After a strong start to 2024 fueled by excitement surrounding its advancements in artificial intelligence (AI) chip development, Advanced Micro Devices (NASDAQ: AMD) stock has experienced a significant correction over the past month.

While the company’s future in AI remains promising, technical indicators suggest a potential downtrend in the near future.

Signs of struggle and potential downtrend ahead

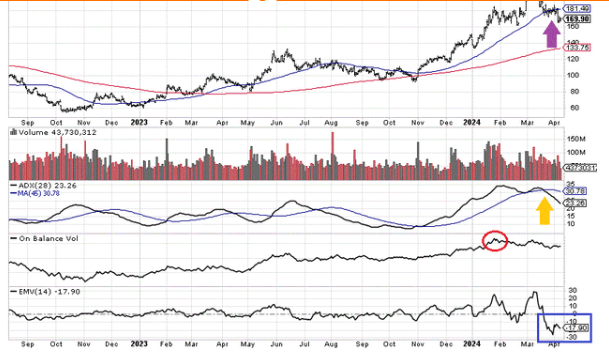

Despite reaching a high of nearly $212 in early March, AMD stock has struggled to maintain momentum. The price failed to find support at the crucial 50-day moving average, a technical indicator that can signal a potential shift towards a decline.

At the press time, AMD is valued at $167.14, reflecting a loss of -1.75% over the past five days and a larger decline of -17.94% over the past month. This represents a significant decrease of almost 21% since the price peak.

Further evidence of a possible downtrend comes from other technical indicators. The on-balance volume (OBV), which measures buying and selling pressure, peaked in January and did not confirm the price highs of March.

Additionally, the average directional index (ADX), a momentum indicator, has recently reversed course. The ADX typically strengthens during uptrends, and this reversal indicates a potential shift in momentum towards a downtrend.

The ease of movement (EMV) indicator adds another layer of concern. The EMV for AMD has plunged to its worst level since January 2022, signifying overwhelming selling pressure in the market.

Wall Street weighs in on AMD stock

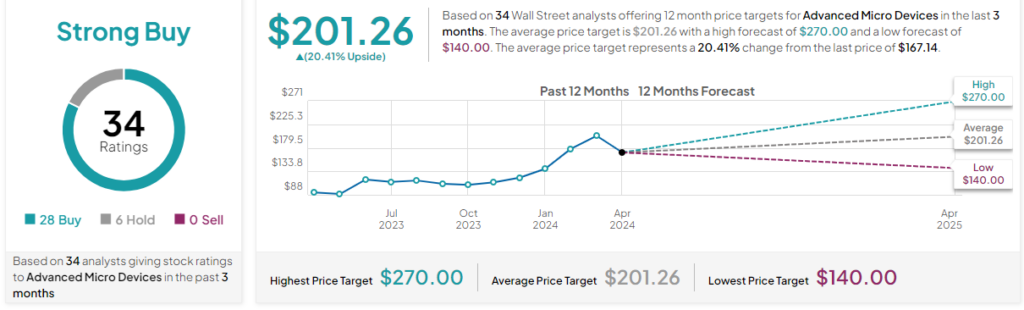

However, it’s important to consider the sentiment of Wall Street analysts. Interestingly, despite the recent technical signals, analyst sentiment towards AMD remains positive.

With 28 experts, on TipRanks as of April 11, advocating for buying the stock and no selling recommendations, there’s a clear belief in the company’s long-term potential.

As of April 11, 34 professionals project an average price target of $201.26 over the next 12 months, indicating a potential gain of 20.41% from the current price of $167.14.

Wells Fargo is bullish on AMD, expecting their MI300X AI chips to be a major revenue driver.

While there are concerns about chip supplies and a potential slowdown from Microsoft (NASDAQ: MSFT), Wells Fargo downplays these worries. They rate AMD as “overweight” with a price target of $190 per share on April 9.

Although the technical indicators suggest a possible short-term correction, the strong analyst sentiment and positive growth projections paint a brighter picture for AMD’s long-term future.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.