Palantir Technologies (NYSE: PLTR), a big data analytics and software company, was a major player in the artificial intelligence (AI) boom of 2023. The company’s products and well-received Artificial Intelligence Platform (AIP) launch fueled a surge in its stock price.

However, since then, Palantir’s stock has experienced a rollercoaster ride, leaving investors to question its future trajectory.

In an earlier analysis from February 2024, the stock price had begun to show signs of decline, dropping almost 20% in the preceding six months and nearly 3% year-to-date.

Since February, Palantir’s stock price has experienced a significant surge, climbing from $16.72 to $22.94, representing a 37% increase, largely due to Palantir’s partnership with Oracle.

On Friday, PLTR increased by $0.48 with Palantir’s stock price sitting at $22.94 (2.16%) at the end of the trading session, and up 3.66% over the last five trading days.

Wall Street analysts set PLTR stock price

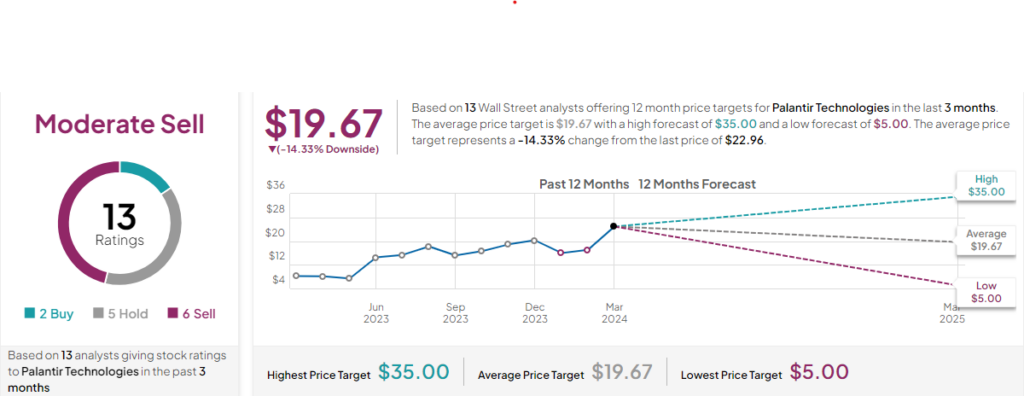

Over the last three months, a group of 13 Wall Street analysts have forecasted the price of Palantir’s stock for the next 12 months. The analyst’s sentiment leans mixed, with two votes for “buy,” five experts suggesting to “hold,” and six “sell” recommendations, according to TipRanks data on April 8.

On average, Wall Street analysts predict a price target of $19.67, and a low forecast of $5, suggesting a potential further decrease in the next year. However, there’s significant variation in these predictions, with some analysts holding onto a bullish view with targets as high as $35.

Besides the latest forecasts offered by tipranks over the past three months Wall Street analyst Bruce Kamich updated his price target after the Oracle announcement. Kamich’s new $48 target price is more than double where shares are trading currently.

“If Palantir continues to trade mostly above $22 it should look like it is building a base for another move higher,” said Kamich.

Palantir’s partnership with Oracle

In a recent development, Palantir announced a partnership with tech giant Oracle. This collaboration aims to combine Oracle’s cloud and AI capabilities with Palantir’s leading data and AI platforms.

The impact of this partnership on Palantir’s stock price remains to be seen. Some analysts believe it could be a positive development, expanding Palantir’s reach and market potential.

This collaboration could lead to new, innovative solutions, attract new customers, and ultimately drive revenue growth.

On the other hand, some may view it as Palantir relying on another company’s infrastructure, potentially hindering its long-term independence.

Uncertainty and opportunity

Palantir’s future hinges on its ability to capitalize on the long-term growth of AI and demonstrate consistent revenue and profitability.

Upcoming earnings reports, new contract announcements, and the success of the Oracle partnership will be critical factors influencing the stock price in the coming months.

While Palantir may not maintain its initial meteoric rise, it’s too early to write off the company entirely.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.