XRP crashed over 4% on Friday, December 5, extending its now two-month-long general decline, which has seen the token’s price drop more than 30% since October 5.

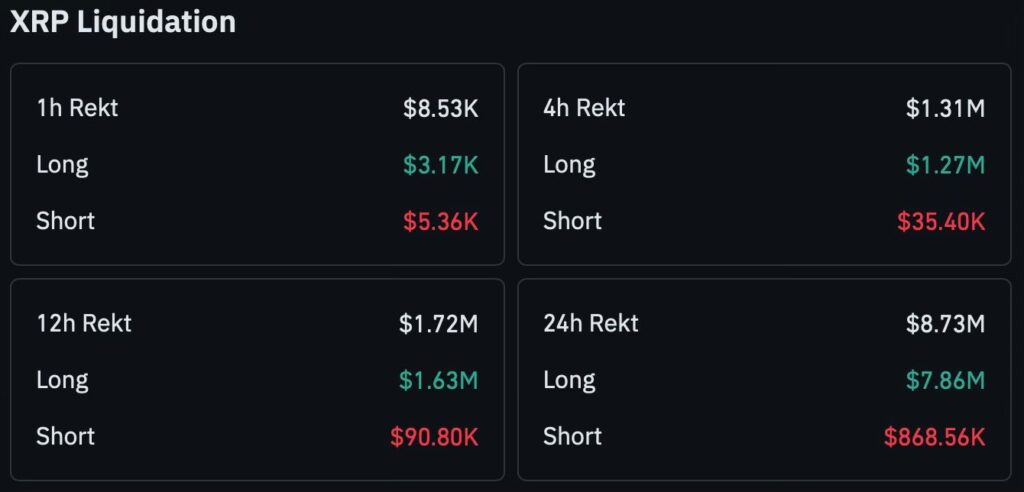

Punctuating the downward trend, the previous 24 hours have witnessed $7.83 million in long positions liquidated from the market, as per real-time liquidation data Finbold reviewed on Coinglass.

Liquidations such as these occur when leveraged traders are forced to close their positions due to price downswings, causing their margin to fall below required levels. Simply put, bullish traders that bet on an XRP price rebound were wiped out as prices slid lower, amplifying the already high selling pressure in the process.

Meanwhile, Fear, Uncertainty, and Doubt (FUD) levels have gone 72% more bearish, their lowest reading in roughly the same period, according to Santiment, which tracks positive and negative comments on the price action to generate a metric that measures crowd sentiment.

Extreme pessimism could set the stage for a sharp short-term rebound, however. Looking at the same data, the setup is similar to that seen on November 21, when XRP rallied 22% over the next 3 days before renewed greed put a full stop on it.

😨 XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data.

— Santiment (@santimentfeed) December 4, 2025

🔴 Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)… https://t.co/lJNW8zlRwK pic.twitter.com/ZoFmwrtw3h

XRP ETF inflows continue as technicals weaken

At the same time, an unfavorable technical picture is contributing to XRP’s loss of firepower. That is to say, the token failed to defend its 38.2% Fibonacci retracement at $2.29 and is now trading under all major short- and mid-term moving averages (MA). Similarly, the relative strength index (RSI) at 44 also signals weak momentum as the asset trades at $2.07 at the time of writing, down 4.42% on the daily chart.

Not all is bleak, however, as spot XRP ETFs have logged $12.84 million in daily net inflows, their 13th consecutive day of growth. Overall, ETF assets under management have climbed past $887 million, though a turnover ratio of just 2.54% might suggest thin liquidity conditions.

Still, the funds are drawing unprecedented institutional interest, with cumulative inflows approaching the $1 billion mark just weeks since their launch in mid-November. That is, XRP ETFs are surpassing the growth rates of most Bitcoin (BTC) and Ethereum (ETH) products over comparable launch periods.

Featured image via Shutterstock