As the month of July unfolds, Amazon (NASDAQ: AMZN) shares have failed to sustain the momentum that has previously led it to a new all-time high (ATH), raising questions about the reasons for such a poor performance of the company’s stocks in recent days.

Indeed, for the past month, Amazon stock has been trading in quite a wide range between $181.45 and $201.20, with its more recent performance near the lows of this price area, and AMZN currently not offering a high-quality setup despite a positive long-term trend.

Why is Amazon stock down?

Notably, the factors that might be weighing down heavily on AMZN shares’ latest price performance possibly entail the recent downgrade of the stock target price from $230 to $220 by the experts at banking behemoth Barclays, although they have retained the ‘overweight’ rating.

Another reason could be a recent report that the administration of President Joe Biden has told allies it is considering using draconian trade restrictions, including a measure called the foreign direct product rule (FDPR) if companies continue giving China access to America’s advanced chip technology.

On top of that, over the past 90 days, company insiders, such as Director Keith Brian Alexander and CEO Douglas J. Herrington, have sold over 6 million AMZN shares valued at $1.2 billion, according to the United States Securities and Exchange Commission (SEC) filing data.

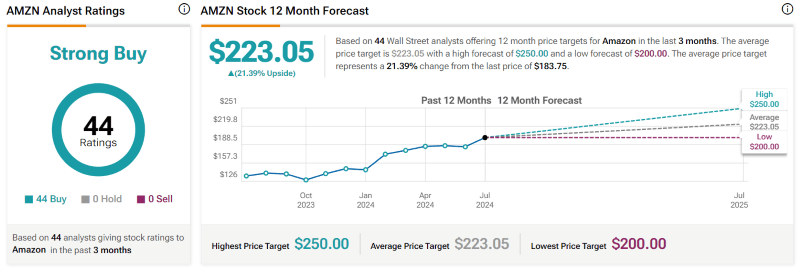

Regardless of its recent underperformance, the Wall Street darling holds a ‘strong buy’ rating from the market’s renowned analysts, 44 of them unanimously expressing conviction that AMZN stock is a ‘buy,’ with no calls for a ‘sell’ or ‘hold,’ and with an average price target of $223.05.

Amazon stock price analysis

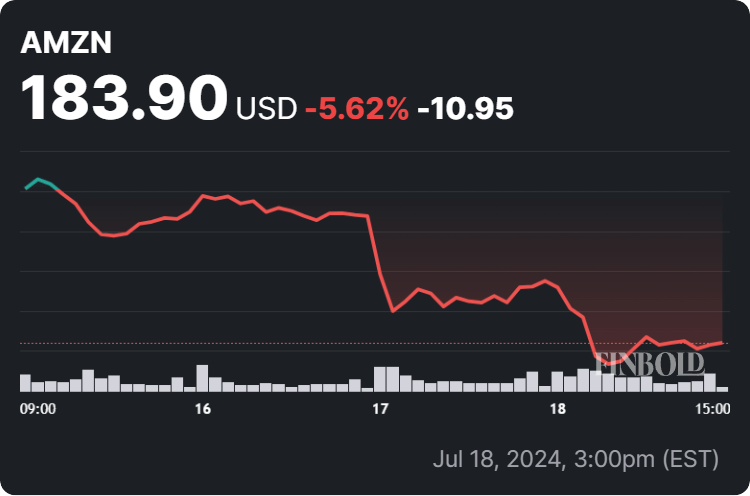

At press time, the price of Amazon stock stood at $183.90, reflecting a decline of 2.93% on the day, as well as dipping 5.62% across the past week, while accumulating a loss of 0.73% on its monthly chart, according to the most recent data on July 19.

It is also important to note that Amazon stock’s support zone currently resides between $171.96 and $176.43, so dropping below it would lead to more losses, while it is also facing a resistance area between $184.53 and $187.78, and recovery could follow if it manages to climb and remain above it.

Furthermore, its 5, 10, and 50 simple moving averages (SMAs) are all bearish, whereas the 20, 100, and 200 SMAs remain bullish, which means that AMZN shares’ short-term trend is negative whereas its long-term behavior seems to justify experts’s confidence.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.