The world is growing more hostile by the day, with rises in violence and volatility from Ukraine and Gaza to Yemen and Sudan. As humanitarian crises and ticking nuclear threats brew, the surging conflicts leave investors worried about the fate of the stock market. So, what happens to the stock market if we go to war? Today’s article will cover the historical performance of the stock market during global conflict, as well as the potential influence on individual sectors of the market.

The ongoing wars that could draw in the United States

The United States, as the leading NATO country, has worn the mantle of a global police force tasked with maintaining balance and limiting conflicts. The past couple of decades have been generally described as the most peaceful time in history, but the times are seemingly changing.

There are several ongoing armed conflicts in the world, including those in Myanmar, Sudan, and Yemen. However, two wars have drawn the most attention from the United States: Russia’s invasion of Ukraine and the Israeli invasion of the Gaza Strip.

The United States has spearheaded efforts to deliver military and financial aid to Ukraine in the wake of Russian aggression. However, the American public is divided on the issue, with the Republicans headed by Trump opposed to costly additional support packages. Despite this, on April 24, Biden signed a bill to deliver a $61 billion foreign aid package for Ukraine. While direct U.S. involvement currently remains unlikely, it is still not impossible.

As a staunch ally of Israel, the U.S. has been actively monitoring and supporting its war on Hamas. However, as the conflict has involved Iran-backed militias and even caused a missile shootout between Israel and Iran, there is a non-negligible possibility of open conflict and direct American involvement.

What happens to the stock market in a war?

The stock market tends to react negatively to sudden changes, which wars certainly bring. However, it might come as a surprise, but the stock market has shown historical resilience to armed conflict.

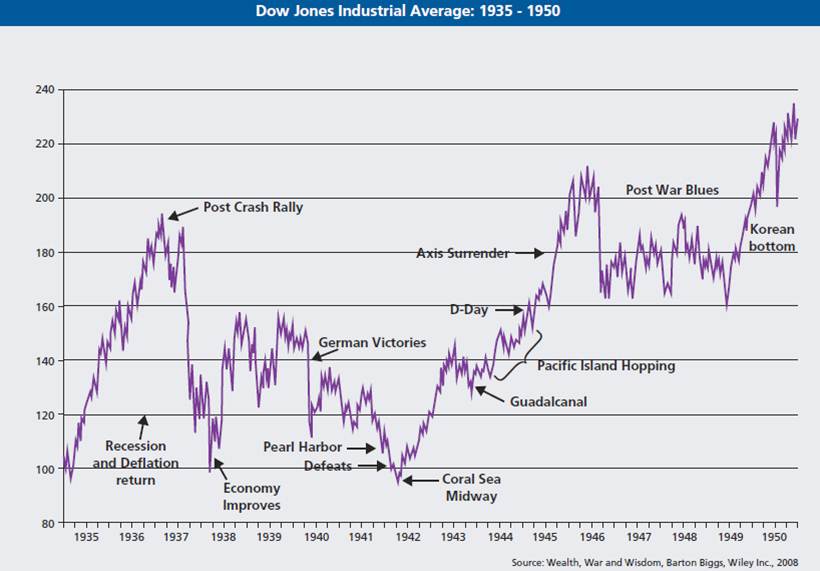

LPL Financial Chief Investment Strategist John Lynch has stated that, based on previous experiences, conflict is unlikely to seriously affect the United States market performance. Furthermore, Ben Carlson has highlighted the complexity of the link between global crises and stock market health when describing the Dow during World War II:

“From the start of World War II in 1939 until it ended in late 1945, the Dow was up a total of 50%, more than 7% per year.”

– Ben Carlson

For example, in the days after Russia’s invasion of Ukraine, the S&P 500 index fell more than 7% as the West introduced heavy sanctions. However, after only a month, the S&P was valued higher than before the invasion. Similarly, in the wake of Hamas’ attack on October 7, 2023, and Israel’s military response, the S&P sank initially but then spiked to experience growth the next week.

Do stocks do well during war?

While what happens to the stock market if we go to war is not significant on a global scale, individual stocks can face significant impact from global conflict.

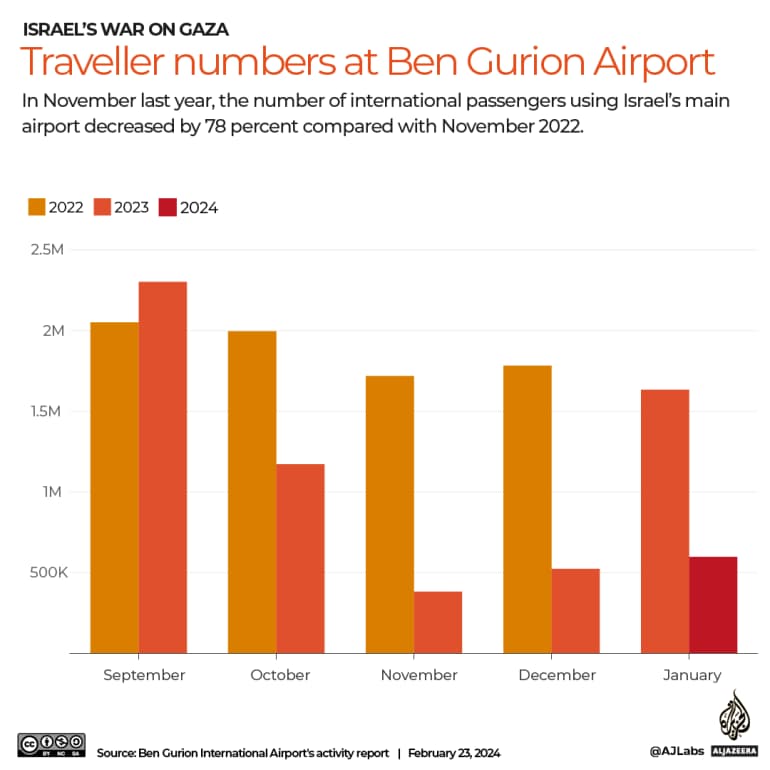

Travel, transportation, and leisure stocks suffered the most, as exemplified by Israel’s tourism industry, which collapsed by over 50% since the beginning of the war.

Furthermore, any American-listed stock with direct involvement with Russia, Ukraine, or Israel has experienced a sharp downturn, like the Israeli Mobileye Global (NASDAQ: MBLY), which experienced a -30.85% in year-to-date stock price movement. The U.S.-based companies had to liquidate their Russian assets, severely impacting the likes of Philip Morris (NYSE: PM), PepsiCo (NASDAQ: PEP), and McDonald’s (NYSE: MCD), and many Russian companies had to be delisted.

In that manner, if China ever engages in a war against Taiwan, Chinese stocks like PDD Holdings (NASDAQ: PDD) and Alibaba (NYSE: BABA) will risk similar fates to Russian companies, while U.S. companies with heavy exposure to the Chinese and Taiwanese markets, like Qualcomm (NASDAQ: QCOM), Nvidia (NASDAQ: NVDA), and AMD (NASDAQ: AMD) will likely suffer downturns.

On the other hand, the stocks likely to benefit from the conflict are defense stocks, like Northrop Grumman (NYSE: NOC), RTX Corporation (NYSE: RTX), and Leidos Holdings (NYSE: LDOS), and energy stocks, like Energy Transfer (NYSE: ET), Enterprise Products Partners (NYSE: EPD), and Kinder Morgan (NYSE: KMI).

What happens to the stock market if we go to war – the bottom line

The most probable answer to what happens to the stock market if we go to war is – almost nothing. As previous examples taught investors not to react to geopolitics impulsively, the stock market will probably experience an increase in volatility in the short run but quickly regain composure and possibly even benefit from the events. Furthermore, the central bank has the ability to intervene (and will likely do so, as in the case of COVID-19) to preserve the economy.

While war is a dire thing and has numerous adverse consequences, you should not worry about the market. And let’s consider ourselves lucky we have the luxury to worry about the economy in the first place!

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.