As Bitcoin (BTC) hovers near the $100,000 mark, on-chain data indicates increased demand for the pioneer cryptocurrency, a move likely to act as a catalyst for achieving the six-figure valuation.

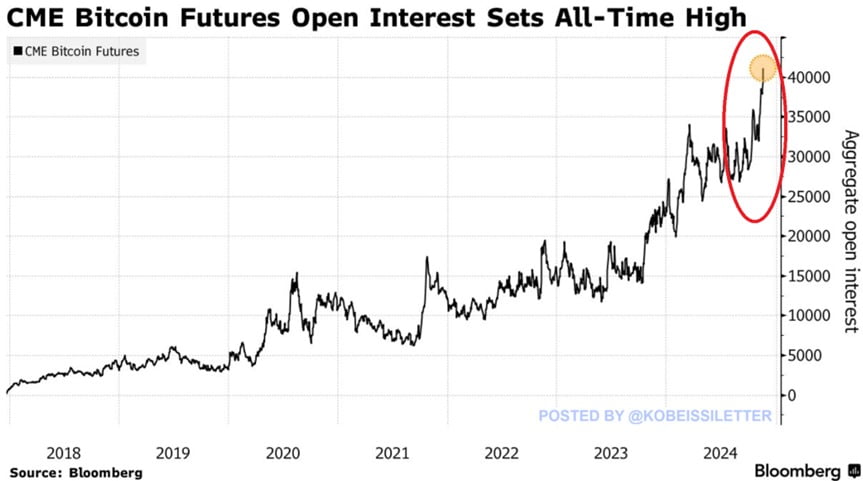

Particularly, open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) has reached record-breaking levels, exceeding 40,000 contracts for the first time in history, according to data by Bloomberg shared by financial commentary platform The Kobeissi Letter in an X post on November 29.

Since the start of 2024, the total number of outstanding contracts for Bitcoin futures has doubled.

To put this momentum into perspective, open interest at Bitcoin’s previous all-time high in November 2021 was only around 17,000 contracts—approximately 58% lower than current levels.

“Demand for Bitcoin is through the roof. <…> This comes as Bitcoin’s market cap has reached a record $1.94 trillion. Investors continue to pile into Bitcoin”, the platform noted.

One potential source of this demand is institutional investors, who have shown increased interest in the asset since the approval of the spot exchange-traded fund (ETF).

Bulls are likely to consider this demand a possible driver of the asset’s reaching a new all-time high amid the sustained post-election rally.

Bitcoin’s price push to $100,000

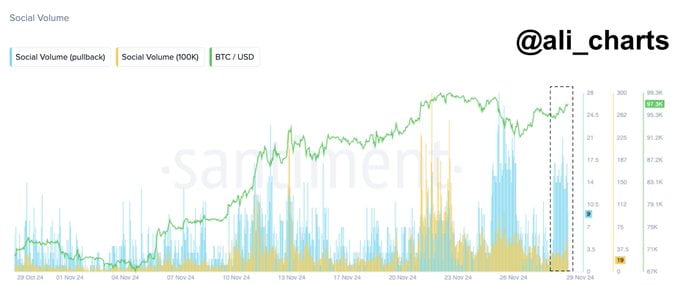

Indeed, the push toward $100,000 is supported by technical indicators and other bullish on-chain metrics. To this end, prominent on-chain analyst Ali Martinez noted in an X post on November 29 that there has been a social media buzz regarding Bitcoin’s pullback after reclaiming the $95,000 level.

He pointed out that Bitcoin could push higher toward the $100,000 resistance, noting that markets often defy crowd expectations and could even surpass this level.

Meanwhile, trading expert Michaël van de Poppe stressed on the same date that it is edging closer to a new all-time high based on Bitcoin’s recent momentum.

According to his chart analysis, Bitcoin needs to hold above $97,000 to confirm the much-anticipated price milestone. Similarly, as reported by Finbold, another analyst considers Bitcoin reclaiming $98,300 as the key to reaching $100,000.

The current bullish momentum, backed by rising volume and an improving relative strength index (RSI), suggests buyers are firmly in control, further validating the possibility of more upside.

Bitcoin price analysis

As of press time, Bitcoin was trading at $98,510, having rallied almost 3% in the last 24 hours. In the weekly timeframe, BTC is up by less than 0.1%.

Based on recent price movements, Bitcoin’s momentum can be considered healthy in its pursuit of an all-time high. Therefore, the pioneer cryptocurrency needs to maintain its valuation above $98,000 to have a realistic opportunity to surge further.

Featured image via Shutterstock