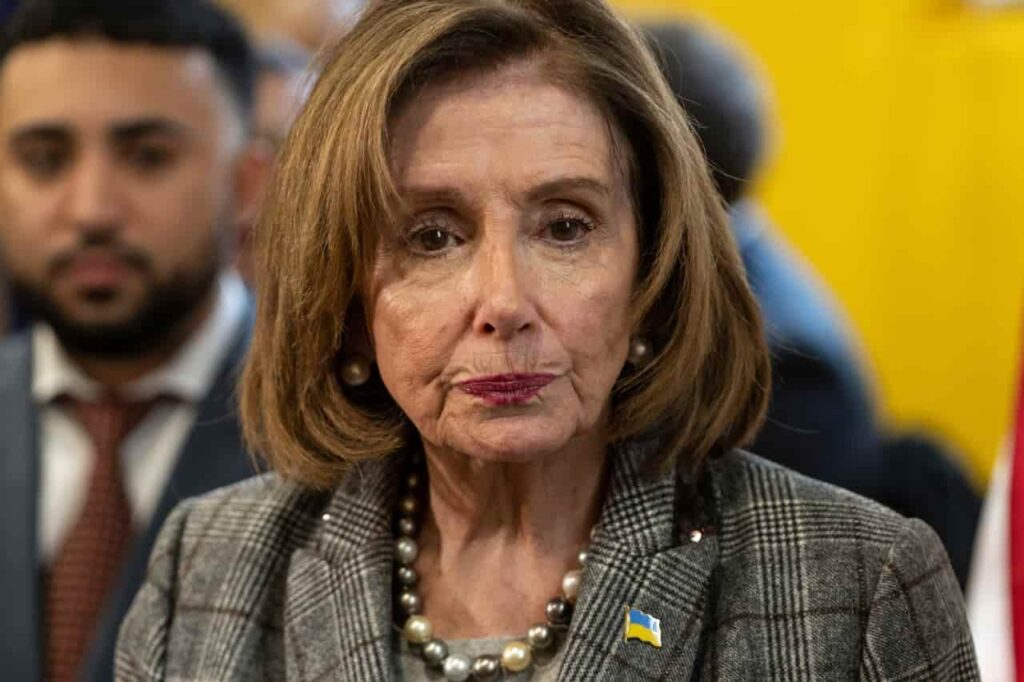

At the start of July, Nancy Pelosi – the most recognizable and the most criticized congressional trader of all – revealed significant updates to her portfolio, including a major investment in the stock of Broadcom (NASDAQ: AVGO).

While the acquisition of up to $5 million worth of AVGO call options could have been seen as savvy at the time of purchase – the analyst outlook for the company was mostly positive at the time – more recent developments have, arguably, turbocharged it.

Indeed, on July 18, 2024, it was reported that Broadcom was in talks with OpenAI – the company behind the leading artificial intelligence (AI) platform ChatGPT – about developing a new AI chip.

The partnership would seek to address the shortages of advanced processing units necessary for the development and upgrade of new advanced models due to both production capacity and expenses.

Previously, Sam Altman, the CEO of OpenAI, was reported as attempting to raise approximately $7 trillion for improvements of infrastructure needed to scale up and improve AI technology.

How high can AVGO stock go?

Looking at the effects of becoming a key player in the AI boom or even of just partnering with OpenAI, AVGO shares are likely to rocket in the near future.

While Nvidia’s (NASDAQ: NVDA) stock market successes are well known as the company rose some 1,000% and had its market capitalization grow approximately $2.5 trillion since the release of ChatGPT in late 2022, the recent price action of Apple (NASDAQ: AAPL) might offer another glimpse at what is ahead for AVGO.

After struggling to keep its footing for much of early 2024, AAPL stock surged from $165 to $224 between May and July – largely due to its own agreement with OpenAI that is set to see ChatGPT integrated into upcoming products.

AVGO stock price chart

Finally, Broadcom stock reacted quickly to the news of the talks and ended Thursday trading 2.91% in the green following a rapid rise late in the day. AVGO shares are also in the green in the Friday pre-market, having risen another 0.92% by the time of publication to a price of $162 – $1.48 per share above their latest closing price.

Whether Broadcom shares get turbocharged or not, the company has already been doing well in the 2024 stock market and is 47.89% in the green in the year-to-date (YTD) chart.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.