The cryptocurrency market has experienced ups and downs in the past week, showing the expected volatility natural to this space. Some cryptocurrencies offer higher risks than others, and speculators should avoid trading them to improve their results.

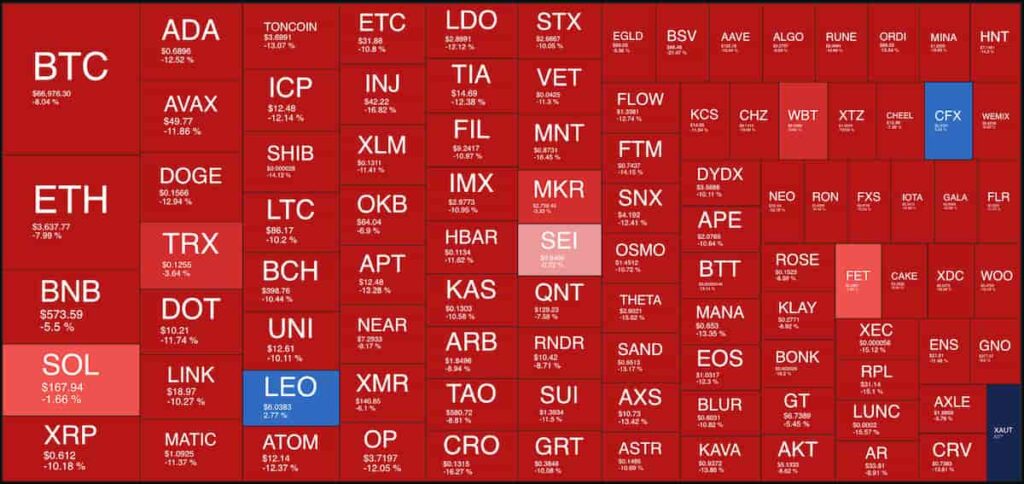

Notably, cryptocurrencies woke up in the red on March 15 after days of positive performance and euphoria. This evidences the importance of carefully investing and applying proper risk management in this market.

Based on this, successful cryptocurrency traders usually look for higher risk-reward ratios when initiating trading operations. Avoiding lower risk-reward ratio assets is crucial, and Finbold considered multiple factors to raise this alert for next week’s trades.

Avoid trading dogwifhat (WIF) next week

First, dogwifhat (WIF) has conquered the spotlight with a remarkable and unexpected performance in the past 20 days.

The Solana-based meme coin has seen over 1,000% gains from February 24’s $0.297 to today’s all-time high of $3.55. As of writing, WIF trades at $2.74 and is overbought in the daily Relative Strength Index (RSI).

However, dogwifhat is a purely speculative token with no tangible use cases. Speculators buy with the only expectation of selling at higher prices for someone with the same intention. Essentially, this creates unsustainable growth, usually described as “the greater fool game” by finance experts.

In this scenario, investors should avoid trading WIF next week, as early buyers could sell off their tokens, causing a crash.

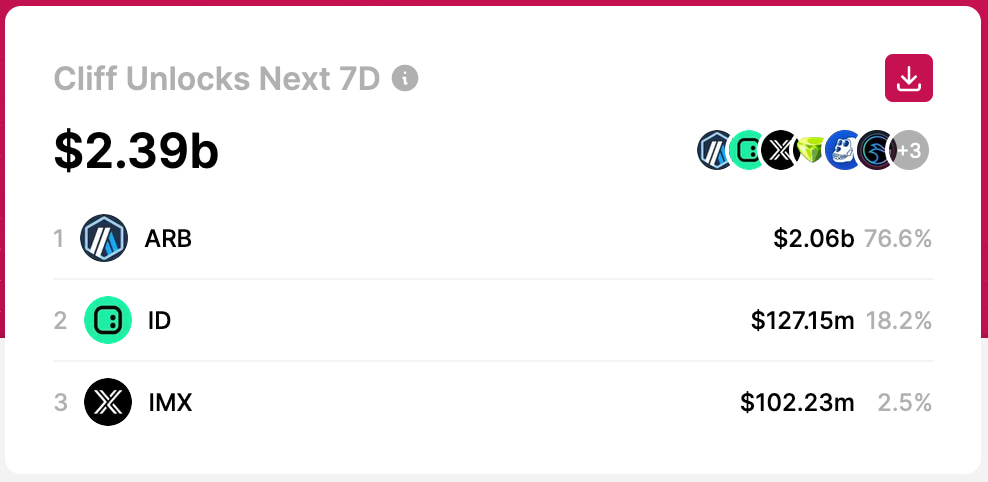

Arbitrum (ARB)

Second, Arbitrum (ARB) is a second layer for Ethereum’s Web3 ecosystem and a cryptocurrency to avoid trading next week. This is due to a massive token unlock worth over $2 billion in ARB, effectively doubling its circulating supply.

Worryingly, this is one of the largest single unlocks ever registered by TokenUnlocksApp, adjusted by the token’s capitalization. Moreover, Arbitrum is responsible for 86% of next week’s cliff unlocks, showing how representative this is for the token.

Such huge inflation may create strong selling pressure that will likely have a meaningful impact on ARB’s price. ARB changed hands by $1.89 at the time of publication, threatening to test the $1.0 psychological resistance soon.

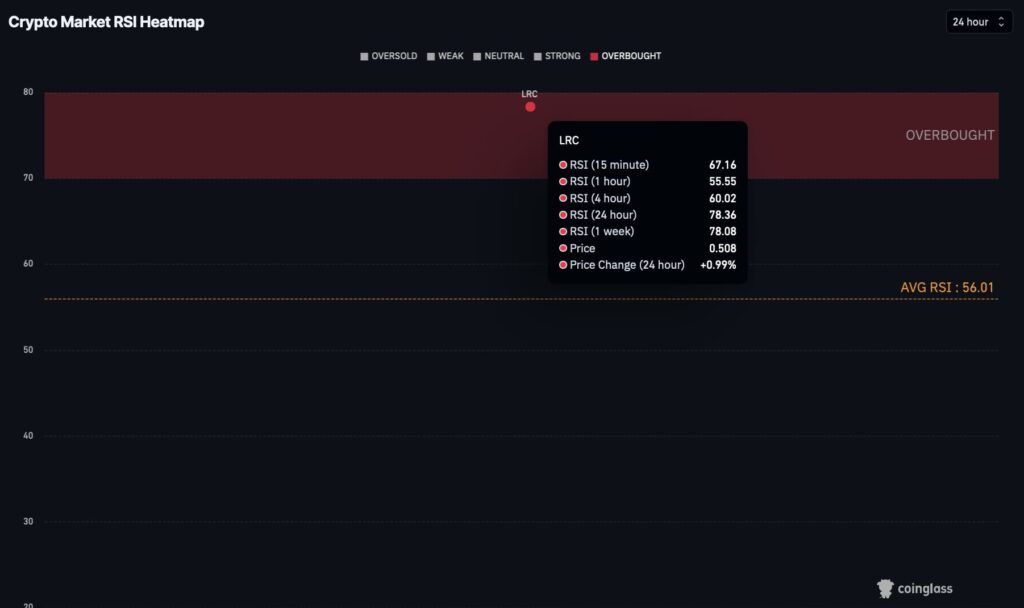

Loopring (LRC)

Finally, Loopring (LRC) is the third cryptocurrency to avoid trading next week, considering its overbought status. Loopring is a nearly $700 million market cap protocol that assists in creating decentralized exchanges in DeFi.

The token, LRC, has a daily and weekly RSI of 78 points, suggesting an overbought asset. Therefore, it could face a trend reversal at any moment, dropping from the current $0.5 per token.

In closing, while it would be a good idea to avoid the aforementioned cryptos for now, the situation can change very quickly, so it is important to observe the market sentiment and thoroughly research any asset before investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.