Bitcoin (BTC) long-term holders suddenly activated two dormant wallets on May 12, moving 1,000 BTC worth over $60 million. These whale addresses remained inactive for 10.7 years since September 2013, when this stash was valued at $125,000.

Notably, the Whale Alert account on X posted each transaction with an interval of 20 minutes. According to the alerts, these holdings were valued at $62,890 and $63,565 when the addresses first acquired them.

On that note, the Lookonchain account also reported the dormant whales’ activity, identifying that one address acquired 500 BTC on September 13, 2013, and the other on September 14, 2013.

Picks for you

The short interval between each receiving and, later, spending suggests that both 10-year Bitcoin wallets belong to the same entity. This recent activity could mean simple wallet management or that this whale intends to sell the 1,000 BTC.

Bitcoin dormant whales activity and BTC price analysis

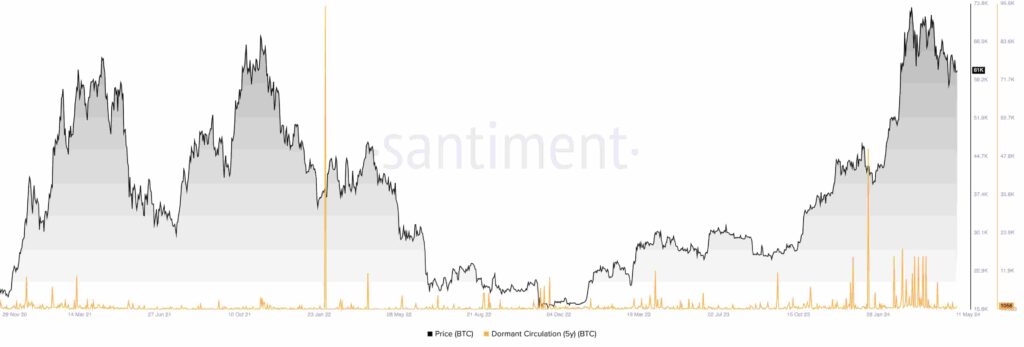

Interestingly, Finbold retrieved data from Santiment showing that increased dormant whale activity usually correlates to BTC’s price top formation. The chart shows that most spikes on this metric were close to a trend reversal, typically bearish.

However, despite the recent two, there is currently significantly low 5-year dormant whale activity in the Bitcoin network.

As of this writing, Bitcoin trades at $61,000, and only 1,056 BTC have been moved within this category instead of over 10,000 units during top formations. Moreover, technical analysis, derivatives liquidations, and on-chain metrics suggest Bitcoin could soon rally to $72,000, for over 18% gains.

Conversely, analysts warned of an imminent BTC meltdown, while others are optimistic about an altcoin season potentially surging.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk