MSCI Inc (NYSE: MSCI) is a prominent global provider of various financial instruments and services. Its offerings include equity, fixed income, and real estate indices alongside multi-asset portfolio analysis tools.

Additionally, MSCI specializes in environmental, social, and governance (ESG) and climate-focused products, contributing to its comprehensive offerings in the finance sector.

MSCI has computed its global equity indices since 1969, with the MSCI World being a notable example. In 2018, MSCI significantly added mainland Chinese “A” shares to its MSCI Emerging Markets Index.

With the current market volatility and news of MSCI removing 66 companies from its China Index, Finbold utilized machine algorithms to predict the MSCI price by the year’s end.

Algorithms indicate that the current volatility will not impact the MSCI’s performance much, as its price is predicted to surge to $1,052.79, which represents an 82.89% increase from the current price level of $576.61

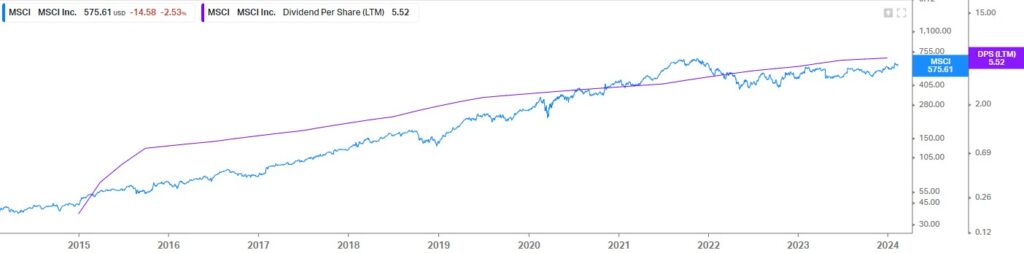

Dividends reflect healthy growth

For investors who prioritize dividends as a means of wealth accumulation, it’s noteworthy that MSCI is set to go ex-dividend. The ex-dividend date, February 15, is essential as any stock purchase on or after this date will not entitle the buyer to the upcoming dividend, to be paid on February 29.

It is promising to note that MSCI has experienced significant earnings growth, averaging a 20% increase annually over the past five years. Additionally, the company has raised its dividend by an average of approximately 27% per year.

Generally, companies experiencing rapid growth while allocating a small portion of earnings for dividends tend to retain profits for reinvestment in their operations.

A silver lining in the removal of Chinese companies

During its quarterly review on February 12, the index compiler implemented changes to its MSCI China Index, resulting in a net loss of 66 names and leaving approximately 700 companies included. Additionally, several Chinese names were removed from the MSCI China All Shares Index.

The MSCI China Index has experienced a decline of -8.5% since the start of the year and over -26% in the past 12 months.

Meanwhile, it was announced that five Indian stocks would be added to the MSCI Global Standard Index. These additions are anticipated to bring in approximately $816 million in inflows following the adjustments.

India’s representation in the MSCI Emerging Market Index will rise from 17.9% to 18.2% after the February adjustment, reaching a historic peak. Meanwhile, China’s weight in the index has decreased to 25.4%. This reduction has narrowed the gap between Indian and Chinese equities on the MSCI index to its shortest-ever.

What do analysts say?

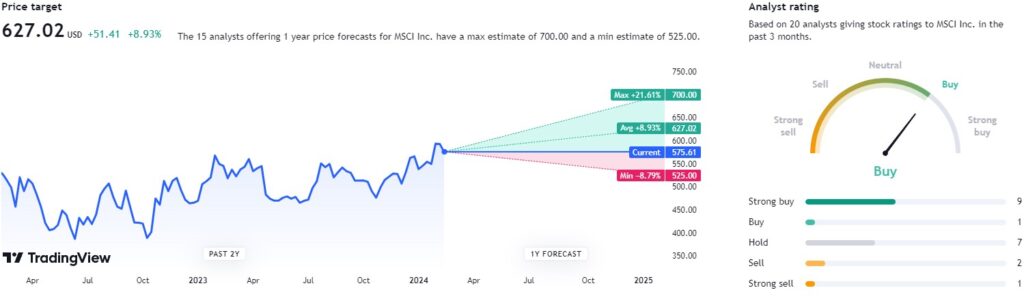

Looking at the performance of MSCI and predictions made by AI, it is hard for investors not to be bullish; however, analysts urge controlled optimism as they award it with a ‘buy’ rating.

TradingView’s experts set a price target of $627.02, representing a small growth of 8.93% in the next 12 months.

As trouble might be brewing at the homefront as CPI came higher than expected, MSCI seems protected by its other indexes, such as ‘emerging markets’ and ‘ACWI,’ as they continue to record solid performance.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.