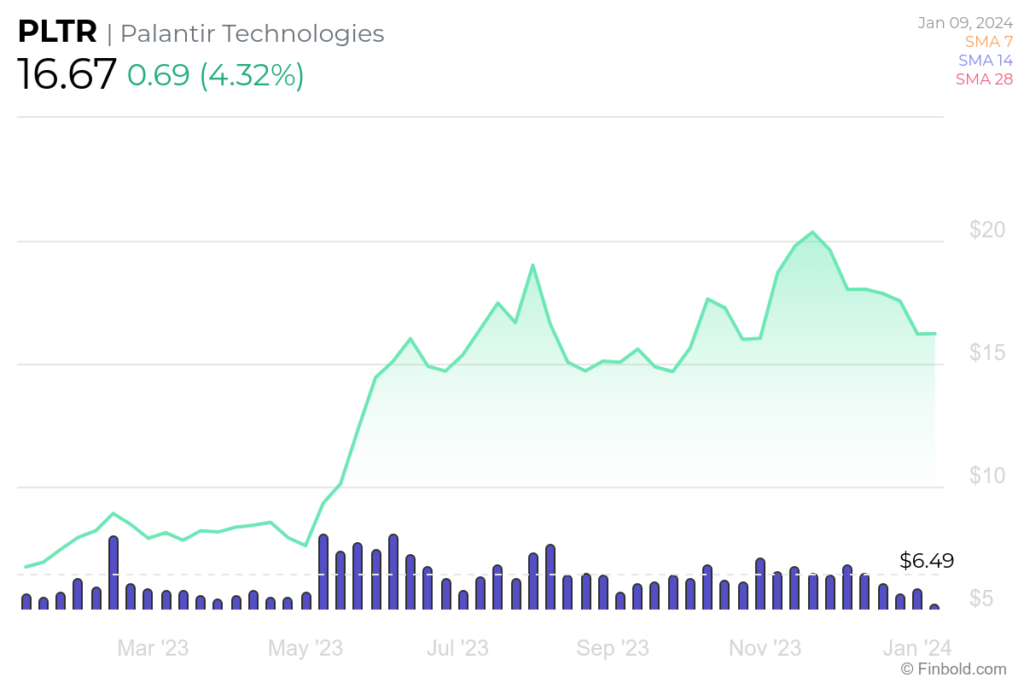

Palantir Technologies (NYSE: PLTR) experienced a remarkable performance in 2023, witnessing a staggering surge of over 150% in its share price. The success of this data analytics company can be attributed to the growing prominence of artificial intelligence (AI) and the increasing trend among businesses to leverage cloud computing for enhanced operations.

However, recently, its stock received a downgrade by Jefferies analysts, which justified this move as an ‘overhype’ on AI and that its current price range does not genuinely portray its performance.

This contrast in performance has led Finbold to utilize the AI-driven predictions by CoinCodex to predict this stock’s possible price range by the end of 2024.

According to the algorithms, the projected price for PLTR is expected to increase to $63.54 by the end of this year, reflecting a 281.164% rise from its present level of $16.67 as of the time of writing.

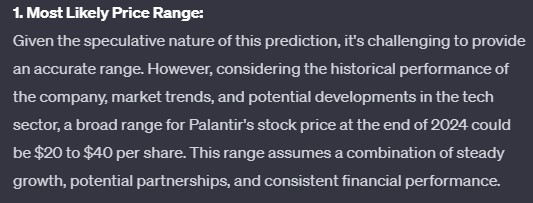

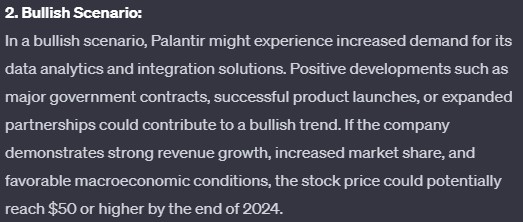

Possible price ranges for PLTR stock by ChatGPT

Considering Palantir’s historical performance, market trends, and potential developments elsewhere, ChatGPT from OpenAI has placed the most likely price range for PLRT stock between $20 and $40 per share by the end of this year.

Under a bullish scenario, Palantir could encounter heightened demand for data analytics and integration solutions. Favorable advancements, including securing major government contracts, successful launches of new products, or establishing expanded partnerships, may play a pivotal role in fostering a bullish trend, propelling its stock price above $50.

Conversely, in a bearish scenario, heightened competition, regulatory obstacles, or deceleration in adopting data analytics solutions could adversely affect Palantir’s stock price, lowering it below $15.

PLTR stock price analysis

Currently, the PLTR stock is valued at $16.67, reflecting a daily increase of 4.32%. However, over the past five days, it has experienced a decline of -1.42% and the monthly chart indicates a loss of -6.19%, as per the latest data retrieved on January 9.

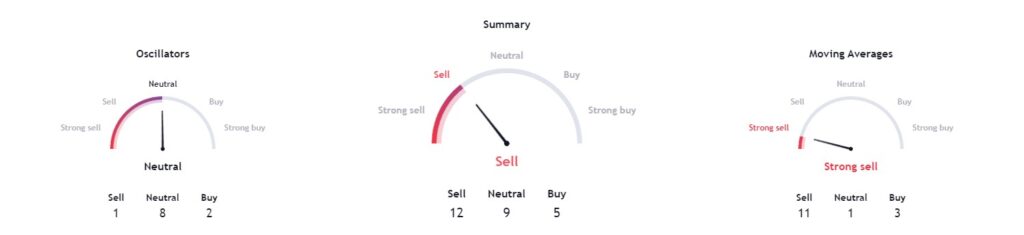

Present technical indicators depict a bearish outlook for Palantir. The general sentiment leans toward ‘sell’ with a rating of 12, aligning with the consensus of moving averages set at 11. Oscillators, however, maintain a ‘neutral’ stance with a rating of 8.

Whether Palantir stock will overcome this recent hurdle, prove the analysts wrong, and repeat its performance in 2024 remains to be seen.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.