IMPORTANT NOTICE

Finbold may provide educational material to inform its users about crypto and digital assets. This content is for general information only and does not constitute professional advice or training certification. Content is provided "as is" without any warranties. Users must conduct their own independent research, seek professional advice before making investment decisions, and remain solely responsible for their actions and decisions.

RISK WARNING: Cryptocurrencies are high-risk investments and you should not expect to be protected if something goes wrong. Don’t invest unless you’re prepared to lose all the money you invest.

By accessing this Site, you acknowledge that you understand these risks and that Finbold bears no responsibility for any losses, damages, or consequences resulting from your use of the Site or reliance on its content. Click here to learn more.

Summary: In this guide, we introduce you to the concept of Bitcoin ETFs, explaining why they matter and how to invest in them. Additionally, we will take a look at the recent US Securities and Exchange Commission (SEC) approval of Bitcoin ETFs.

What is an ETF?

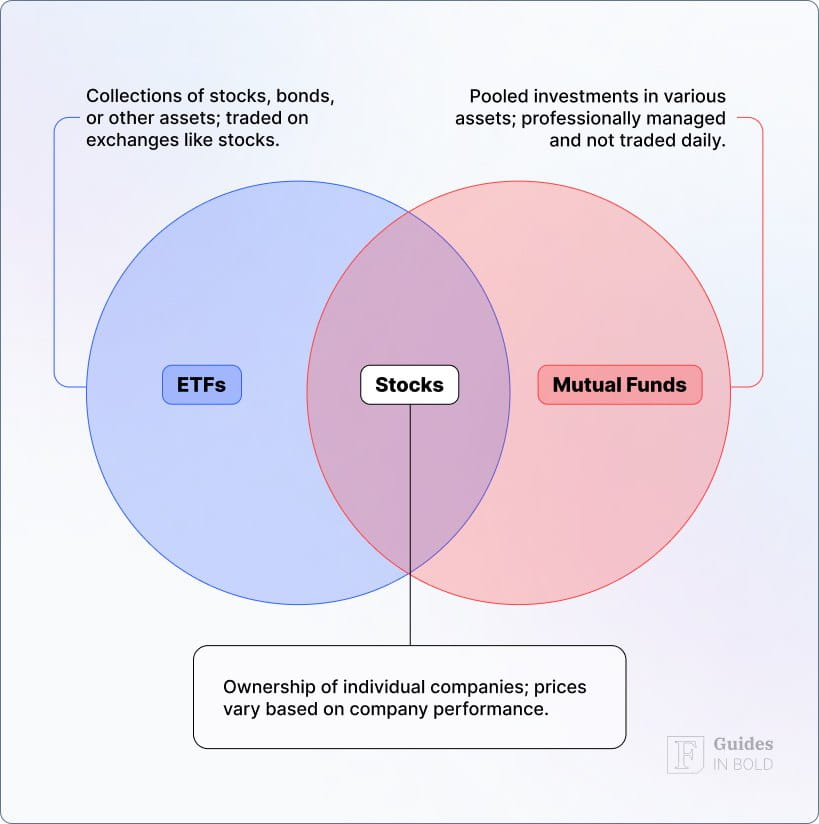

An ETF (or exchange-traded fund) is a regulated financial instrument whose price tracks the value of underlying assets. For example, the price of a Gold ETF would track the value of the gold reserves that are represented within the ETF. Similarly, the price of an oil ETF, a stock index ETF, or a crypto ETF would track the value of oil, the stock index, or the crypto assets, respectively. Just like stocks, an ETF can and is traded on regulated exchanges across the world, allowing investors to trade ETFs through their brokerage accounts.

The basic idea behind an ETF is to have an instrument whose value is pegged to the value of an underlying asset. That way, an investor does not have to deal with the actual asset directly. For instance, if an investor wants to invest in gold but would rather not deal with the asset physically, an ETF tracking it would be a great way to get the gold exposure otherwise.

In this definition, you may have picked up one of the main selling points of ETFs, but later in this guide, we will dive deeper into the benefits of ETFs, especially as they apply to Bitcoin and other cryptocurrencies.

What is a Bitcoin ETF and how does it work?

A Bitcoin ETF is a tradable instrument that tracks the value of Bitcoin. The Bitcoin ETF can and is often listed on traditional exchanges where the ETF can be bought and sold, similar to equity stocks.

To create a Bitcoin ETF or any crypto ETF for that matter, a management company will acquire the actual coins from the market. These are used as reserves, just like how the management company will purchase stock to include in a traditional shares ETF. The company will then create a fund that represents the value of the Bitcoin it holds in custody and list it for trading on the stock exchange, where it is available to investors and traders.

Investing in a Bitcoin fund is extremely convenient to the average investor, who will not have to deal with the security and logistics risks inherent with handling the digital currency. The whole process of buying Bitcoin through a cryptocurrency exchange and figuring out a way to store your coins is admittedly clunky. And it is especially risky for the average investor who may not be technically inclined.

Some notes on volatility

Investing in a Bitcoin ETF does not, however, eliminate all your investment risks. It is important to remember that cryptocurrencies are still highly volatile assets whether you invest directly or through an ETF.

In terms of how a Bitcoin ETF works, there are no surprises. Crypto ETFs work exactly like any other traditional asset-backed ETF. This is part of the allure of crypto ETFs. You do not have to understand blockchain and cryptocurrencies to take advantage of the crypto market’s volatility. Although, it does help to learn about the markets in which you want to invest.

As long as one has or can create a brokerage account, they can trade any crypto ETF supported through their brokerage account. Trading a crypto ETF is as simple as logging into your brokerage account, selecting the trading symbol that represents the Bitcoin ETF, and proceeding to buy or sell the asset.

History of Bitcoin ETFs in the United States

It took a long time for the Securities and Exchange Commission (SEC) to approve the launch of a Bitcoin ETF. Here is a brief rundown of the process:

- July 2013 – Winklevoss Bitcoin Trust application made by the Gemini co-founders Cameron and Tyler Winklevoss sponsored by Math-Based Asset Services LLC. The SEC rejected the application on March 10th, 2017.

- December 2017 – ProShares Bitcoin ETF and the ProShares Short Bitcoin ETF applications filed by the ProShares Trust in conjunction with the New York Stock Exchange (NYSE). The two funds were to be listed on the NYSE Arca exchange, tracking the Bitcoin futures’ performance listed on CME and CBOE exchanges. The SEC rejected both applications on August 22nd, 2018.

- January 4th, 2018 – NYSE Arca applies to list five Bitcoin-related funds. The funds were Direxion Daily Bitcoin Bear 1X Shares, Direxion Daily Bitcoin 1.25X Bull Shares, Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares, and Direxion Daily Bitcoin 2X Bear Shares. The SEC rejected the application on August 22nd, 2018.

- January 5th, 2018 – Cboe BZX Exchange applied to list shares of GraniteShares Bitcoin ETF and the GraniteShares Short Bitcoin ETF. The SEC disapproved the application on August 22nd, 2018.

- January 2019 – NYSE Arca applies to list shares of Bitwise Bitcoin ETF Trust. This application was also rejected on October 9th, 2019.

- January 2019 – the Cboe BZX Exchange applies to list SolidX Bitcoin Shares Issued by the VanEck SolidX Bitcoin Trust. However, the exchange does not wait for a determination from the commission following several postponements. It withdrew the application on September 17th, 2019.

- June 2019 – the NYSE Arca exchange files another Bitcoin ETF application in conjunction with the New York-based investment management firm Wilshire Phoenix to list shares of the United States Bitcoin and Treasury Investment Trust. On February 26th, 2020, the SEC again rejected this application.

- 2021 – 2021 saw increasing growth in the number of applications to the SEC, possibly due to the change of guard at the commission’s helm. In April 2021, former CFTC chief Gary Gensler assumed office as the new chief of the SEC, taking over from Jay Clayton. Gensler has a breadth of experience regulating the commodities industry. But more importantly, before joining the SEC, he was an MIT Sloan professor of Economics teaching a course on blockchain, digital currencies, FinTech, and public policies and commenting extensively on the same.

- 2022 – In November 2022, FTX declared bankruptcy, resulting in a lot of skepticism regarding crypto.

- 2023 – Ordinals, Bitcoin NFTs, went live.

- January 2024 – SEC approves 11 Bitcoin ETFs.

SEC approval ushers in a new crypto era

The US Securities and Exchange Commission (SEC) has granted approval for the first US-listed exchange-traded funds (ETFs) tracking Bitcoin. No matter your opinion on the matter, the approval marks a significant milestone not only for Bitcoin but the broader crypto sphere.

The initial announcement generated a lot of buzz and led to a surge in Bitcoin price. However, a lot of confusion followed the hype when the SEC claimed its account had been compromised and that the tweet announcement was unauthorized. Nonetheless, the news was true, and the SEC officially approved 11 Bitcoin ETFs the day after.

What did it all mean? Most importantly, the ETF approval made Bitcoin accessible to a broader audience, specifically those with no direct experience trading crypto. That is, ETFs provide investors with a more accessible way to gain exposure to crypto without directly owning it. This has the potential to increase Bitcoin distribution in the US and push the token into the mainstream. Moreover, institutional fund managers operating alternative asset hedges can now turn to Bitcoin to further diversify their platforms and attract more investors.

While a lot of investors are excited, however, the SEC is still somewhat skeptical, seizing every opportunity to emphasize associated risks. To quote SEC chairman Gary Gensler:

“Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

Other analysys have likewise expressed concerns about the potential risk and volatility SEC’s decision could bring. For example, many emphasize that the approval may disturb the price of other cryptocurrencies.

While the future is uncertain, it is also exciting, and there is no doubt we are in for a lot of surprises in the months to come.

Bitcoin ETFs in the US

The list of approved Bitcoin ETFs includes:

- ARK 21Shares Bitcoin ETF (NYSE: ARKB);

- Bitwise Bitcoin ETF (NYSE: BITB);

- Blackrock’s iShares Bitcoin Trust (NASDAQ: IBIT);

- Franklin Bitcoin ETF (NYSE: EZBC);

- Fidelity Wise Origin Bitcoin Trust (NYSE: FBTC);

- Grayscale Bitcoin Trust (NYSE: GBTC);

- Hashdex Bitcoin ETF (NYSEARCA: DEFI);

- Invesco Galaxy Bitcoin ETF (NYSE: BTCO);

- VanEck Bitcoin Trust (NYSE: HODL);

- Valkyrie Bitcoin Fund (NASDAQ: BRRR);

- WisdomTree Bitcoin Fund (NYSE: BTCW).

Bitcoin ETFs outside the US

While the US cryptocurrency investors were busy seeking SEC approval, several Bitcoin ETFs were launched in Canada, Brazil, the Middle East, and Europe just this year alone. We expect more regulators to take the cue from Canada’s Ontario Securities Commission (OSC) and the other trailblazers.

Crypto ETFs in Canada

The OSC approved the launch of the first Bitcoin ETF in Canada on February 12 2021. This saw Purpose Bitcoin ETF (BTCC) launch a week later on the 18th, managed by Purpose Investments. Technically, this was the world’s first Bitcoin ETF, considering that several similar products offered in Europe are referred to as ETPs and ETNs standing for exchange-traded products and notes, respectively.

Since the launch of the Purpose Bitcoin ETF in Canada, several other cryptocurrency-related ETFs have been launched, including one by Purpose Investments that tracks the performance of Ethereum, the second-largest digital asset by market value.

The crypto ETFs you can invest in if you are in Canada include the following:

- Purpose Bitcoin ETF was launched by Purpose Investments in February 2021. Shares of this ETF are listed on the Toronto Stock Exchange (TSX). The fund currently manages more than $940 million. This fund is listed on the TSX under three symbols representing three variants of the same fund. They are BTCC (FX HEDGED and quoted in local currency), BTCC.B (NON-FX HEDGED, also quoted in CAD), and BTCC.U (quoted in USD). You can also invest in the Purpose Ether ETF, another first ETF tracking the performance of Ether. This fund was launched on April 20th 2021 and held more than CAD 312M or 65636 ETH under management.

- Evolve Bitcoin ETF (EBIT), managed by Evolve Funds Group Inc., was cleared for launch by the OSC on February 16th 2021. The fund was listed on the 19th, just a day after the Purpose Bitcoin ETF started trading on the TSX exchange. The fund manages $171 million.

- 3iQ CoinShares Bitcoin ETF (BTCQ) shares are listed on the TSX exchange under the ticker symbols BTCQ (unhedged) and BTCQ.U (hedged against the US Dollar). The fund was listed on April 19th 2021 by 3iQ Corp in partnership with London-based CoinShares. So far, the fund has over $217 million in assets under management.

Bitcoin ETF in Brazil and Dubai

Brazil got its first Bitcoin ETF in June 2021, launched by Rio asset manager QR Asset Management. Shares of the fund are listed on Sao Paulo-based B3 exchange under the ticker symbol QBTC11. The fund tracks the performance of the CME Group index of Bitcoin futures contracts.

QR Capital received the approval to launch the fund in March 2021 from the Brazil Securities and Exchange Commission (CVM).

In July, 2021 QR Capital received another approval from the CVM to launch an Ether ETF that tracks the performance of Ether cryptocurrency. The fund would launch similar to the Bitcoin ETF, listing the shares on the B3 exchange under the ticker symbol QETH11.

Another Bitcoin ETF available to Brazilian investors is the Hashdex Nasdaq Bitcoin Reference Price Index Fund trading on the B3 exchange under the ticker symbol BITH11. The fund was launched in July by Brazilian asset manager Hashdex.

For investors in the Middle East and North Africa (MENA), 3iQ Corp has dual-listed its Bitcoin fund on the Nasdaq Dubai international exchange. The shares of this fund are listed under the ticker symbol QBTC and function just like its Canadian counterpart.

Pros and Cons of Crypto ETFs

The benefits of investing in a Bitcoin or Ether ETF over a direct investment in the underlying asset are numerous. On the flip side, however, there are some drawbacks.

Pros

- Convenience – perhaps the greatest pro of a crypto ETF over direct investments is that average investors don’t have to handle the underlying asset. Crypto is quite hard to understand, and most of the platforms that allow you to buy and store your assets have less than stellar track records. Additionally, most cryptocurrency exchanges also have dubious regulatory policies, which raises the risk for its investors. As a result of crypto ETFs, investors may gain exposure to the new market using their existing brokerage accounts. This way, they do not have to worry about the safety and security of the assets they hold

- Flexibility – speculators need to be able to take advantage of both market rallies and corrections. As a result of investing through the spot market, you will not be able to profit from a falling asset’s value. In this case, it’s known as short selling or “going short.” However, with a Bitcoin ETF, you have the option of going long or short.

- Regulations – ETFs are highly regulated financial assets, and crypto ETFs are no exception. Not only can regulators monitor and analyze the performance of a Bitcoin ETF on public platforms, they can also provide protection against price manipulation within the ETF markets. However, the underlying asset’s price, in this case, Bitcoin or Ether, can still be manipulated through unregulated crypto exchanges.

Cons

- Management fees – ETF fund issuers charge a management fee usually between 0.4% and 1.5% annually. There is no fee involved in storing Bitcoin on a cryptocurrency exchange or a private wallet.

- Exchange limitation – it is easy to exchange your ‘physical’ digital assets that you directly hold. If you have some Bitcoin in your wallet, you can easily swap it for some Ether or Litecoin or any other asset supported on your platform of choice. This is not the case with a crypto ETF. Arbitrage speculators can thus take advantage of price differences between trading pairs across various platforms. This is not possible when dealing with crypto ETFs.

- Price discovery errors – ETFs track the performance of underlying assets. This could be indices or actual assets held in reserves. Sometimes, the net asset value (NAV) of the fund lags behind the actual value of the assets they track. Other times, the price difference could be caused by market volatility.

Depending on how you look at it, a Bitcoin or Ether ETF may just be the right kind of asset to include in your portfolio. Any prudent investor will have to consider the asset’s merits and disadvantages to ensure that they are familiar with the risk factors that go along with this asset class.

Conclusion

There are several ways to invest in Bitcoin and other cryptocurrencies. But few of them are any good to a regular investor. A Bitcoin ETF is one of those. Since the SEC has finally approved the first Bitcoin ETFs in the United States, we are finally seeing a transition of the crypto market to the next maturity stage, which brings convenience and flexibility, allowing investors to get in on the current market buzz without taking too much risk.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Frequently Asked Questions about Bitcoin ETFs

What is a Bitcoin ETF?

A Bitcoin ETF is an exchange-traded fund created to track the price of Bitcoin. Shares of a BTC fund are listed on traditional exchanges allowing regular traders to buy and sell them through their brokerage accounts.

What is the difference between Bitcoin and a Bitcoin ETF?

Bitcoin is a digital currency that employs blockchain technology to facilitate value transfer whereas a Bitcoin ETF is a tradable financial instrument whose value is pegged to the value of the Bitcoin cryptocurrency. Also, crypto ETFs are regulated products as opposed to Bitcoin, which is a decentralized and pseudonymous digital currency.

Is there a Bitcoin ETF in the US?

Yes, Bitcoin ETFs are available in the US, as the SEC has approved them in January 2024.

Are Crypto ETFs safe?

Bitcoin and Ether ETFs are, ideally, safe products since they are approved for listing on traditional exchanges. They are constantly monitored and audited with reports available to the public. However, crypto ETFs are still risky assets, given that their value is pegged to the value of cryptocurrency, which is a highly volatile asset.

Is there an ETF to short Bitcoin?

Yes, there are ETFs to short Bitcoin, for example, the The ProShares Short Bitcoin Strategy ETF (BITI).

Has the SEC approved a Bitcoin ETF?

Yes, the SEC approved 11 Bitcoin ETFs in January 2024.

What crypto ETFs were approved?

The SEC has approved 11 Bitcoin ETFs:

- ARK 21Shares Bitcoin ETF (NYSE: ARKB);

- Bitwise Bitcoin ETF (NYSE: BITB);

- Blackrock’s iShares Bitcoin Trust (NASDAQ: IBIT);

- Franklin Bitcoin ETF (NYSE: EZBC);

- Fidelity Wise Origin Bitcoin Trust (NYSE: FBTC);

- Grayscale Bitcoin Trust (NYSE: GBTC);

- Hashdex Bitcoin ETF (NYSEARCA: DEFI);

- Invesco Galaxy Bitcoin ETF (NYSE: BTCO);

- VanEck Bitcoin Trust (NYSE: HODL);

- Valkyrie Bitcoin Fund (NASDAQ: BRRR);

- WisdomTree Bitcoin Fund (NYSE: BTCW).