After being hit by the overall gloomy sentiment characterized by low demand in the electric vehicle (EV) sector, Tesla’s (NASDAQ: TSLA) stock is building positive momentum as investors anticipate new highs.

The slowdown in demand for electric vehicles is evident in TSLA’s 2024 performance, with the stock plunging nearly 12% year-to-date.

However, in the short term, Tesla has emerged as one of the winners despite prevailing concerns about the economic outlook due to fears of a possible recession amid anticipation regarding the Federal Reserve’s next monetary policy. Specifically, at the close of markets on September 4, TSLA was valued at $219, a 24-hour gain of over 4%. Over the past month, the stock has risen by 10%.

Notably, Tesla’s current trading position and technical indicators present a mixed outlook. The stock is trading below its 50-day simple moving average (SMA) of $221, suggesting a possible consolidation in the near term. Additionally, it remains above its 200-day SMA of $203, indicating a bullish future trend.

Although Tesla appears to be gaining in the short term, it’s important to note that the price movement is not yet convincing. Since late July, the stock has traded between $200 and $220, failing to break out following a disappointing Q2 2024 earnings report.

While revenue grew by 2.3% year-over-year to reach $25.5 billion, net income dropped by 45% to $1.48 billion, reflecting the broader sell-off in the EV sector.

Why Tesla stock is surging

Looking at Tesla’s current momentum drivers, a few key fundamentals are impacting its share price. Interestingly, the recent rise can be attributed to a post by CEO Elon Musk on X, where he hinted at the potential use of robots by the EV maker.

Investor interest increased after Musk shared his thoughts on the company’s prospects following its headquarters relocation, stating that the outcome was “mostly good, some bad.”

Musk also said shareholders should expect a “wild” future involving robots. While specific details were lacking, Tesla’s leadership in robot development suggests Musk’s comments could be viewed as a commitment to this direction.

It’s worth noting that Tesla has been focusing on developing artificial intelligence (AI)-trained robots with potential applications in its manufacturing operations.

In a similar realm, investors anticipate unveiling Tesla’s robotaxi, designed for ride-hailing and autonomous driving, with the company planning to harness its Autopilot and Full Self-Driving software to power the new fleet line.

In addition, Tesla is reportedly developing a ride-hailing platform that will feature its robotaxi fleet. Speculation suggests the robotaxi could be officially announced as early as October.

Wall Street analysts take on Tesla

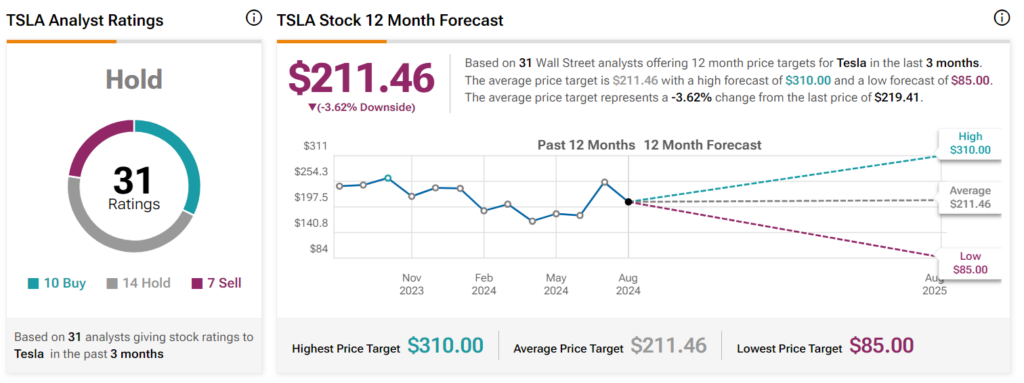

Currently, 31 Wall Street analysts on TipRanks project a potential downside for TSLA over the next 12 months. They predict the stock could drop by over 3%, with an average target price of $211. The analysts also forecast a high target of $310 and a low of $85.

Considering current economic conditions, Tesla’s stock will require more than internal fundamentals to maintain its recent gains.

Notably, similar to the broader stock market, concerns about a potential recession exist. Monitoring how equities like TSLA perform will be important, especially as investors anticipate a possible Federal Reserve interest rate cut in September.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.