Several economic indicators historically associated with predicting potential recessions are currently signaling warnings as uncertainty persists.

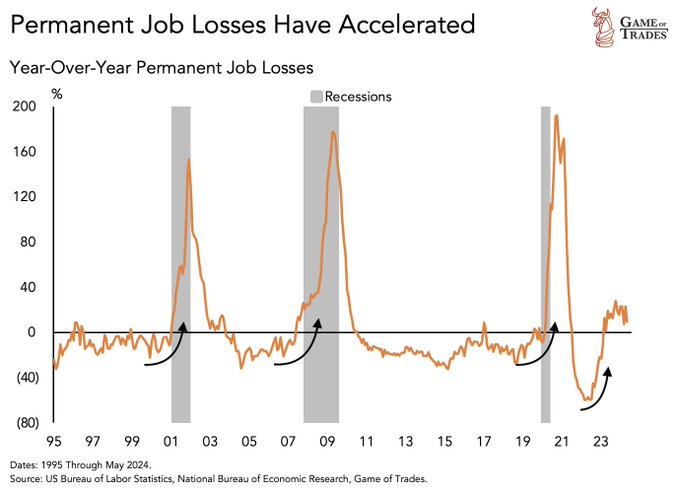

Notably, the latest indicator to signal danger is the emerging worrying trend in the labor market, where permanent job losses are ‘accelerating aggressively,’ according to data shared by investment research platform Game of Trades in an X post on June 18.

According to the platform, historical data shows significant spikes in permanent job losses have consistently heralded recessions since 1995.

“A big spike in this indicator has ended in recessions since 1995. Job losses have been accelerating aggressively,” the platform noted.

The latest data indicates that year-over-year permanent job losses have surged to levels comparable to those witnessed during the Dot-Com bubble, the Financial Crisis, and the COVID-19 pandemic.

This sharp rise in job losses has raised concerns about the likelihood of an impending recession in the second half of 2024.

U.S. corporation potential mass layoffs

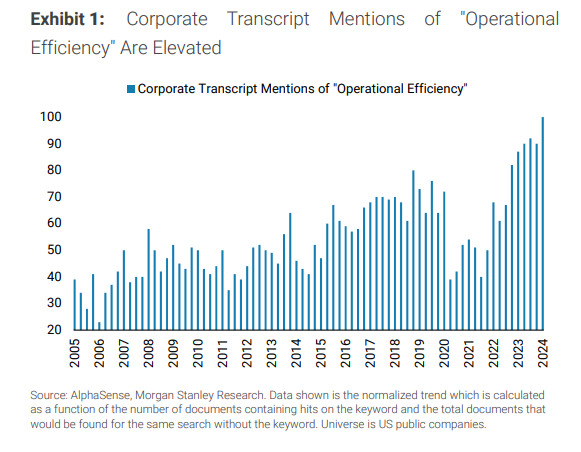

Indeed, job losses are further highlighted by the fact that most U.S. corporations will likely conduct mass layoffs. Specifically, data provided by AlphaSense indicates a clear upward trend in mentions of “operational efficiency” over nearly two decades, suggesting an increasing focus on this concept among U.S. public companies.

The most significant increase in mentions occurred from 2020 onwards, with a noticeable spike in 2023 and a peak in 2024. Therefore, some market players believe this aspect could signal impending job losses in the near future.

Despite these warning signals, the markets continue to display bullish momentum for now. Interestingly, as reported by Finbold, macroeconomist Henrik Zeberg cautioned that the U.S. economy may face one of the worst recessions in history. He pointed out that the recession could come after bullish momentum in the stock market and the crypto sector.

Notably, Zeberg projected an impending crash in two-year Treasury yields, signaling a recession that could rival the Great Depression of 1929.

At the moment, the main speculation is when the recession is likely to hit, with most chatter projecting the second half of 2024. During this period, the upcoming Federal Reserve interest rate decision will likely play a key role.