With March 2024 just around the corner, the clarity of the stock market’s trends becomes unmistakable, highlighting artificial intelligence’s paramount role in shaping the industry’s future.

Amazon (NASDAQ: AMZN), with its strategic focus on diverse AI initiatives, is poised to reinforce its market leadership, potentially enhancing its valuation significantly.

Amazon AI ventures

In 2023, Amazon acknowledged the significance of AI within the industry and began accelerating its integration into its services. This strategic move aimed to enhance efficiency, reduce costs, and boost the valuation of the e-commerce behemoth.

In the fourth quarter, Amazon Web Services (AWS) reported revenue of $24.2 billion, which closely aligned with analysts’ predictions. AI development advancements and subsequent integration significantly supported this revenue, allowing it to set a foundation for further investments in AI.

Additionally, in an effort to bolster cloud business and respond to Microsoft’s pledged $10 billion investment in OpenAI, the parent company of ChatGPT, Amazon is committing up to $4 billion to the chatbot developer Anthropic.

In the latest move to enhance their prospects, Amazon, Arm (NASDAQ: ARM), Microsoft (NASDAQ: MSFT), Nvidia (NASDAQ: NVDA), and other key players in the industry are joining forces to launch the AI-RAN Alliance. This collaborative effort aims to rejuvenate cellular technology tailored for artificial intelligence, highlighting how major tech firms work together to solidify their positions in the rapidly growing AI domain.

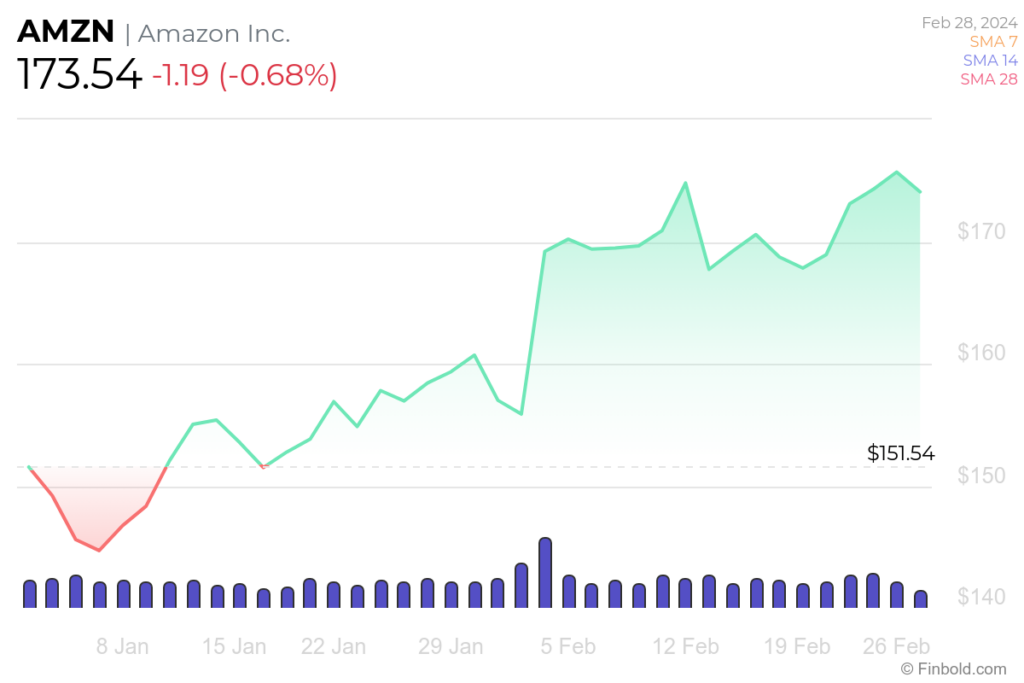

AMZN stock price chart

Since the start of 2024, AMZN has surged by 15.75% from an opening value of $149.93, reaching $173.54 at the latest close.

Several dips, particularly noticeable, have slowed the upward trajectory of AMZN’s stock price, with the biggest one being in January, when the price dipped to levels seen in 2023. Nevertheless, despite these minor setbacks, the progress remains evident and consistent.

What would $1,000 invested in AMZN stock be worth now?

Given the consistent growth of AMZN stock since the start of the year, investors who put $1,000 into this stock would now be witnessing similarly strong growth in their initial investment.

To illustrate, by February 28, AMZN shares purchased at $149.93 during the New Year holidays would now be valued at $1,157, thereby adding a nice profit to the investor’s portfolio.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.