Nvidia’s (NASDAQ: NVDA) share price has dropped significantly in recent weeks, but there remains considerable optimism that the chipmaker might recover soon.

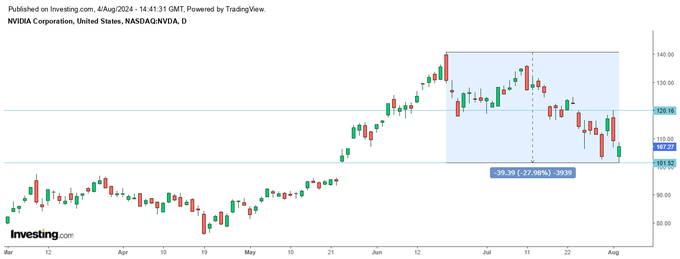

Analysts like CyclesFan support this sentiment, believing that Nvidia might rally after clearing key resistance positions. However, the stock has seen a drop of 28% from its June highs, raising questions about its near-term trajectory.

In an X post on August 4, the analyst stated that Nvidia experienced a notable drawdown in its stock price, which bottomed on Friday at $101.52, marking the top of the earnings gap from May.

This drawdown might signify a multi-week low, suggesting that a rally into earnings is highly probable. However, according to the expert, for this potential rally to be confirmed, NVDA will need to break out above the critical resistance level of $120.16.

Mixed sentiments around Nvidia stock

Overall, the recent pullback has led to mixed sentiments among investors and analysts. Some view this as a buying opportunity, expecting a rebound ahead of Nvidia’s earnings report. Should NVDA manage to break above the $120.16 resistance, it could signal the beginning of a sustained upward movement, potentially leading to new highs.

At the same time, recent market news supports a cautiously optimistic outlook for Nvidia. For instance, banking giant Goldman Sachs (NYSE: GS) highlighted that Nvidia is expected to reveal significant insights during its upcoming Q2 earnings call, which could bolster investor confidence.

This includes showcasing how end customers are generating substantial profits using Nvidia’s artificial intelligence (AI) chips, potentially alleviating concerns about AI investments’ high costs and long-term viability. Goldman Sachs remains bullish, reiterating a ‘Buy’ rating with a price target of $135.

Meanwhile, other analysts echo a positive sentiment. MarketBeat’s consensus rating for Nvidia is a “Moderate Buy,” with an average price target of $131.59, suggesting a 22.67% upside from current levels. Additionally, Morgan Stanley analysts upgraded their price targets to $144, driven by strong demand for Nvidia’s AI chips.

NVDA’s high volatility

Despite the bullish outlook, Nvidia faces an uphill task of shaking off recent volatility, which has seen the stock earn comparisons to trading like a penny and meme stock. Notably, between July 31 and August 1, NVDA saw a $600 billion swing in market capitalization.

By the close of markets on August 2, Nvidia ended the day almost 2% down, trading at $107.

Currently, the stock continues to be weighed down by falling investor confidence in the stock market sparked by disappointing economic data.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.