After already selling billions in Bank of America (NYSE: BAC) shares, Warren Buffett, the popular investor and CEO of Berkshire Hathaway (NYSE: BRK.A), has continued to offload the banking behemoth’s stocks, dumping nearly 6 million additional BAC shares in recent days.

Specifically, Buffett’s Berkshire Hathaway sold about 5.8 million Bank of America stocks, worth $228.65 million, between September 6 and September 10, at average prices ranging from $39.30 to $39.67 per share, according to a regulatory filing from September 10.

As a reminder, the ‘Oracle of Omaha’ started his BAC stock selling spree back in mid-July and has since sold over $7 billion in multiple trades, his latest trade bringing down Berkshire’s stake in Bank of America to 11.1%, as it still holds nearly 760 million BAC shares valued at $33.5 billion.

Although Buffett hasn’t yet commented on his massive Bank of America stock sales, speculations have appeared that he might be reducing his exposure to the finance sector due to the uncertain macro landscape. Asked about Buffett’s recent selling spree, BofA’s CEO Brian Moynihan said:

“I don’t know what exactly he’s doing because, frankly, we can’t ask, and we wouldn’t ask, but on the other hand, the market is absorbing the stock, and it’s a portion of the volume every day, and we’re buying the stock, a portion of the stock, and so life will go on.”

Wall Street’s Bank of America stock forecast

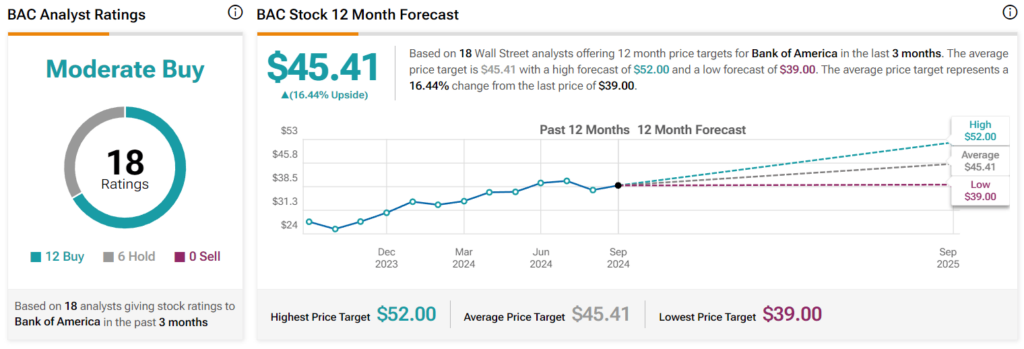

On the other hand, despite possible bearish sentiment from the famous investor, Wall Street analysts remain generally optimistic about the price of Bank of America shares, rating it as a ‘moderate buy’ based on 12 ‘buy’ recommendations, six of them advising to ‘hold,’ and with no ‘sell’ calls.

At the same time, their average Bank of America stock forecast for the next 12 months stands at $45.41, suggesting a potential 16.56% increase from its current pre-market price, with the lowest target at $39 (+0.10%), and the highest at $52 (+33.47%), as per latest TipRanks data.

Bank of America stock price analysis

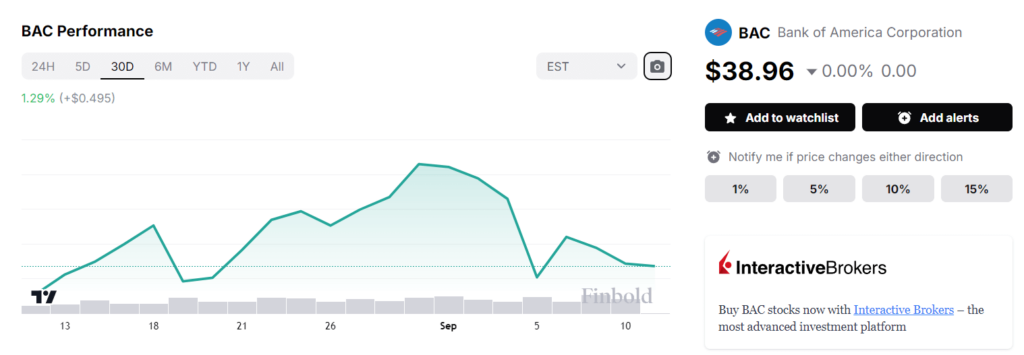

Meanwhile, the price of BAC stock in pre-market stood at $38.96, reflecting a 1.27% increase on the day, a decline of 1.70% across the week, advancing 1.29% in the past month, and accumulating a gain of 14.91% year-to-date (YTD), as per the most recent charts on September 12.

Overall, Buffett’s BAC selling spree could align with his years-long trend of withdrawing from the United States banking sector, considering he had already sold his positions in Goldman Sachs (NYSE: GS), JPMorgan (NYSE: JPM), Wells Fargo (NYSE: WFC), U.S. Bancorp (NYSE: USB), and Bank of New York Mellon (NYSE: BK).

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.