The latest XRP derivatives data is pointing to a rise in bearish sentiment.

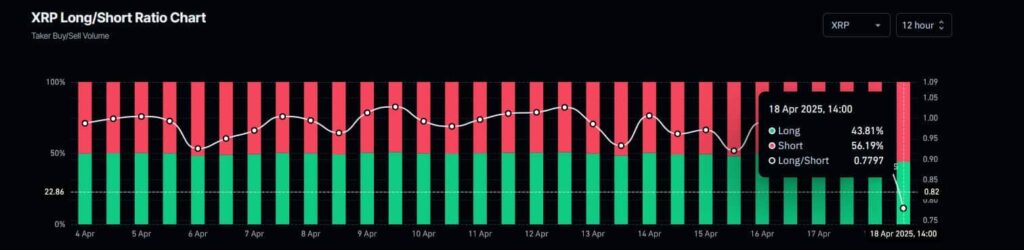

In particular, data retrieved by Finbold from cryptocurrency analytics platform CoinGlass shows that the token’s long/short ratio has fallen to 0.7797 at the time of writing on April 18.

In other words, 56.19% of the XRP positions opened within the last 12 hours have been shorts against the token.

This represents a significant bearish surge, as the preceding 12-hour period saw XRP shorts account for 51.55% of opened positions. Notably, this is the lowest and most bearish long/short ratio XRP has seen since the beginning of April.

Recent price action points to XRP’s resilience

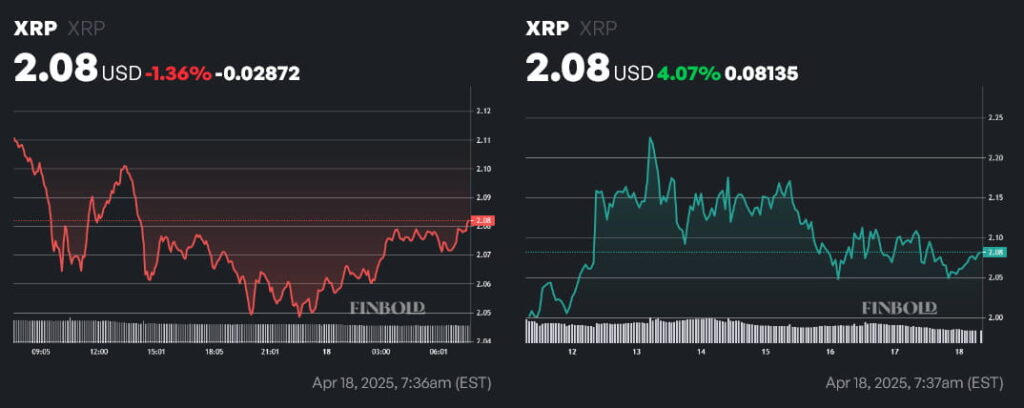

Interestingly enough, price action does not correspond to this apparent bout of pessimism on the account of derivatives traders. At press time, XRP was changing hands at $2.08. A 1.36% loss on the daily chart has brought weekly gains down to 4.07%.

Despite failing to hold prices above $2.20, reached on April 13, the token has bounced back from the $2.05 mark twice in the last week — indicating strong support at those levels.

In addition, the cryptocurrency’s open interest is near a 1-year low. This indicates that derivatives trading volume has significantly diminished, which lessens the impact of the surge in XRP shorts.

With that being said, XRP whales have dumped some 370 million tokens since the start of the year. However, even with that bearish fact taken into account, XRP’s relative strength index (RSI) currently stands at 45 — still a long way to go from levels indicating either oversold or overbought conditions.

Once everything is taken into account, significant moves to the downside remain a less likely development in comparison to sideways trading.

Featured image via Shutterstock