With a history of almost two centuries, JPMorgan (NYSE: JPM) is widely recognized as one of the most prestigious financial institutions on Wall Street.

As a key player among the Big Four banks, with thousands of financial experts and analysts conducting the necessary research, this banking giant has made notable stock acquisitions over the years, utilizing its $611 billion large market cap to secure the best stock deals.

Building on this legacy, Finbold analyzed JPMorgan’s latest 13F filing on March 31 to identify some of the financial giant’s top stocks that could potentially turn a $100 investment into $1,000 by 2025.

Microsoft (NASDAQ: MSFT)

With a 5.64% position in JPMorgan’s investment portfolio, Microsoft (NASDAQ: MSFT) is the banking giant’s largest position, with over 81 million shares held, worth approximately $34.1 billion.

The technology giant boasts a strong performance following its most recent Q4 report, adding over 6% to its stock value, mitigating losses of 2.44% from the previous five trading sessions.

Overall, this year has been positive for MSFT stock, which has grown by 13.55% since January 1.

Wall Street analysts also have faith in Microsoft stock, as evidenced by Joel Fishbein’s highest 12-month price target for the company, which stands at $600.

Nvidia (NASDAQ: NVDA)

The second-largest holding is Nvidia (NASDAQ: NVDA) at 3.96%, with over 254 million shares worth over $23 billion after a positive market performance in the latest trading session.

Thanks to the gains of over 7%, NVDA stock is trading at a price of $117.02, building up on the gains from the previous five trading days, which amounted to 3.51%.

Since January 1, this semiconductor giant’s stock has increased by over 142% in value, making it the best performer among the top six holdings.

Wall Street views Nvidia stock as a “strong buy,” with the highest price target of $200 awarded by Hans Mosesmann, a Rosenblatt analyst.

Amazon (NASDAQ: AMZN)

E-commerce giant Amazon (NASDAQ: AMZN) is the third-largest holding, occupying 3.54% of the overall portfolio, and is set to announce its Q2 earnings after the markets close on August 1.

Following a slight drawback caused by the stock sector rotation, AMZN stock is trading at $186.98 after adding 2.30% in the past five trading sessions.

AMZN shares recorded a solid advance of 24.71% on a year-to-date basis.

Wall Street considers AMZN stock a “strong buy” pick with a unanimous decision from 34 analysts, as $250 is the highest price target assigned by Goldman Sachs’ analyst Eric Sheridan.

Apple (NASDAQ: AAPL)

Apple (NASDAQ: AAPL), the Cupertino giant, is taking up a 2.89% large position in the portfolio. According to the latest AAPL stock closing price, over 98 million shares are worth over $16.8 billion.

As of July 31, AAPL stock is valued at $222.08 after an increase of 0.29%, which is part of a larger 1.43% five-day gain.

The iPhone maker turned around its weak performance in the first half of 2024 after the WWDC conference and trades in the green by 19.63% so far.

Ahead of its Q3 earnings scheduled for August 1, Loop Capital Markets analyst Ananda Baruah believes AAPL shares can reach $300.

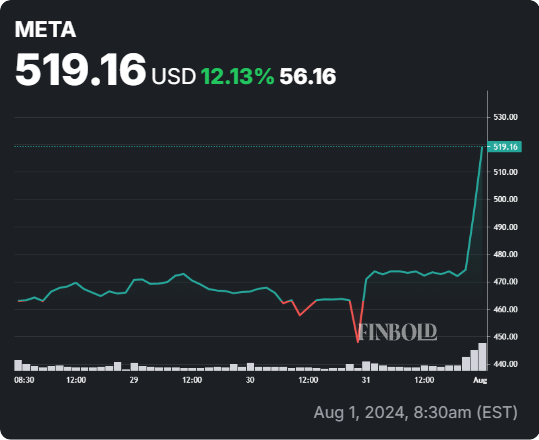

Meta Platforms (NASDAQ: META)

Meta Platforms (NASDAQ: META) delivered perhaps the biggest surprise to analyst expectations in its latest Q2 report and significantly benefited its 2.79% position in JPMorgan’s portfolio, which is 33 million shares strong and worth $16.2 billion.

With the pre-market gains, META stock added over 12% to its value in the previous 24 hours, opening August 1 trading at $519.16.

In 2024, this social media giant’s stock has grown by 37.12%.

In the most recent report on August 1, UBS analysts raised the META stock price target to a Wall Street high of $635.

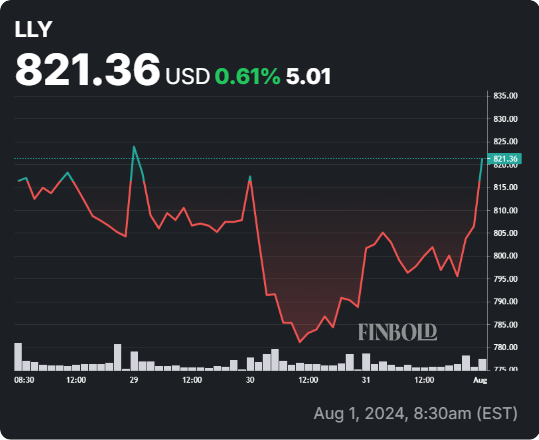

Eli Lilly (NYSE: LLY)

Last but not least, the sixth-largest holding in the portfolio at 1.63% is Eli Lilly (NYSE: LLY), a pharmaceutical giant that boasts a presence of over 12 million shares worth approximately $9.4 billion.

LLY stock opened on August 1, trading at an $822 valuation, following pre-market gains of 2.20%, which carried over a positive performance from the previous five trading days, which added 1.39%.

Wolfe Research analyst Tim Anderson recently assigned Eli Lilly stock with the Street high price target of $1,117.

All of these holdings have boasted positive performance over the previous months, and as evidenced by their price actions and bullish price targets from Wall Street, they have the potential to multiply their valuations by the end of 2024.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.