While the entire cryptocurrency market suffered a bloodbath in the 24 hours between the morning of January 29 and January 30, none of the major digital assets experienced a larger relative drop than XRP.

Specifically, the popular token is down 7% in the 24 hours – a move that led to a total weekly downturn of 8.41% – and is, at press time on Friday, changing hands at $1.75.

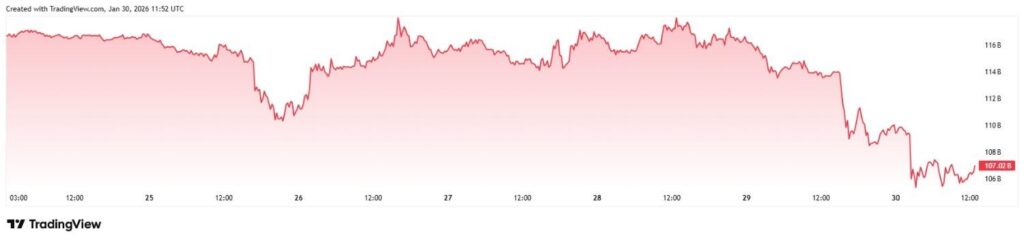

In terms of market capitalization, XRP is down as much as $7 billion as the cryptocurrency’s valuation collapsed from $114 billion to $107 billion by the morning of January 30.

Why XRP is crashing today

The overall bloodbath appears driven by a series of external factors that exacerbated the wider digital assets downtrend that arguably started in October 2025 – shortly after Bitcoin (BTC) recorded its latest all-time high (ATH) near $125,000.

XRP itself has been on a downward trajectory even longer, since, despite the substantial volatility, it hit its latest high above $3.50 as far back as July and has shed about $103 billion from its market capitalization by January 30, 2026.

The factors contributing to the most recent crash are varied. President Donald Trump advanced his fight against Fed Chair Jerome Powell on Friday morning by naming Kevin Warsh, while simultaneously facing the possibility that there would be another government shutdown already on January 31.

Looking beyond the American shores, the situation is not substantially more stable. For weeks, the U.S. has been conducting a military buildup in the Middle East, leading some observers to estimate a new attack on Iran is imminent.

Indeed, multiple recent reports indicate President Trump has been presented with several options for striking the country, though he has, allegedly, not reached a decision yet.

Did investors lose faith in the U.S. economy?

At least part of the sell-off among risk assets can also be linked with a wider lack of confidence among investors. This possibility was highlighted by Microsoft’s (NASDAQ: MSFT) own 10% stock market crash on January 29 in the wake of a somewhat mixed earnings report.

The notion that investors are jittery is also backed by the fact that, along with risk-sensitive digital assets that lost a total of $200 billion in valuation in a day, gold – traditionally a ‘safe haven’ asset – also wiped nearly $3 trillion in just 24 hours.

Featured image via Shutterstock