Iran’s retaliatory strike against Israel on April 13 had a significant impact on various assets, raising concerns about critical supply routes like the Hormuz Strait and sparking fears of broader regional conflict involvement.

Due to its value-preserving properties, traders often turn to gold as a haven and hedge against inflation during geopolitical tension and market uncertainty.

The immediate effect of the potential conflict was evident as gold surged over 1% to $2,380.07 an ounce. This prompted Finbold to employ ChatGPT, an AI-powered chatbot developed by OpenAI, to investigate the potential trajectory of gold prices in case of further escalation between Israel and Iran.

ChatGPT predicts Gold price in case of an Israel-Iran war

If Iran’s attack on April 13 was merely the beginning of a broader regional or global conflict, ChatGPT speculated on a potential gold price and provided its rationale.

Gold serves as a safe-haven asset during periods of geopolitical instability, and investors seek it for stability and protection against uncertainty, geopolitical risks, and currency fluctuations.

During conflicts, disruptions in supply may arise, especially if key gold-producing regions are affected, or transportation routes are disrupted. Furthermore, heightened demand for gold as a haven can increase prices.

Market sentiment heavily influences gold prices during geopolitical tension, with fear, uncertainty, and risk aversion driving up demand for gold.

Considering these factors, ChatGPT indicates that ‘given the current price of gold at $2,390.06 per ounce, a hypothetical price target in the event of a full-blown war could be in the range of $2,800 to $3,200 per ounce.’

With the possibility of Israel’s retaliation and the conflict’s further prolongation into the upcoming months, ChatGPT offered a prediction for the price of gold over this period.

Central bank policies regarding monetary stimulus and interest rates can influence gold prices. If central banks maintain or increase stimulus measures in response to heightened geopolitical risks, gold prices could be boosted.

If gold reaches the upper range of the prediction, which is $3,500, it would mark a 47.67% increase, which would mark its highest spike in valuation in almost 50 years.

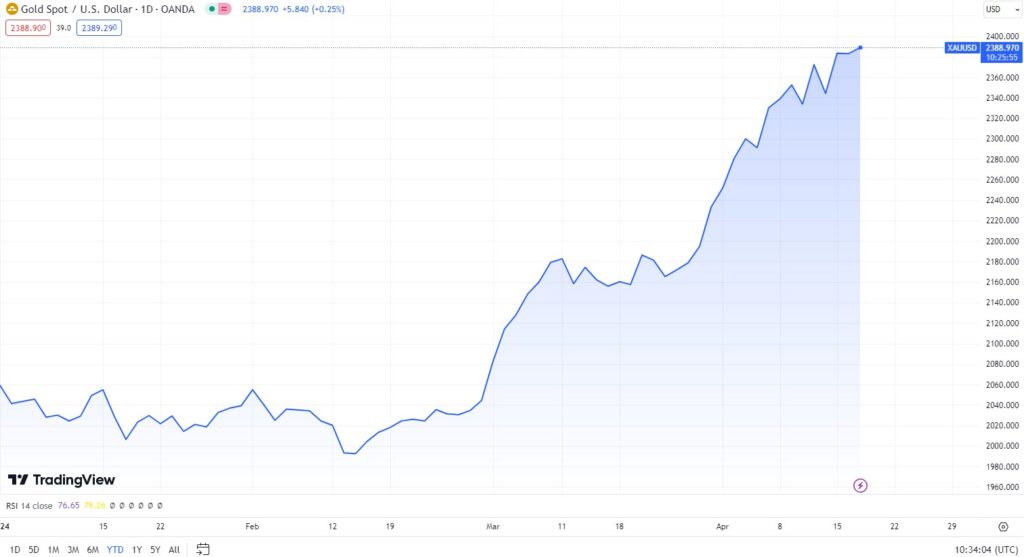

Gold price chart

While the unfortunate event of war would make its price surge drastically, gold has already notched an impressive YTD increase in its valuation, which stands at 15.54%, just one quarter behind us. This is pawing a way to a yearly increase not seen in the previous two decades.

The ongoing geopolitical uncertainties have sparked a significant rally in gold prices. This rally could gather even more momentum due to escalating tensions, a downturn in stock market performance, and increased speculation, with large investment groups already seeing gold above the $3,000 threshold in a matter of months.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.