Finbold identified three cryptocurrencies that speculators should avoid trading due to the upcoming substantial token unlocks. These unlocks have the potential to flood the market, leading to increased selling pressure and significant price fluctuations.

Experienced cryptocurrency market participants closely monitor factors like token supply and demand to optimize their trading strategies and mitigate potential losses. By taking these dynamics into account, they can make well-informed decisions that maximize profitability while effectively managing associated risks.

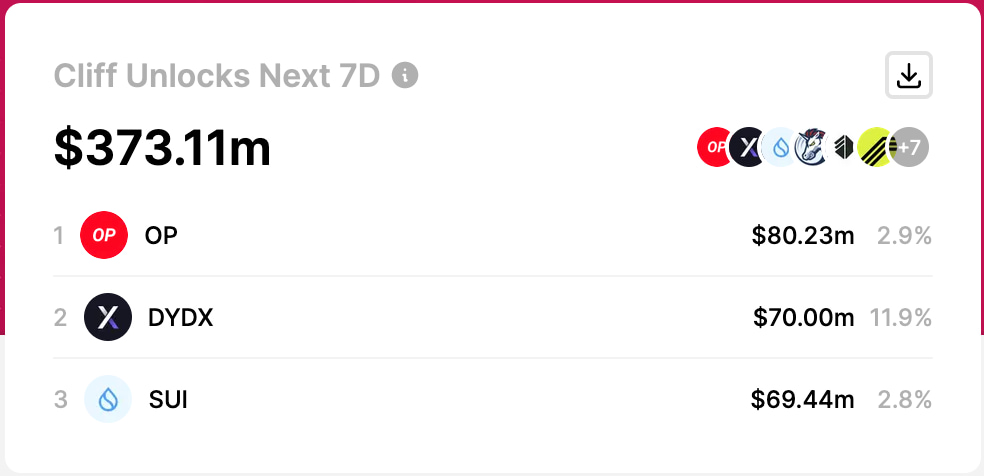

In particular, data from TokenUnlocksApp shows $373.11 million in potential sell-offs for the next seven days from May 25. The top 3 highest unlocks will happen on May 31 and June 1, releasing $219.67 million worth of tokens.

Avoid trading Optimism (OP)

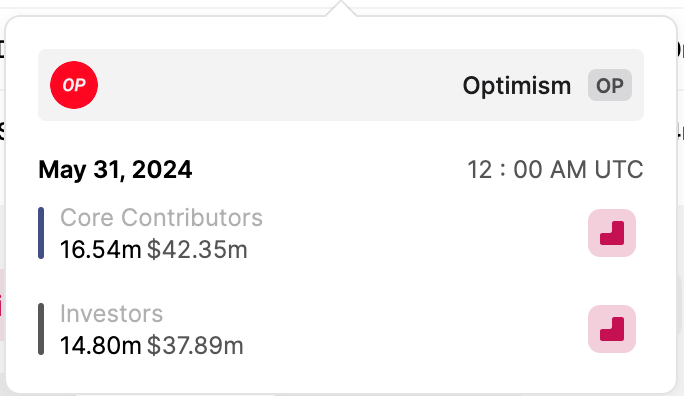

First, investors should avoid trading Optimism (OP), the popular second layer for Ethereum (ETH), amid a potential sell-off incoming. On May 31, the protocol will unlock 31.34 million OP tokens currently worth $80.23 million.

Optimism’s unlock represents a nearly 3% supply inflation that repeats every month with slight variations, as previously reported by Finbold. Core contributors to the protocol will receive 16.54 million OP worth $42.35 million, while private investors will get $37.89 million to realize their monthly profits over retail buyers.

dYdX Protocol (DYDX)

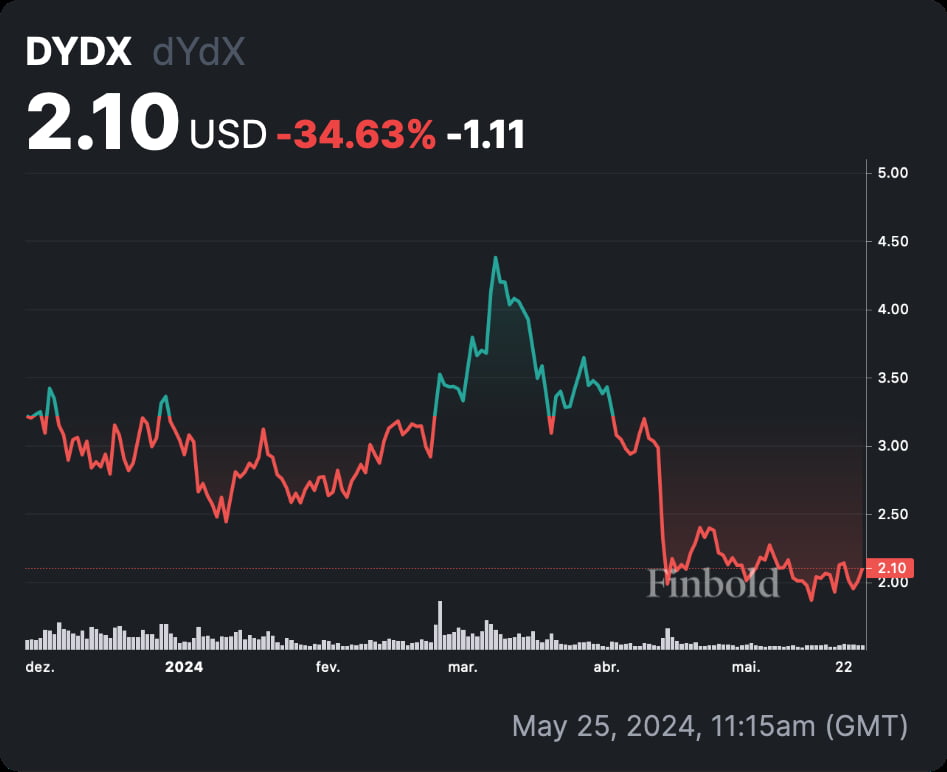

The decentralized exchange protocol DYDX is again featured among cryptocurrencies to avoid trading due to its unlocks. Finbold reported a similar warning for April 27 and, previously, for March 31, with 33.34 million tokens unlocked – worth $70.33 million and $117.33 million, respectively.

On February 29, we also reported the unlock of the same amount, worth $130 million. The gradual loss of purchasing power evidence the nefarious effects of supply inflation on cryptocurrencies and the “avoid trading” alert.

Now, the protocol will put the same amount of DYDX in circulation on June 1, currently worth $70 million. This represents a nearly 12% monthly inflation likely to affect DYDX investors. As of this writing, the token trades at $2.10.

Sui Network (SUI)

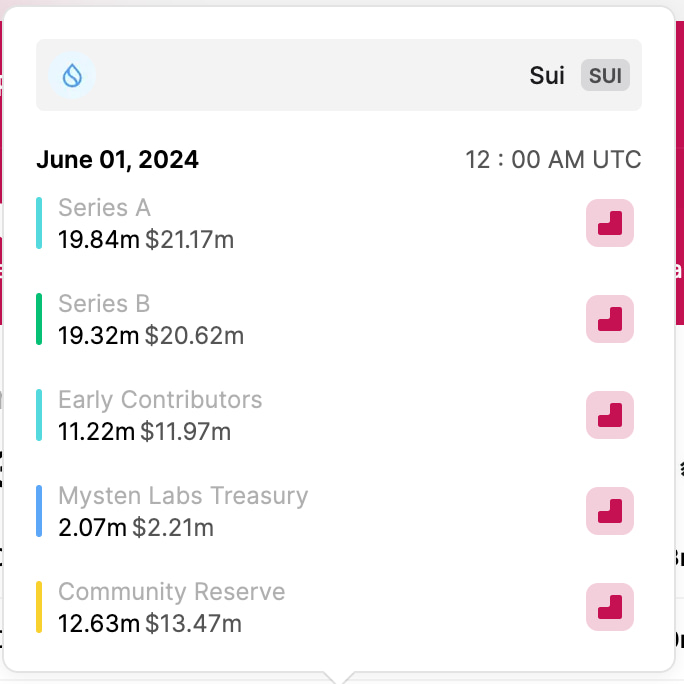

Another cryptocurrency to avoid trading due to recurrent monthly token unlocks is Sui Network (SUI). The competing layer-1 blockchain developed by former Meta Platforms (NASDAQ: META) engineers will inflate its supply by 2.8% this month.

On June 1, the protocol will unlock 65.08 million SUI for private investors, the development team, and the Mysten Labs treasury. Notably, private investors will receive 39.16 million SUI for over 60% of the total $70 million worth of unlocks.

However, crypto traders will try to speculate on the economic effects these unlocks may have on price, which could bring increased volatility and worsen the potential risk-reward ratio. The market is uncertain and influenced by multiple factors, requiring proper risk management and learning when to avoid trading specific cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.