in early July, as Finbold reported on August 7.

NVDA stock price analysis

At press time, the price of NVDA stock stood at $98.91, reflecting a drop of 5.08% on the day, adding up to the 15.87% decline across the past week, as well as accumulating a loss of 22.82% on its monthly chart, but nonetheless gaining 105.42% since the year’s turn.

All things considered, Nvidia stock might meet analysts’ expectations and recover its price in the following months, but doing one’s own research is critical when investing, as things in the stock market can sometimes change rapidly and dramatically.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.