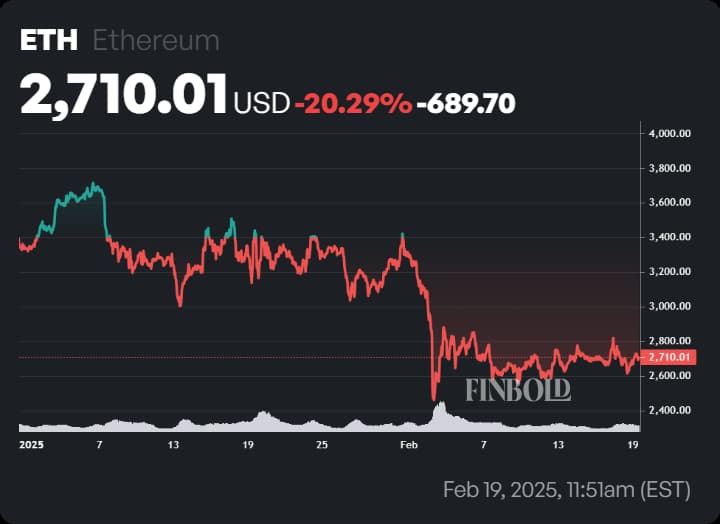

Ethereum (ETH) has faced a challenging year, emerging as the worst-performing cryptocurrency among the top five, with a year-to-date decline of 20%.

Currently trading at $2,710 the asset has struggled to gain momentum even during broader market recoveries.

However, key network indicators suggest potential signs of a turnaround, with Ethereum transaction fees dropping to $0.41 per transfer, their lowest level since August 2024.

This sharp decline signals reduced congestion and a possible accumulation phase, historically seen before price rebounds.

Yet, uncertainty surrounding Ethereum’s near-term trajectory remains, leaving investors divided on its next move.

Finbold AI predicts Ethereum price target for March 1

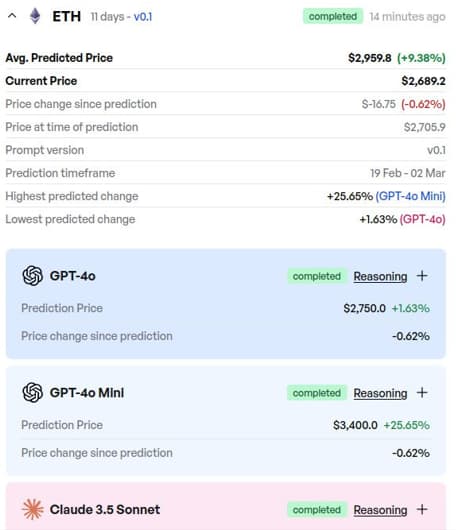

Finbold’s AI-powered prediction tool has provided an updated forecast for Ethereum’s price trajectory leading up to March 1, 2025. Factoring in technical indicators and market data, the model predicts an average ETH price of $2,959.8 for early next month, representing a 9.38% increase from the level of $2,689.2 at the time of the forecast.

Despite this moderately bullish projection, AI models remain sharply divided on Ethereum’s next move. The most optimistic outlook, generated by GPT-4o Mini, foresees a 25.65% rally, suggesting ETH could climb to $3,400 in the coming weeks.

Conversely, GPT-4o presents a more cautious view, predicting a 1.63% increase to $2,750, indicating that ETH may struggle to gain momentum.

Is Ethereum gearing up for a major comeback?

Ethereum’s regulatory landscape and upcoming network upgrades could play a key role in determining its next market shift.

A recent U.S. Securities and Exchange Commission (SEC) filing has invited public comments on a proposal from Cboe Exchange, Inc. to list and trade options on Ethereum ETFs, including the Grayscale Ethereum Trust ETF, Grayscale Ethereum Mini Trust ETF, and Bitwise Ethereum ETF. If approved, this could increase institutional participation and introduce greater liquidity into the market.

At the same time, Ethereum’s Pectra upgrade, scheduled for April 2025, aims to enhance scalability, transaction speeds, and cost efficiency.

Testing phases are already in progress, with the Holesky network set for February 24 and Sepolia scheduled for March 5. If successful, the upgrade could boost developer activity and adoption, further driving demand for ETH.

Adding to Ethereum’s potential institutional appeal, Cboe and 21Shares have submitted a proposal to integrate staking into their Ethereum ETF. If approved, ETF investors would be able to earn staking rewards, making Ethereum’s investment vehicles more attractive to long-term investors.

With these factors in play, Ethereum could be on the brink of a major market shift, though its near-term trajectory remains dependent on regulatory outcomes, the successful rollout of network upgrades, and broader market recovery.

Featured image via Shutterstock