Amid concerns that the price of Nvidia (NASDAQ: NVDA) stock has reached its top and will not go any higher any time soon, the artificial intelligence (AI) chipmaking titan’s CEO Jensen Huang has continued to sell his company’s shares, surpassing $711 million in value since June.

Indeed, Huang has sold another $25 million worth of Nvidia shares in a recent trading session, bringing last week’s total to over $78 million NVDA stocks sold, according to the observations shared by markets analytics platform Barchart in an X post on September 12.

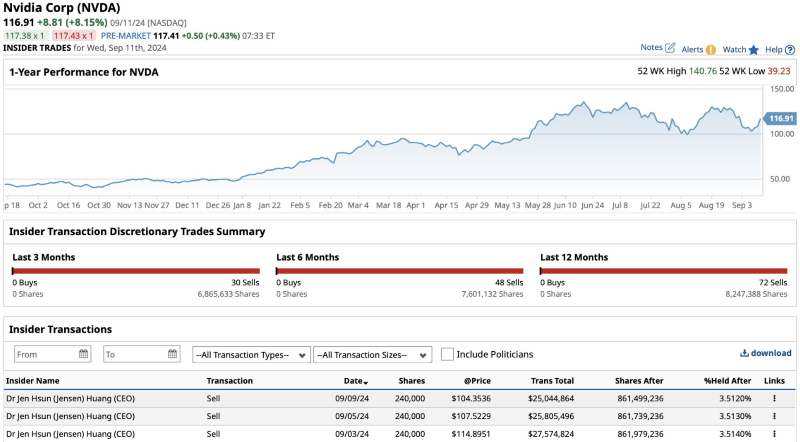

Specifically, the most recent sale, in which Huang sold 240,000 NVDA stocks worth $25,044,864 (at an average price of $104.35), took place on September 9 and reduced the number of Nvidia shares owned by him to 861.5 million or 3.512% of the total amount.

As a reminder, the Nvidia CEO previously sold 240,000 Nvidia stocks on September 3, followed by another 240,000 on September 5, which means that he has now sold around 5.7 million NVDA stocks since mid-June as part of a Rule 10b5-1 plan, according to which he intends to sell up to 6 million NVDA shares by March 31, 2025.

Nvidia stock price history

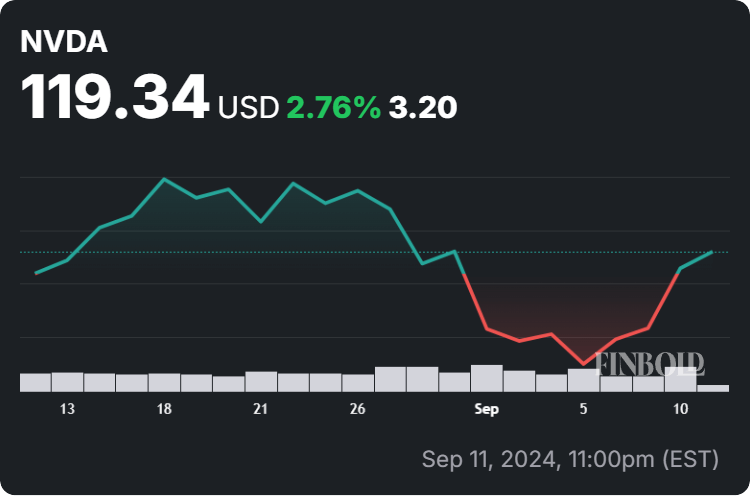

At press time, the price of Nvidia stock stood at $119.34, recording a 2.77% increase on the day, gaining 15.05% across the past week, accumulating a 3.19% advance in the last month, as its year-to-date (YTD) growth amounted to 148.80%, as per the most recent chart data retrieved on September 12.

Recently, renowned markets trader TradingShot observed a possible disaster in the form of 3-month pullback for Nvidia, “the first it had on a 1M basis since September – October 2023,” while the latter was “simply a mid-Bull consolidation phase within the wider picture of a Channel Up pattern that started almost 10 years ago.”

According to the analyst, Nvidia stock price was now “pulling-back from the Channel’s top (Higher Highs trend-line), and if the 1M MACD forms a Bearish Cross, we should be preparing for a cyclical correction within the pattern which in the previous two times (…) it corrected back to the 1M MA50 (blue trend-line) to form a bottom.”

As TradingShot concluded, Nvidia formed the November 2021 top “exactly at the time of the 1M MACD Bearish Cross,” while it reached the October 2018 top ten months later, adding that “we should really see the extent of the correction” in October or November this year if this truly is a three-year cycle.

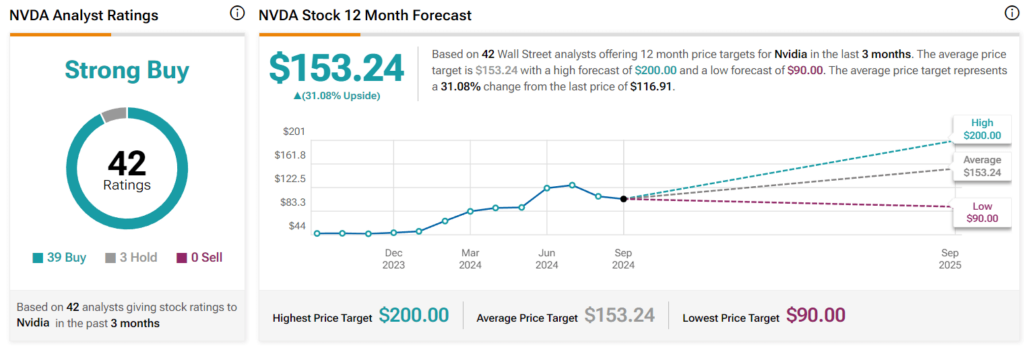

Meanwhile, Nvidia lost around $400 billion in market value last week, pulling down many other stock market players with it in what the Bespoke Investment Group said was the worst September start since 1953, although Goldman Sachs (NYSE: GS) and other analysts have retained their positive outlook.

What’s next for Nvidia stock?

All things considered, Nvidia CEO selling his shares does not necessarily mean he is losing confidence in his company’s stock, although it might look that way considering the technical analysis and recent hiccups in the form of the U.S. Department of Justice (DoJ) subpoena and other troubles.

However, the semiconductor giant expects to rake in over $3 billion in revenue in the fiscal Q4 after the launch of its Blackwell products later this year, which, alongside strong forecasts for the October quarter and positive results in the previous one, suggests potentially strong recovery. Hence, Huang might just be taking the opportunity to cash in some of the company’s good fortune.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.