The long-awaited Berkshire Hathaway (NYSE: BRK.A) annual shareholder meeting occurred on May 4. It was presided over by renowned investor Warren Buffett, who shared his thoughts on the stock market and the reasoning behind changes in his stock portfolio.

On May 4, it was revealed that Buffett’s portfolio underwent significant adjustments. These changes included a 13% reduction in the holding of Apple (NASDAQ: AAPL) stock compared to the previous quarterly report.

Is Buffett losing confidence in AAPL?

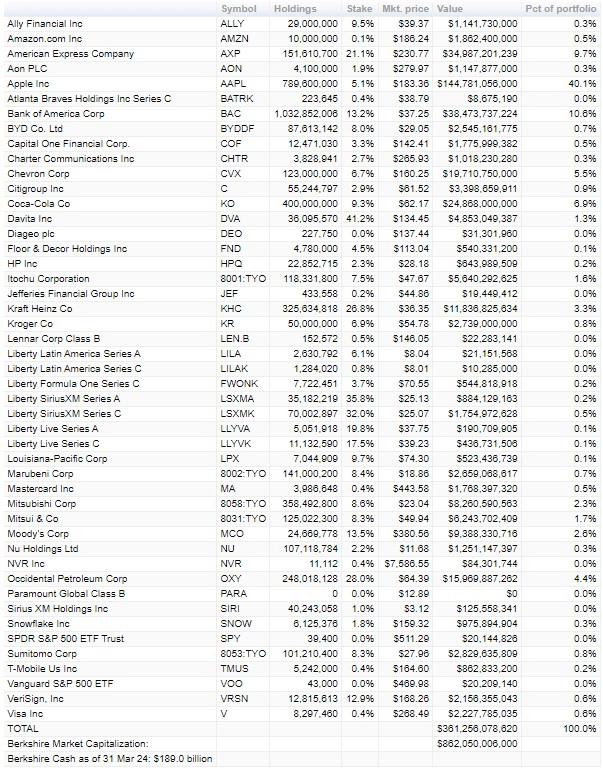

Berkshire Hathaway’s first-quarter earnings report, released on Saturday, revealed that its investment in Apple was valued at $135.4 billion, indicating approximately 790 million shares. This reflects a decrease of around 13% in the stake. Despite this decline, Apple remains Berkshire’s largest holding by a significant margin.

Picks for you

This marks the second consecutive quarter in which the Omaha-based conglomerate has reduced its stake in the tech giant.

In the fourth quarter, it sold approximately 10 million Apple shares, representing just 1% of its substantial stake. Considering Apple’s stock price change, this latest filing suggests that Berkshire sold approximately 116 million shares.

During Berkshire’s annual meeting in Omaha, Buffett indicated that the sale of Apple shares was driven by tax considerations due to significant gains. He hinted that it might also be a move to preemptively avoid higher tax liabilities in the future, especially if rates increase to address the growing U.S. fiscal deficit.

Despite the sale, Berkshire remains Apple’s top shareholder among non-exchange-traded fund (ETF) providers.

Notable reductions in portfolio

Although there was little buying activity in the first quarter, Buffett reduced his stake in Chevron (NYSE: CVX) by 2%. This starkly contrasts with the previous quarter, when he added 14.37% more CVX shares, possibly indicating a shift in preference towards increased investment in Occidental Petroleum (NYSE: OXY).

Regarding Paramount Global (NASDAQ: PARA), Buffett stated that ‘they sold it all,’ indicating a continuation of the trend from the previous quarter, where PARA stock is no longer part of Buffett’s portfolio.

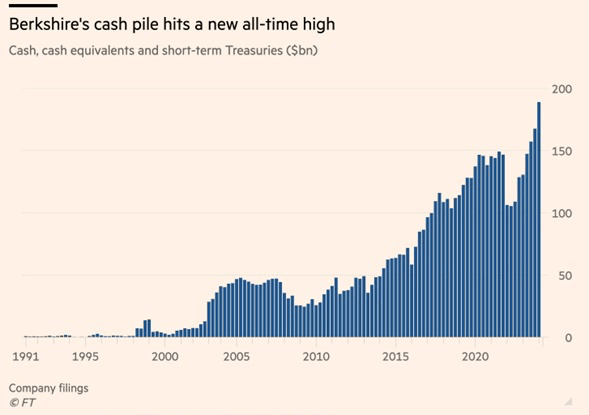

The increasing cash pile by Berkshire Hathaway might hint at the next investment

Berkshire Hathaway’s cash reserves have reached record highs and continue to increase, highlighting the challenge of finding investment opportunities that meet Warren Buffett’s criteria.

Buffett emphasized at the annual general meeting that they only invest in opportunities they find favorable. As of March, Berkshire’s cash, cash equivalents, and short-term Treasurys amounted to $189 billion, marking a 13% increase from the end of 2023.

Buffett projected that these reserves will likely reach around $200 billion by the end of the current quarter.

This could prove a substantial war chest if Berkshire Hathaway decides to invest in some new opportunity on the stock market or substantially increase its already-owned holdings.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.