Alphabet (NASDAQ: GOOGL) has seen fierce competition in the domain of AI, as it seems that it is slowly falling behind in the race to become the industry leader, as OpenAI’s ChatGPT continues to outdo Google Gemini (formerly known as Bard).

Alphabet, Google’s parent company, witnessed a decrease in its share value on February 15. This decline followed reports indicating that OpenAI is developing a web search product poised to directly challenge Google’s market position.

At the final bell on February 15, GOOGL closed at $143.94, marking a -2.17% decrease. However, this minor loss adds to a -2.69% downside observed over the previous five trading sessions, highlighting the stock’s recent downward trend.

Currently, GOOGL is trading within the upper range of its 52-week span. However, compared to the S&P 500 Index, which is approaching a new peak, GOOGL is trailing the market slightly.

There is notable support at $137.27, identified from a trend line observed in the weekly timeframe. On the other hand, a resistance zone spanning from $143.47 to $146.52 is evident. This resistance zone is established by converging multiple trend lines and significant moving averages in the daily timeframe.

Wall Street forecast for GOOGL stock

However, the current performance and potential future intense competition don’t seem to scare analysts from TipRanks, as they are optimistic about GOOGL stock and award it with a ‘strong buy.’

Of 37 experts, 29 opted towards ‘buy,’ 8 advised ‘hold,’ and none to ‘sell.’

Furthermore, the average price target is set at $164.56, which is an upside of 15.26% from the current price level.

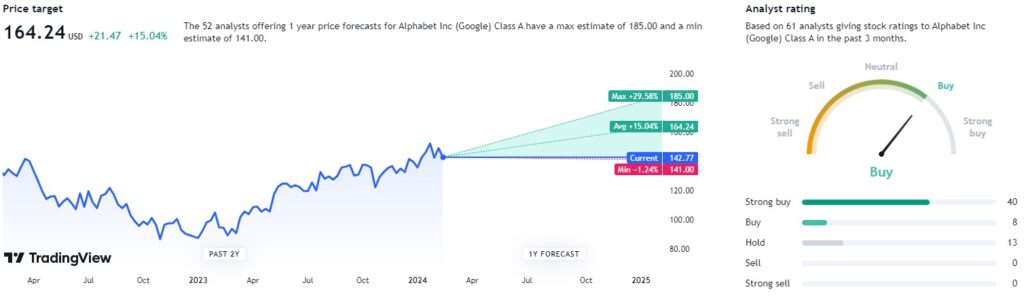

Their colleagues from TradingView share the same kind of optimism and award it with a ‘buy’ rating. Of 61 experts, 40 went for the ‘buy’ ranking, 8 advised a ‘buy,’ and 13 to ‘hold.’

The price target is also similar at $164.24, representing a 15.04% upside.

Competition actually might not be so strong

The current underperformance of GOOGL stock underscores apprehensions regarding the potential influence of competing artificial intelligence services on Google’s supremacy within the search sector.

However, analysts assert that the perceived risk to Alphabet from an OpenAI search product remains relatively minimal.

According to Colin Sebastian, an analyst at Baird, crafting a credible contender in the search arena poses significant challenges, with Google having effectively repelled numerous competitors over time due to the excellence of its search outcomes.

Sebastian further highlighted that alternative search engines would probably need to surpass Google’s performance to genuinely alter user habits, which even OpenAI might find daunting.

While the goal of surpassing Google as a search engine might look far-fetched, OpenAI continues to move boundaries when it comes to generative AI, as it recently introduced Sora, a text-to-video model.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.