In a major show of confidence, personal computer manufacturer Dell (NYSE: DELL) is anticipated to see its stock benefit after its inclusion in the S&P 500 index.

Although DELL is trading in tandem with the general stock market patterns, its addition to the benchmark index could offer more exposure, particularly to institutional investors, and add more credibility to the equity—factors central to triggering a possible price appreciation.

Notably, Dell, which earned its incorporation alongside software giant Palantir (NYSE: PLTR), has seen its stock correct in the short term, plunging almost 5% in the last week. As of press time, DELL was trading at $106, reflecting 24-hour gains of over 4%.

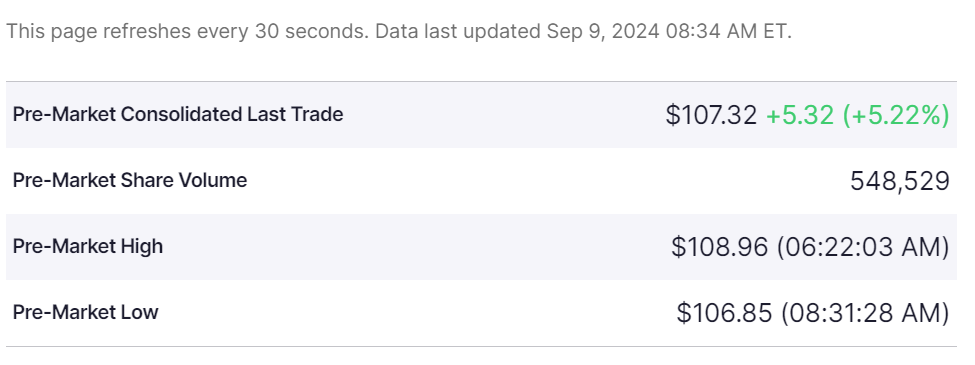

The renewed investors’ interest in the stock was visible in DELL’s pre-market trading on September 9, when the share price was up over 5% to $107. Notably, the stock claimed the level at market opening.

DELL’s key fundamentals

Dell continues to be influenced by key fundamentals, especially its ability to tap into the artificial intelligence (AI) craze that has swept the technology world. This aspect was highlighted in the firm’s Q2 2024 results, which indicated that the tech firm’s venture into generative AI and machine learning algorithms contributed significantly to its revenue.

The company reported $25 billion in revenue, reflecting a 9% increase year-over-year. Infrastructure Solutions Group’s (ISG) revenue reached $11.6 billion, marking a 38% YoY growth. At the same time, server and networking products registered a record annual growth of 80%.

Although the AI scene is mainly dominated by big players such as semiconductor giant Nvidia (NASDAQ: NVDA), analysts maintain that Dell still has the potential to earn a notable stake in the sector. In this line, the company believes its AI server product pipeline is a positive indicator for future revenue growth.

Despite the recent price volatility, analysts from Citi (NYSE: C) believe that Dell’s inclusion in the index makes the stock a “buy,” noting that the company has several other catalysts to drive price growth.

“We believe DELL shares can continue to work post inclusion, given multiple other potential catalysts ahead including recovery in general purpose infrastructure demand, PC refresh cycle ahead into CY25, AI momentum and capital returns,” the Citi analysts said.

DELL’s technical indicators

With the stock seemingly reacting positively to the latest S&P 500 development, a trading expert has noted that DELL still has crucial resistance to clear to confirm possible bullish sentiments.

In an X post on September 9, Andrew Moss acknowledged that the path ahead might be bumpy given the current momentum. He noted that the stock faces resistance levels between $107 and $109, which align with the 8-day, 21-day, and 200-day moving averages.

Indeed, given the underlying bearish market sentiment, these technical levels may prove challenging for the equity to break through in the near term.

Dell stock price targets

Looking at the next Dell stock price forecast, 25 Wall Street analysts on TradingView have shared their insights based on the equity’s performance over the last three months. Notably, 15 analysts have issued a ‘strong buy’ rating, with seven recommending a ‘buy’ stance.

Over the next 12 months, the experts predict DELL will likely trade at an average price of $150, reflecting gains of almost 50%. This prediction is based on a high forecast of $220 and a low forecast of $102.

In summary, as things stand, the possibility of Dell rallying will mainly depend on the revival of momentum in the technology space, especially around the AI boom. However, DELL investors should be on the lookout for the overall economic outlook and how upcoming Federal Reserve monetary policy will impact the market.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.