Cryptocurrencies have mostly become a game of highly capitalized institutional investors known as venture capitalists (VC), often described as a “predatory” dynamic. As the Securities and Exchange Commission (SEC) continues with the cryptocurrency industry crackdown, VC-funded projects could offer increased risks.

In an exclusive report, DL News obtained confidential documents showing that the SEC is targeting three crypto venture capitalists. The report, however, could not reveal who the agency was targeting, sounding alarms to the entire market.

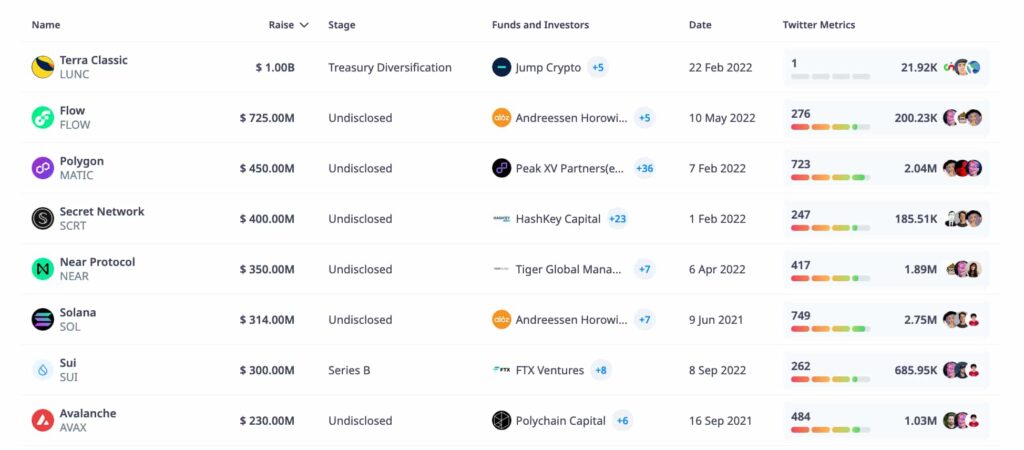

Within this context, Finbold retrieved data from CryptoRank to identify some of the cryptocurrencies with higher capitalization and VC funding. As things develop, investors should avoid these projects in the short term until more information comes to the surface.

Overall, venture capitalists usually fund crypto startups in the early phases in exchange for vested tokens. These vesting contracts will later unlock scheduled amounts of these tokens so the VC can sell on the open market, realizing its profit against retail investors.

Cryptocurrencies with higher VC funding and market cap

Notably, eight cryptocurrencies stand out when ranking by the highest amount raised in a single round. These rounds have raised up to $1 billion for mid-caps like Terra Classic (LUNC), Flow (FLOW), and Secret Network (SCRT).

However, the five others now sit at the top 30 by market capitalization, making them more relevant projects to watch. They are Polygon (MATIC), Near Protocol (NEAR), Solana (SOL), Sui Network (SUI), and Avalanche (AVAX).

These cryptocurrencies have registered significant unlocks of the vested tokens over the years, putting significant selling pressure on retail. Now, VCs have an extra incentive to sell and liquidate a higher part of their position, fearing the SEC crackdown.

In particular, Solana and Sui are known for having the highest monthly unlocks to private investors. Meanwhile, Avalanche, Near, and Polygon have ongoing linear unlocks with a lower weight over their market cap. SOL and SUI also have linear daily unlocks in the form of staking, standing among the market’s higher supply inflations.

Strong demand could overcome high supply pressures

Nevertheless, it is possible that this recent development does not directly affect the price of these cryptocurrencies. Even when facing higher selling pressure on the supply side, accruing enough demand on the buying side could sustain good performance.

For example, Solana has grown to be one of the best performers in this cycle, and Raoul Pal believes Sui could be the next big mover following SOL’s leadership.

On the other hand, Justin Bons named MultiversX (EGLD) as the “technological Holy Grail of crypto.” Interestingly, EGLD had ten times less private funding than its mentioned competitors, holding a lower capitalization.

Investors and traders, however, must understand the risks and market dynamics while speculating in this VC-dominated environment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.