Millions of dollars in capital are leaving the Avalanche (AVAX) ecosystem amid a major network outage on February 23. At the time of writing, the Avalanche network is still down and is not producing any new blocks.

Notably, DavyCrypto was one of the first accounts to notice and report the issue on X at 13:50 (UTC). Davy mentioned “another major chain” in reference to Solana’s (SOL) major outages, which have become common in the past few years.

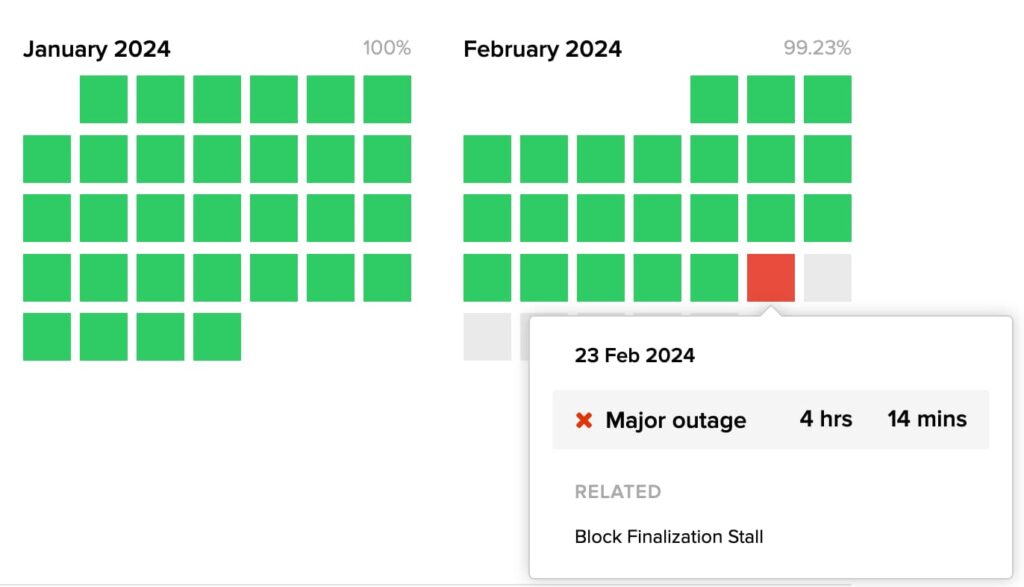

The Avalanche official account has not posted or shared any information about this major network outage by press time. However, the website Avalanche Status is sharing updates to what it has called a “Block Finalization Stall” issue.

According to the network status, Avalanche stopped reaching block finality at 11:30 (UTC) on February 23. At 15:59 (UTC), Ava Labs oriented developers and node runners to upgrade the nodes with a fix.

Curiously, Pop Punk spotted an issue with Ava Labs’ official block explorer amid the major network outage. Despite the stall, the block explorer still increased the number of Avalanche transactions. Kevin Sekniqi, co-founder of Ava Labs, explained this was due to an implementation issue on the website.

Additionally, Sekniqi has been posting updates on the issue and its proposed fixes through its personal account on X.

Avalanche price analysis amid major network outage

In the meantime, the network’s native token AVAX dropped 4.35% since the start of the “Block Finalization Stall.” Avalanche was trading at $36.75 at 12:00 (UTC), going to as low as $35.15 during the major outage.

Currently, AVAX has changed hands by $35.54, and the cryptocurrency market awaits the upgrade to take effect.

Interestingly, this current major network outage on Avalanche is not the only sell-off factor for AVAX in the short term. On February 22, the protocol unlocked nearly $400 million in tokens from vesting contracts. Since then, Avalanche has lost over $1 billion in market cap.

Therefore, investors must now be extremely cautious and wait until the situation settles to make better decisions. It is important to observe how the network will behave with the “Block Finalization Stall” fix and how the cryptocurrency market will handle any possible AVAX sell-off.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.