In the global semiconductor industry, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is positioning itself for a potential surge in stock price, partly powered by strategic business moves.

The company aims to capitalize on the gains impacting the general semiconductor sector in recent months as the industry becomes increasingly crucial in the artificial intelligence (AI) scene.

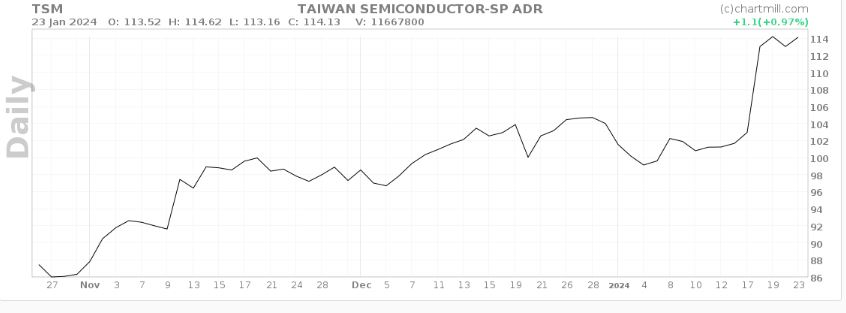

While TSMC may be considered late to the party, trailing entities like Nvidia (NASDAQ: NVDA), its potential is underscored by a steady rally of over 12% in 2024. The company faces key fundamentals likely to impact its valuation in this context.

TSM bullish potential

Firstly, reports indicate that TSMC is likely to partner with a major player in the AI world. Specifically, OpenAI’s CEO is in talks with TSMC regarding the launch of an AI chip fabrication plant. This development is expected to influence TSMC’s finances, given OpenAI CEO Sam Altman’s intention to raise billions of dollars for the chip plant.

Already, OpenAI, through its ChatGPT tool, has revolutionized the AI industry, and the possible partnership with TSMC will likely boost investor interest in TSM.

At the same time, TSMC is entering high-profile partnerships with key technology platforms. For instance, initially collaborating with Samsung for its Tensor chips, Google plans to shift chip manufacturing from Samsung to TSMC. The transition has already begun, with Alphabet (NASDAQ: GOOGL) assigning chip testing responsibilities to the Taiwanese manufacturer KYEC. This move is a step toward Google’s future association with TSMC, a potential boon for the company.

Additionally, TSMC is poised to benefit from the recovery in the global chip market, reinforcing its position among the top leaders in the industry, particularly in producing advanced chips. Against the backdrop of this anticipation, the company projects a revenue growth of about 20% in 2024.

Already, the company financials are also looking bright, considering that in the fourth quarter of 2023, TSMC reported a 19.3% year-on-year decline in net income, amounting to $7.48 billion. Despite this decline in net income, the company’s revenue remained relatively stable at $19.9 billion compared to the same period the previous year.

Analysts take on TSM

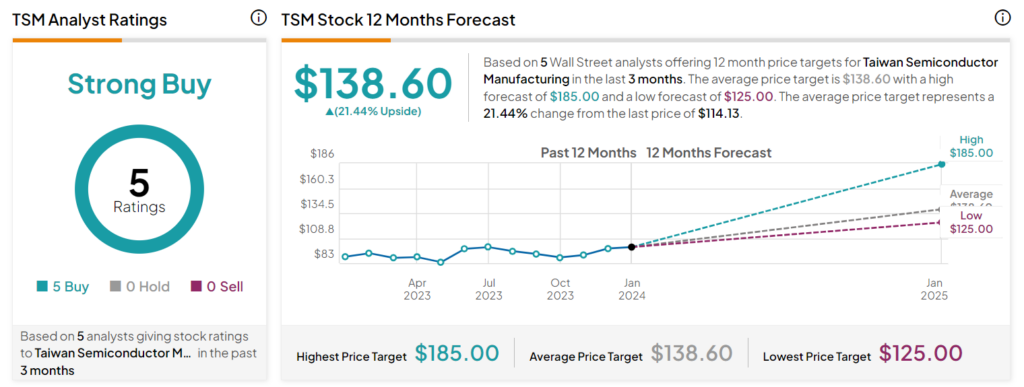

On the other hand, Wall Street analysts have assigned a ‘strong buy’ rating to TSM stock. According to the five analysts at TipRanks, basing their projections on the stock’s performance in the last three months, suggest that the equity will likely trade at an average price of $138.60, indicating a potential upside of 21% in the next 12 months. The experts have also set a high price target of $185 and a low forecast of $125.

By press time, TSM was valued at $114.13, reflecting a year-to-date gain of 12.41%. The stock’s consistently trading above the critical $100 support level over the past month is noteworthy.

Despite the positive fundamentals, TSMC still faces challenges. Increased competition in the highly competitive semiconductor sector and potential economic slowdown could dampen the stock’s prospects.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.