When Larry Fink, the CEO of BlackRock (NYSE: BLK), the world’s largest asset manager, managing an eye-popping $13 trillion, admits he was wrong about Bitcoin, people take notice.

On October 14, 2024, BlackRock’s Bitcoin (BTC) strategy reached new heights as the company’s spot Bitcoin ETF broke $1.65 billion in 24-hour trading volume.

But the headline isn’t just about numbers—it’s about Fink’s evolving view on Bitcoin.

“We believe Bitcoin is an asset class in itself,” Fink stated. “It is an alternative to other commodities like gold. And so, I think the application of this form of investment will be expanded to the role of Ethereum as a blockchain can grow dramatically.”

BlackRock’s Bitcoin bet

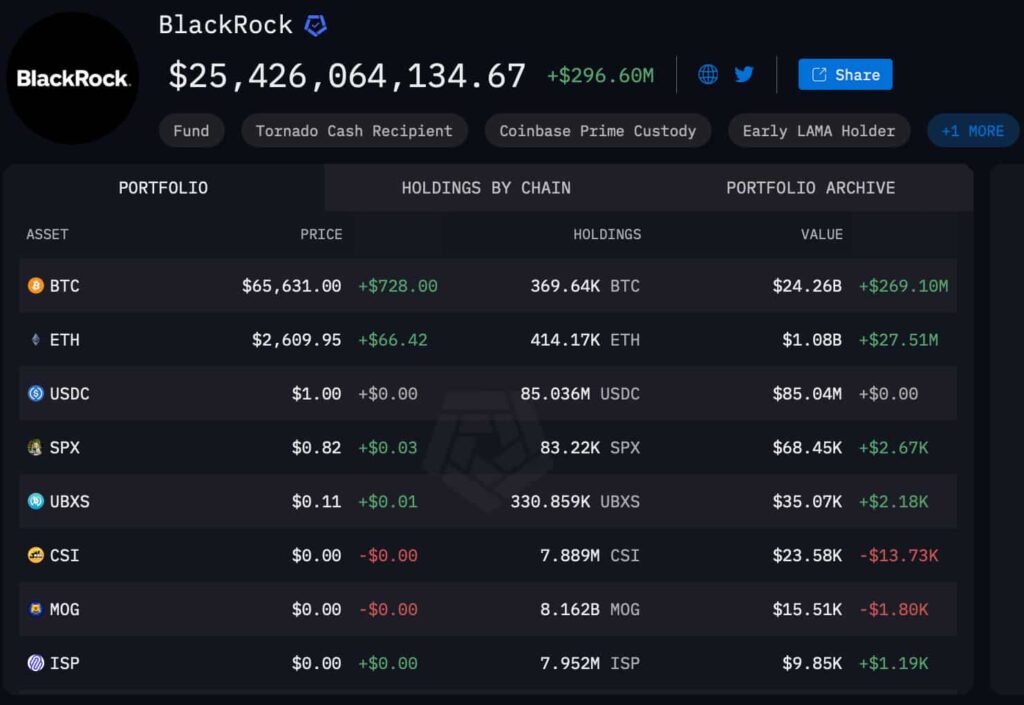

As of now, BlackRock holds an astonishing 369,640 BTC, worth over $24.26 billion, which accounts for 1.76% of the total Bitcoin supply.

The massive allocation signals a paradigm shift in institutional acceptance of Bitcoin, with Fink positioning BlackRock at the forefront of the digital asset revolution.

According to Fink, Bitcoin is no longer just a speculative asset—it’s cementing itself as a fundamental part of the financial ecosystem.

“I truly don’t believe it’s a function of regulation — of more regulation, less regulation. I think it’s a function of liquidity, transparency … no different than years ago when we started the mortgage market, years ago when the high-yield market occurred.”

While Bitcoin’s current market capitalization stands at around $1.3 trillion, Fink envisions the digital currency growing to rival the U.S. housing market, which is valued at over $50 trillion. He believes Bitcoin could become just as integral to the financial system as the housing market has been over the years.

BlackRock has been in discussions with institutions around the world about Bitcoin allocations, further validating its place in global portfolios. Fink’s remarks represent a significant shift from his earlier skepticism, when he aligned with the likes of JPMorgan CEO Jamie Dimon in questioning the value of cryptocurrencies back in 2021.

BlackRock’s Bitcoin ETF

Since launching its spot Bitcoin exchange-traded fund (ETF) in January 2024, BlackRock has set new records for trading volume. The Bitcoin ETF has soared to $24 billion in assets within just nine months, showcasing the growing demand for Bitcoin exposure.

“And we will continue to pioneer new products to make investing easier and more affordable,” Fink added during the company’s latest call.