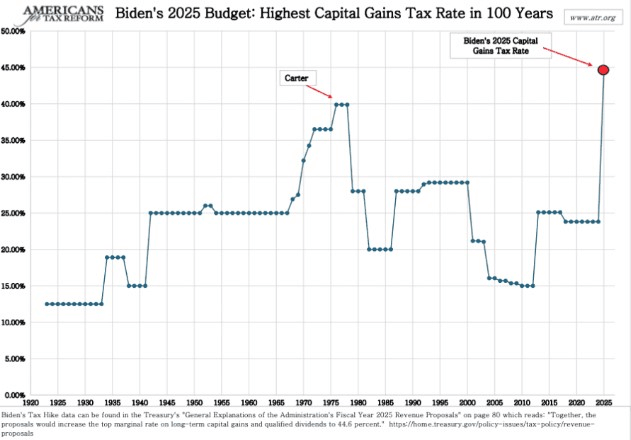

President Biden has formally suggested the highest top capital gains tax rate in over a century.

According to the proposal, the top marginal rate on long-term capital gains and qualified dividends would rise to 44.6%. This could significantly impact the financial returns of investors in stocks and crypto.

In many states, the combined federal-state capital gains tax under Biden’s plan would exceed 50%.

Additionally, the capital gains tax is not adjusted for inflation, which adds another layer of complexity to the proposed tax increase.

Capital gains taxes often result in double taxation, mainly from investments in stocks, stock mutual funds, or stock ETFs. This tax is an additional layer on top of the current federal corporate income tax rate of 21%.

How will gains from stock be impacted?

Currently, the capital gains tax rate for long-term investments, assets held for over a year, tops at 20%. Capital gains represent the profits earned from selling or trading an asset.

The applicable tax rates for these gains vary based on factors such as the type of asset, your taxable income, and the duration of ownership before selling.

President Biden’s fiscal year 2025 budget proposal aims almost to double this capital gains tax rate to 39.6%. This proposed increase would affect investors earning at least one million dollars annually.

“Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.”

Crypto taxes will get updated as well

The 2025 budget, incorporating the new Capital Gains Tax, proposes eliminating a special tax subsidy for cryptocurrency and other transactions.

Currently, cryptocurrency investors enjoy different rules compared to investors in stocks or other securities, which can lead to reporting of excessive losses. For instance, a cryptocurrency investor can sell their assets at a loss, claim a significant tax deduction to reduce their tax liability and repurchase the same cryptocurrency shortly afterward.

The Budget aims to end this tax subsidy for cryptocurrencies by updating the tax code’s anti-abuse rules to treat crypto assets similarly to stocks and other securities.

This means that in addition to paying the same capital gains tax as stock traders, crypto investors won’t be able to benefit from the special tax subsidy.