One of the most anticipated earnings calls of this quarter is surely Nvidia’s (NASDAQ: NVDA). With the sentiment about AI, and the whole stock market resting on its shoulders, Nvidia, a company that has consistently outperformed expectations in the past, managed to do so once again in the previous quarter.

However, investors appear to be starting to move on as their interest diminishes; the significance of Nvidia’s earnings is still important, but much less than before.

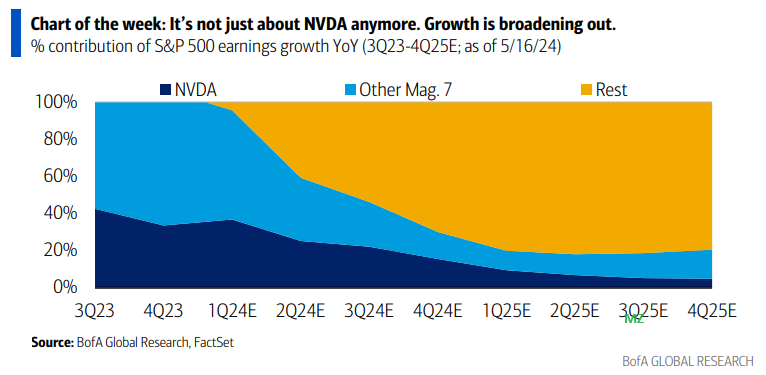

According to Bank of America, Nvidia drove 37% of S&P earnings growth over the last 12 months (and 11% of return) but is expected to drive just 9% over the next 12 months.

While this might mean less importance for Nvidia and possibly fewer returns as investors diversify their portfolios, this is good news for the overall stock market, as dependence on a single company or industry carries many risks.

The bar is set high

The investment bank notes that this earnings season has set high expectations, particularly for tech companies. Their semiconductor analyst predicts increased volatility. However, they emphasize that the focus has shifted beyond just Nvidia.

The bank observes that AI’s benefits are expanding into sectors like power, commodities, and utilities. The market should reflect this broader growth as these fundamental improvements spread.

Overall, BofA indicates that the market’s reaction to earnings shows high expectations. Companies that exceeded sales and earnings per share (EPS) expectations only outperformed the S&P 500 by 30 basis points (bps) the next day, much less than the historical average of 150 bps.

On the other hand, companies that missed expectations were punished more severely, underperforming the S&P 500 by 350 bps compared to the historical average of 240 bps.

And expectations are even higher

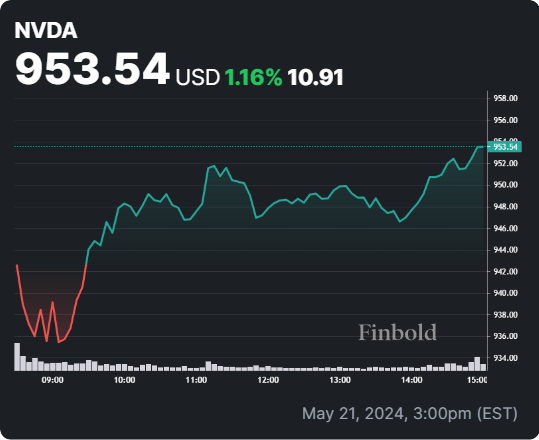

In the wake of Nvidia’s Q1 earnings, NVDA stock managed to reach its highest closing price ever at $953.86, with gains slowly but surely carrying it toward the $1,000 threshold; the investors are keen to find out whether analysts’ expectations were met, outperformed, or surprisingly missed.

Despite big financial institutions presenting optimistic facts and drawing a lot of pressure from Nvidia, the feeling around the industry is that no other earnings call has been more anticipated than this.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.