As Bitcoin (BTC) continues to experience heightened volatility recently, which has made its price fall below $60,000 valuation, a $102 billion investment firm, VanEck, laid out the potential scenarios for its price by 2050.

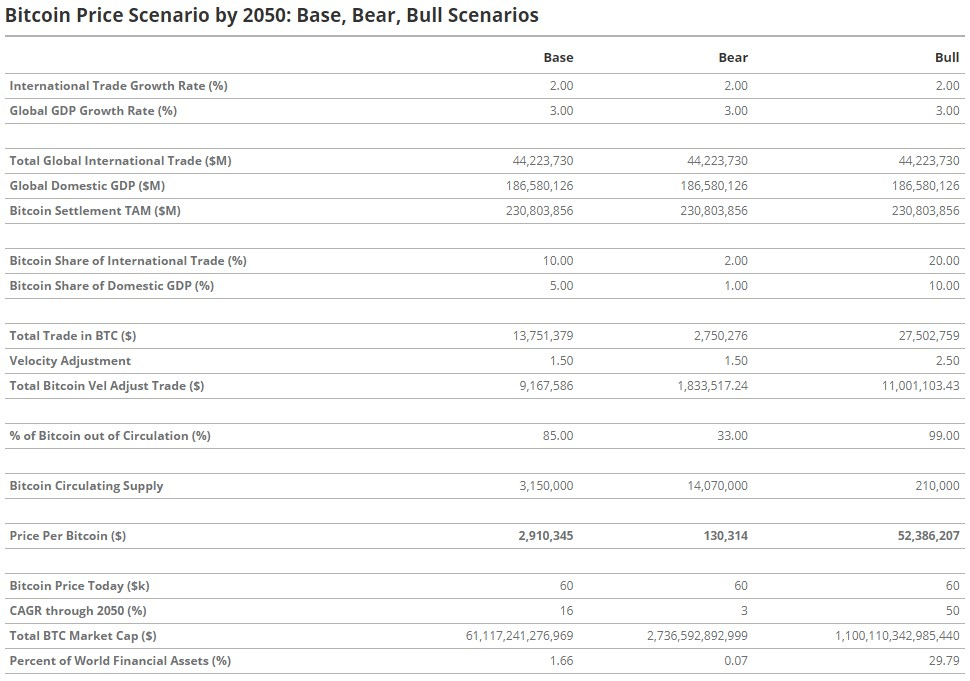

In a recently released report, VanEck’s digital asset research team, Matthew Sigel and Patrick Bush, laid out a pathway for Bitcoin’s price by 2050, including a base, bear, and bullish projection.

Namely, depending on various conditions, Bitcoin’s price should reach a valuation of $2,910,345 under the base scenario, $130,314 in a bearish one, and $52,386,207 if bullish conditions are met.

Which conditions are needed for Bitcoin to succeed?

It is vital to note that in VanEck’s research, the analysts lay out multiple factors that might influence BTC’s price with various severity depending on how the economic conditions developed at the time.

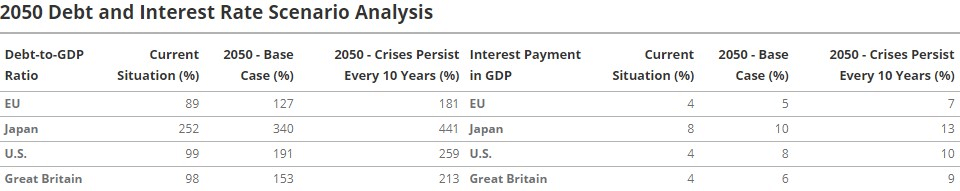

One of the main factors that will influence maiden crypto’s price is the amount of debt that the world’s leading currencies, such as the U.S. dollar, Great Britain Pound, Euro, and Yen, will handle, whereas in the base scenario percentage of interest payments in the gross domestic product (GDP) are expected to nearly double.

This, in return, will cause the currencies mentioned above to lose their purchasing and store-value characteristics and force citizens to shift towards cryptocurrencies such as Bitcoin as an alternative.

Another critical factor will be the increasing usage of sanctions by the world’s leading governments, which used this tool to freeze billions of dollars from other governments and organizations, causing ordinary citizen to worry about their assets’ future.

In addition, the key characteristics that increase Bitcoin’s appeal are its neutrality, immutable monetary policy, and perfect property rights, guaranteeing its users that their store of value will hold the initial valuation or even appreciate over time, contrary to the fiat currencies.

Bitcoin’s risks

As with other assets, the flagship crypto is not protected from potential downsides, such as the sustainability of Bitcoin mining, failure to scale its solutions to higher levels, which could impact its value and appeal rise, and competition from other cryptocurrencies, such as Ethereum (ETH) and Solana (SOL), which might prove damaging to BTC’s valuation.

On the other hand, governments might strike back against crypto holders and essentially ban its usage through a string of laws.

In contrast, institutional holders, such as hedge funds, which can now access Bitcoin through exchange-traded funds (ETFs), might hold a significant sway over its price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.