Despite Bitcoin (BTC) climbing over 80% since the turn of the year, the flagship digital asset is not without its detractors.

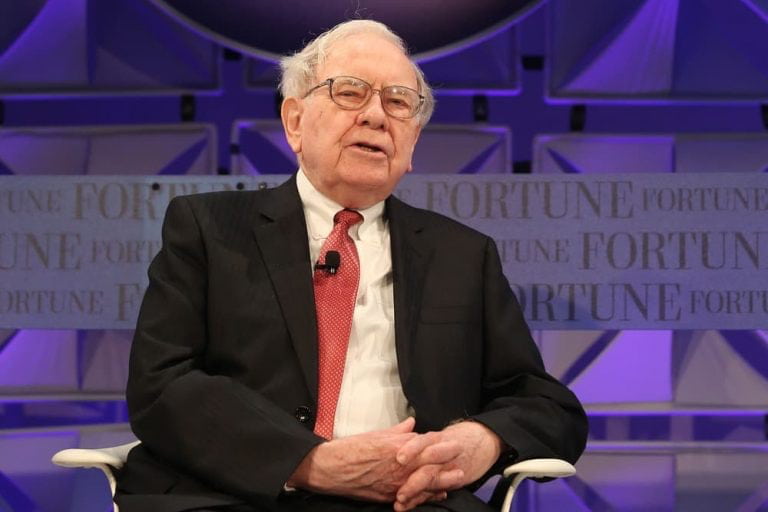

Warren Buffett, one of the most successful investors in history, has criticized Bitcoin, labeling it a “gambling token” that has no “intrinsic value,” in a recent appearance on CNBC’s Squawk Box, which took place on April 12. Notably, this is not the first time Buffett has aired his unfavorable thoughts on the cryptocurrency asset.

“Bitcoin is a gambling token, and it doesn’t have any intrinsic value. But that doesn’t stop people from wanting to play the roulette wheel.”

In the past, the Berkshire Hathaway (NYSE: BRK.A) CEO has referred to Bitcoin as “rat poison squared” and stated that it is a “mirage” that attracts charlatans. He has also warned investors to stay away from Bitcoin, calling it a “delusion.”

The Oracle of Omaha’s criticism of Bitcoin is rooted in his belief that investments should have intrinsic value, which Bitcoin lacks. He sees cryptocurrency as a speculative asset that has no underlying value and is subject to wild price swings.

Buffett and Munger on crypto

Charlie Munger, Buffett’s trusted right-hand man, shares the same views on the matter, arguing that investors should “never touch” cryptocurrencies and instead support both fossil fuels and renewable energy in order to weather the current inflationary storm, since “crypto is an investment in nothing” and “partly fraud and partly delusion.”

However, Finbold reported in April 2022 that Anthony Scaramucci, founder and managing partner of investment firm SkyBridge Capital and former advisor to Donald Trump, had criticized Buffett and several other anti-crypto billionaires, suggesting they had not “done the homework” on crypto.

Interestingly, Linda P. Jones, author of the crypto book 3 Steps to Quantum Wealth, recently drew attention to Buffett’s investments in companies that have exposure to cryptocurrencies by pointing out that he put $500 million into a Brazilian crypto-friendly financial institution called Nubank, which has amassed 1 million crypto users in less than a month in a month.