Bitcoin (BTC) has shown remarkable resilience recently, revisiting the $70,000 price zone, buoyed by macroeconomic indicators and a surge in market optimism.

As we move into the second half of the year, a long-term bullish sentiment permeates the industry, with multiple digital assets showing potential for sustained buying pressure that could impact their market capitalization.

Notably, some assets are nearing the $100 billion market cap threshold and are poised for potential rallies. Finbold has identified two cryptocurrencies likely to surpass that mark in the latter half of the year.

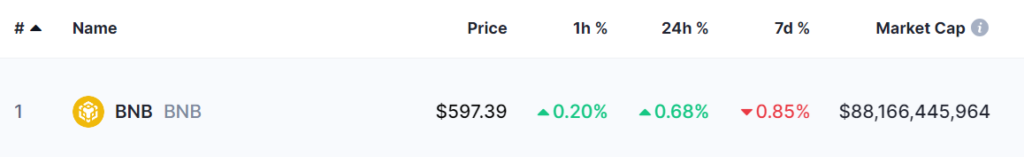

BNB Chain (BNB)

BNB, the native token of Binance, is on track to reach a $100 billion market cap, driven by strategic expansions and innovations within the Binance ecosystem.

Initially an ERC-20 token, BNB transitioned to Binance Chain to enhance its utility, facilitating fee payments and enabling participation in new blockchain projects via Binance Launchpad.

Trading at $597.44 with a market cap of $88.17 billion, BNB is 39.40% above its 200-day Simple Moving Average (SMA) of $427.54. This strong performance reflects growing investor confidence.

The integration of 35 new decentralized applications (dApps) into BNB’s Web3 Wallet has broadened its utility across gaming, finance, and trading sectors, enhancing user experience and increasing platform engagement.

The upcoming closure of Beacon Chain will consolidate Binance’s networks, transferring all capabilities to Binance Smart Chain and potentially boosting BNB’s prominence.

With continuous market growth and further platform expansions, BNB is on track to surpass the $100 billion mark by the end of the year.

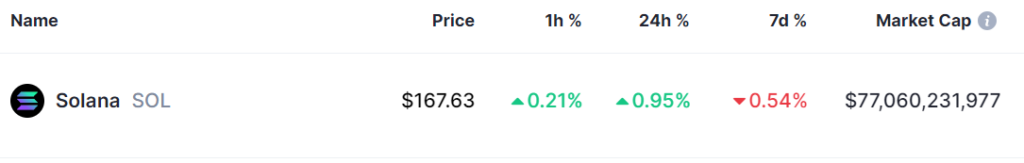

Solana (SOL)

Currently, the fifth-largest cryptocurrency with a market cap of $77 billion, Solana (SOL) is also poised to reach the $100 billion mark due to robust investor interest and confidence.

SOL has experienced a 63% increase year-to-date, and its strong correlation with Bitcoin suggests further potential for growth.

The Solana ecosystem has seen significant activity, particularly with SOL-based meme coins such as Myro F and BONK, which have recently surged in trading volumes and prices.

These developments indicate growing investor interest and contribute positively to Solana’s market value.

Despite occasional network outages, Solana maintains a strong market presence, trading above essential support levels. Its Total Value Locked (TVL) stands at $4.80 billion, reflecting the ecosystem’s health and investor trust.

The integration of stablecoins like USDT, USDC, and PYUSD has enhanced liquidity, providing ample buying power for future rallies.

With solid fundamentals and increasing adoption, Solana is well-positioned to achieve a $100 billion market cap in the second half of the year.

It’s important to highlight that while backed by various fundamentals, the potential for the mentioned cryptocurrencies to reach the $100 billion threshold hinges significantly on the continuation of a bullish market momentum.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.