Algorand (ALGO) has captured the spotlight in the cryptocurrency market, trading at $0.44 after a dramatic one-day gain of 17% and an impressive 47% rise over the past week.

The token has surged above its yearly high of $0.32, established in March, reaching levels unseen since November 2022.

With on-chain metrics signaling bullish momentum, ALGO has captured the attention of traders and investors who are speculating on its year-end price trajectory.

ALGO breaks key resistance levels

ALGO’s current rally has propelled it beyond a long-term horizontal resistance area, cementing a new yearly high. This bullish move aligns with a broader market recovery and has been fueled by strong fundamentals within the Algorand ecosystem.

Notably, Algorand’s Total Value Locked (TVL) has increased by 59% this week, rising from $117.39 million on November 22 to $187.55 million at the time of writing, according to DefiLlama.

This growth indicates heightened user activity and ecosystem development, which are critical drivers of price appreciation.

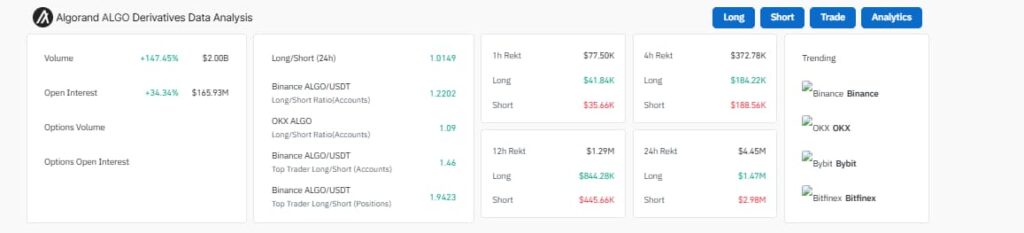

Simultaneously, CoinGlass data reveals that Algorand is showing strong bullish momentum, as evidenced by a 147.45% surge in derivatives trading volume, reaching $2.00 billion, and a 34.34% increase in open interest (OI) to $165.93 million.

These metrics reflect significant market interest and new capital entering the market, often a precursor to further price increases.

The long/short ratio across platforms leans bullish, with Binance’s ALGO/USDT ratio at 1.2202 and OKX’s ratio at 1.09, indicating traders are largely optimistic.

Liquidation data supports this sentiment, as 24-hour short liquidations totaled $2.98 million, significantly outpacing longs at $1.47 million, suggesting shorts are being squeezed as the price rises.

Additionally, top trader data from Binance highlights a strong long bias, with a long/short position ratio of 1.9423.

Overall, the data suggests a continued bullish outlook for ALGO, though traders should remain cautious of potential corrections given its rapid gains and overbought RSI levels.

Finbold has also identified the buy signal flashed by ALGO last week, based on technical indicators aligning with the token’s impressive bullish momentum.

Technical indicators: Strength and caution

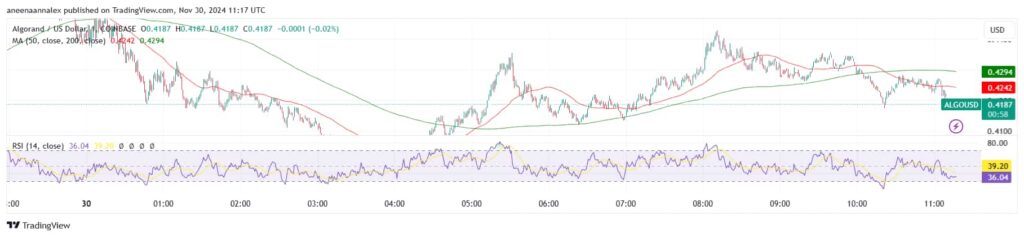

Technical indicators have also presented compelling bullish signals. The formation of a “Golden Cross,” where the 50-day Simple Moving Average (SMA) crosses above the 200-day SMA, suggests a robust upward trend and has historically been a reliable buy signal.

However, caution is warranted as the RSI stands at 71 on the weekly chart, indicating that ALGO has entered the overbought territory.

This increases the likelihood of a short-term pullback or consolidation, which could present a strategic entry point for traders aiming to capitalize on the next potential upward move.

AI prediction for Algorand by year-end

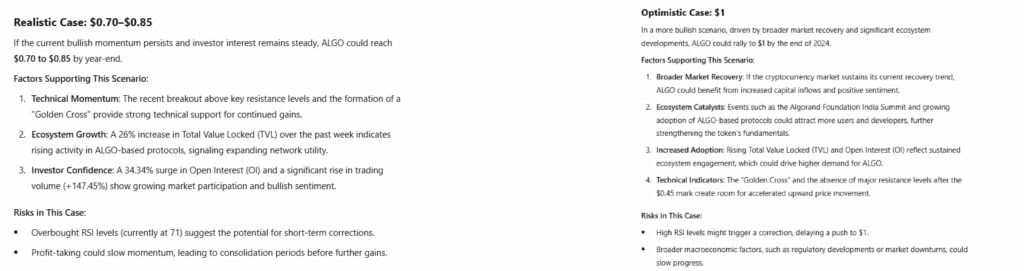

Amid this backdrop, Finbold consulted OpenAI’s ChatGPT-4o for insights into Algorand’s potential year-end price. According to the AI model, if the current bullish momentum continues and investor interest remains strong, ALGO could realistically reach $0.70 to $0.85 by the end of the year.

In a more optimistic scenario, supported by a broader market recovery and continued ecosystem growth, ALGO could potentially push toward $1.

It’s essential to note, however, that cryptocurrency markets are highly volatile, and actual prices may differ from predictions.

Thus, investors should conduct thorough research and consider multiple factors when evaluating potential investments.

Featured image via Shutterstock