The ongoing artificial intelligence rally in the stock market has significantly benefited companies like Broadcom (NASDAQ: AVGO), driving substantial growth and investor interest. The company’s impressive performance, promising guidance, and stock growth have made it a standout player in the tech sector.

Broadcom’s recent second fiscal quarter earnings report, released on Wednesday (June 12), exceeded analysts’ expectations, showcasing the company’s strong foothold in the market.

Broadcom’s financial performance and AI market integration

Broadcom reported earnings per share (EPS) of $10.96, surpassing the expected $10.84.Additionally, the company posted revenue of $12.49 billion, outpacing the anticipated $12.03 billion, highlighting Broadcom’s robust financial health and strategic market positioning.

In a significant move to enhance stockholder value, Broadcom also announced a 10-for-1 stock split, scheduled to begin trading on a split-adjusted basis on July 15.

This announcement caused the stock to rise by approximately 10% in extended trading, demonstrating investor confidence in the company’s future prospects. The company’s devices are also integral to running AI applications, a rapidly growing market segment.

During the quarter, Broadcom attributed $3.1 billion in sales to AI products. For instance, Broadcom collaborates with Alphabet (NASDAQ: GOOG), which designs its AI chip, the TPU, using Broadcom’s technology.

CEO Hock Tan emphasized the growing investments by hyperscale customers in AI accelerators, stating:

“Our hyperscale customers are accelerating their investments to scale up the performance of these clusters.”

Acquisitions and revenue growth

Broadcom’s acquisition of VMware, an enterprise software company, for $69 billion last year has also contributed to its revenue growth and optimistic sales forecast for the rest of the year.

The company reported a 43% increase in overall revenue on an annual basis during the quarter. Excluding VMware sales, the revenue growth was still a notable 12% year-over-year.

Following the earnings report, Broadcom’s shares surged in after-hours trading, reaching about $1,740 by Friday afternoon, a 16% increase from their Wednesday opening price of around $1,500.

Bank of America Corp (NYSE: BAC) raised its target price for Broadcom shares to $2,000 and projected a 2025 fiscal year sales forecast of $59.9 billion, a 16% year-over-year gain.

The analysts reiterated their Buy rating, considering Broadcom a top AI pick alongside Nvidia (NASDAQ: NVDA), citing the company’s potential growth in custom chips, ethernet networking, and VMware upsells.

In this line, both Wall Street analysts and OpenAI’s advanced artificial intelligence tool, ChatGPT-4o, have offered insights into Broadcom’s stock trajectory over the next 12 months.

ChatGPT-4o Broadcom stock prediction

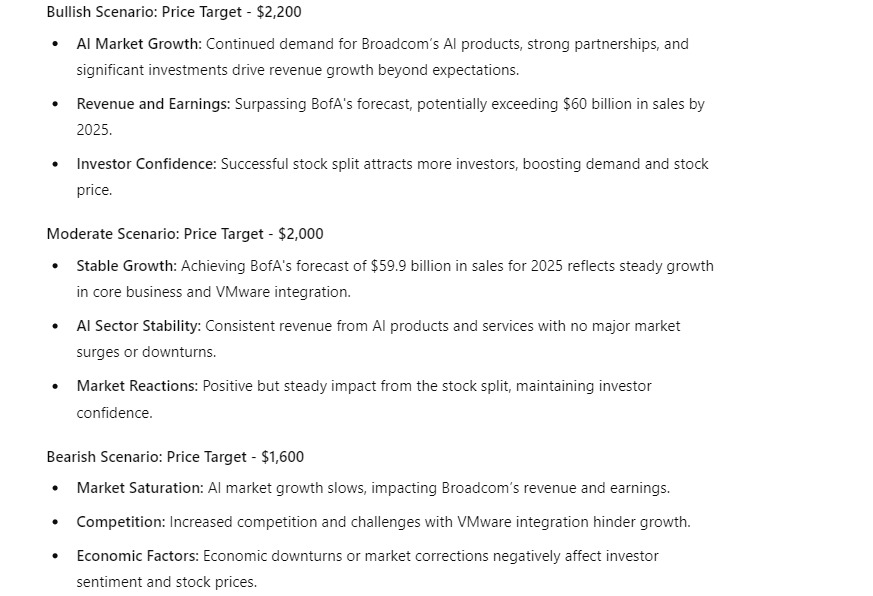

ChatGPT-4o presented three potential scenarios for Broadcom’s stock price. In a bullish scenario, Broadcom’s stock could soar to $2,200 due to robust demand for its AI products, strong strategic partnerships, and significant investments driving revenue growth beyond expectations.

The successful stock split and potential sales exceeding $60 billion by 2025 would further attract investors and boost the stock price.

In a moderate scenario, Broadcom’s stock could reach $2,000, reflecting steady growth in its core business and effective integration of VMware. Meeting sales forecasts of $59.9 billion for 2025 and maintaining consistent revenue from AI products would support a stable yet positive impact on investor confidence and stock performance.

In a bearish scenario, Broadcom’s stock could dip to $1,600 due to slower growth in the AI market, increased competition, and challenges with VMware integration.

Broader economic downturns or market corrections could also negatively affect investor sentiment and stock prices, leading to a more cautious outlook.

Wall Street Broadcom stock prediction

Based on the assessments of 23 Wall Street analysts over the past three months, the average 12-month price target for Broadcom is $1,883.25, ranging from a high of $2,100 to a low of $1,500.

This average target reflects an 8.54% increase from the recent price of $1,735.04. Most analysts are optimistic, with 21 recommending buying the stock and 2 suggesting holding.

Broadcom’s strong financial performance, strategic acquisitions, and deep integration into the AI market position it well for continued growth. Although Wall Street and ChatGPT-4o offer slightly different outlooks, the deviation is minimal.

Both highlight the company’s potential for significant upside. Investors should consider these projections, along with their risk tolerance and current market conditions, when making investment decisions.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.