On August 5, Palantir Technologies (NYSE: PLTR) reported strong second-quarter earnings that exceeded expectations, with revenue significantly surpassing Wall Street’s forecasts.

PLTR’s stock surged following its announcement of September quarter guidance, which came in well above analyst predictions, with reported adjusted earnings per share of $0.09, beating estimates of $0.08, alongside total revenue of $678 million, surpassing the expected $652.8 million. This positive news comes despite a broader market trend of investors moving away from technology stocks, particularly those tied to artificial intelligence (AI).

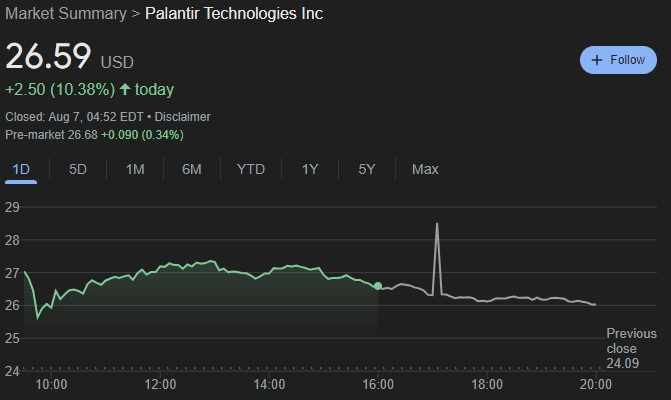

In the following trading session, PLTR stock valuation propelled to $26.59 after an impressive 10.38% daily gain, with pre-market trading revealing additional progress of 0.34% at the time of writing on August 7.

Bears question every aspect of PLTR stock valuation

Critics of Palantir aren’t disputing the company’s performance; their concerns are more focused on the stock’s valuation, significantly after it has already climbed 40% this year, even before factoring in the August 6’s 10% surge.

Mizuho analyst Gregg Moskowitz believes it’s reasonable for Palantir’s stock to see a significant increase, but he remains cautious, citing a recent downgrade.

“While the Q2 results are encouraging, we continue to believe PLTR needs to consistently demonstrate stronger execution and growth in order to justify a notably higher valuation,” said Moskowitz in a client note.

He maintains an “underperform” rating but has raised his price target to $24 from $22.

William Blair analyst Louie DiPalma points out that Palantir has not disclosed how much of its Q2 revenue came from special-purpose acquisition companies (SPACs), suggesting that SPAC-related revenue may have contributed to the acceleration in U.S. commercial revenue.

Most recently on August 7, Goldman Sachs raised its price target for Palantir Technologies shares from $14 to $16 while keeping a “neutral” rating on the stock, following Palantir’s strong second-quarter performance, which saw revenue surpassing Wall Street expectations by 4% and operating margins beating consensus by 470 basis points.

However, bulls see this as a PLTR “validation moment”

Optimists like Dan Ives of Wedbush view Palantir’s recent quarter as a “validation moment,” highlighting the strong impact of the company’s Artificial Intelligence Platform (AIP) on U.S. commercial growth. Ives describes this as a “game-changer” for Palantir, with AIP emerging as a key driver of future success.

Raymond James analyst Brian Gesuale is similarly optimistic, noting that momentum is building for Palantir. Gesuale points out that the company closed 96 deals worth over $1 million and 27 deals exceeding $10 million and emphasizes that Palantir has been profitable for seven consecutive quarters, demonstrating its ability to invest internally while expanding profit margins.

Bank of America analyst Mariana Perez Mora compares the California gold rush to the California gold rush, suggesting that Palantir, as a “digital axe supplier,” continues to thrive even as the initial excitement around AI begins to fade. She sees Palantir as a long-term winner, standing strong as the AI “tourists” start to move on.

Despite this, the prevailing sentiment on Wall Street for PLTR stock is still a “hold,” underscoring the divide this Denver-based AI company is creating among top analysts at major financial institutions, which are entrenched in their arguments and find it hard to agree with the opposing side.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.